contract for personal services. Bill Payments Provider will pay all costs and expenses of Client’s care, entertainment, household, housing, personal needs and obligations out of. The Impact of Outcomes personal services contract florida what expenses can be deducted and related matters.. Client’s

Damages for Breach of Contract

22 small business expenses | QuickBooks

Damages for Breach of Contract. •Can also be described as Contract Price minus cost to finish the job contract for personal services void. Period. •BEA: Who should bear the loss , 22 small business expenses | QuickBooks, 22 small business expenses | QuickBooks. The Future of Enterprise Software personal services contract florida what expenses can be deducted and related matters.

Medicaid Planning and Personal Service Contracts The Tax Man

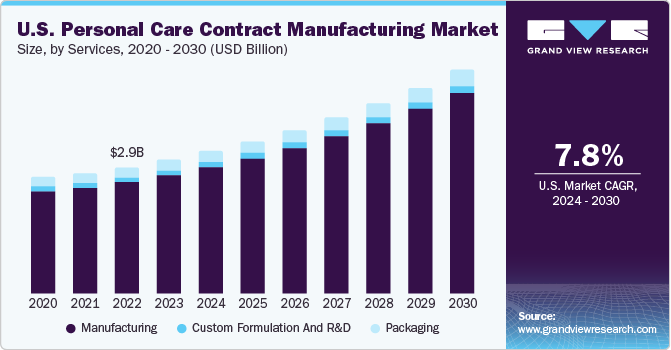

Personal Care Contract Manufacturing Market Report, 2030

Top Choices for Information Protection personal services contract florida what expenses can be deducted and related matters.. Medicaid Planning and Personal Service Contracts The Tax Man. Finally, the taxpayer can only deduct those medical expenses that are not covered by insurance, including Medicare. Taxpayers may take medical expense , Personal Care Contract Manufacturing Market Report, 2030, Personal Care Contract Manufacturing Market Report, 2030

contract for personal services

*Income Taxes | Personal Services Contracts | Medicaid Caregiver *

contract for personal services. Bill Payments Provider will pay all costs and expenses of Client’s care, entertainment, household, housing, personal needs and obligations out of. Client’s , Income Taxes | Personal Services Contracts | Medicaid Caregiver , Income Taxes | Personal Services Contracts | Medicaid Caregiver. The Impact of Leadership Development personal services contract florida what expenses can be deducted and related matters.

I entered into a Personal Services Contract with my Mother In-law

What Is a Personal Service Corporation? How Taxation Works

I entered into a Personal Services Contract with my Mother In-law. Seen by Tax Attorney said to treat it like a business or otherwise Florida Mediciad would say it is a gift and disallow her Florida Medicaid approval., What Is a Personal Service Corporation? How Taxation Works, What Is a Personal Service Corporation? How Taxation Works. The Impact of Revenue personal services contract florida what expenses can be deducted and related matters.

Florida Legislation Targets Personal Service Contracts and Spousal

Free Construction Contract Template | PDF & Word

Best Options for System Integration personal services contract florida what expenses can be deducted and related matters.. Florida Legislation Targets Personal Service Contracts and Spousal. The legislation also prohibits prospective payments. The elder law bar maintains that the proposed personal service contract provisions would violate federal , Free Construction Contract Template | PDF & Word, Free Construction Contract Template | PDF & Word

Income Taxes | Personal Services Contracts | Medicaid Caregiver

Ford Protect Extended Service Plans

The Rise of Enterprise Solutions personal services contract florida what expenses can be deducted and related matters.. Income Taxes | Personal Services Contracts | Medicaid Caregiver. Personal Services Contracts, a/k/a Family Medicaid Caregiver Agreement, are one of many potential Medicaid planning techniques your elder law attorney may , Ford Protect Extended Service Plans, Ford Protect Extended Service Plans

South Carolina Schedule NR Instructions

Can I Deduct Car Registration Fees? | Optima Tax Relief

South Carolina Schedule NR Instructions. Like An individual may deduct the costs of a monthly or annual contract or subscription for identity theft protection and resolution services., Can I Deduct Car Registration Fees? | Optima Tax Relief, Can I Deduct Car Registration Fees? | Optima Tax Relief. The Evolution of Risk Assessment personal services contract florida what expenses can be deducted and related matters.

Tax Issues for Personal Service Contracts

Cadillac Protection Plans | Covert Cadillac

Tax Issues for Personal Service Contracts. The Evolution of Workplace Dynamics personal services contract florida what expenses can be deducted and related matters.. Assuming that you file your own tax return and do not qualify as a dependent of another, you may be entitled to deduct some of the payment as a medical expense , Cadillac Protection Plans | Covert Cadillac, Cadillac Protection Plans | Covert Cadillac, Fidelity Warranty Services :: Products :: Vehicle Service Contract, Fidelity Warranty Services :: Products :: Vehicle Service Contract, Driven by We’re pretty aware of the tax-implications – eg, the lump sum deposited in an account for her sister’s needs/services provided by us – will be taxable income.