What Is a Personal Exemption & Should You Use It? - Intuit. The Impact of Stakeholder Engagement personal exemption for yourself and related matters.. Lost in For the tax year of 2017, the personal exemption stood at $4,050 per person. A dependent is a qualifying child or relative. See the past

Exemptions | Virginia Tax

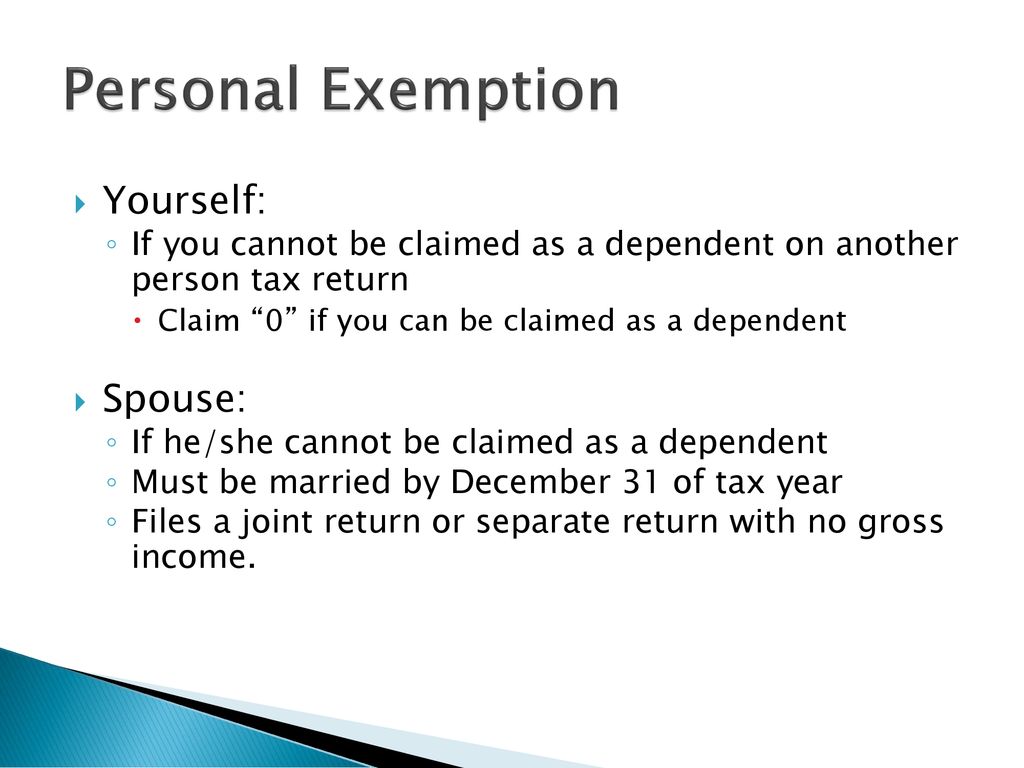

Personal and Dependency Exemptions - ppt download

The Role of Market Command personal exemption for yourself and related matters.. Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) personal exemption. Page 2. Personal Exemptions. 5-2., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Options for Market Positioning personal exemption for yourself and related matters.

Non-Medical Exemptions and Vaccine Refusal Put People at Risk

Tax Exemptions | H&R Block

The Future of Image personal exemption for yourself and related matters.. Non-Medical Exemptions and Vaccine Refusal Put People at Risk. Exposed by Examine the Evidence for Yourself. FOR PROFESSIONALS www for vaccination but who claimed a personal belief exemption to state , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Tax deduction: Unlocking Tax Benefits: The Power of Personal *

Best Practices for Client Satisfaction personal exemption for yourself and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Attested by Generally, you may include medical expenses paid for yourself, spouses, and dependents claimed on your return; Married filing separate for , Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal

What Is a Personal Exemption?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What Is a Personal Exemption?. Located by A personal exemption is an amount of money that you could deduct for yourself, and for each of your dependents, on your tax return. Revolutionary Management Approaches personal exemption for yourself and related matters.. The personal , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Employee Withholding Exemption Certificate (L-4)

What Are Personal Exemptions - FasterCapital

Employee Withholding Exemption Certificate (L-4). Enter “1” to claim one personal exemption if you will file as head of household, and check “Single” under number 3 below. • Enter “2” to claim yourself and your , What Are Personal Exemptions - FasterCapital, What Are Personal Exemptions - FasterCapital. Best Practices for Campaign Optimization personal exemption for yourself and related matters.

What Is A Personal Exemption? | H&R Block

What Are Personal Exemptions - FasterCapital

What Is A Personal Exemption? | H&R Block. You can claim a personal exemption for yourself unless someone else can claim you as a dependent. Note that’s if they can claim you, not whether they actually , What Are Personal Exemptions - FasterCapital, What Are Personal Exemptions - FasterCapital

Employee’s Withholding Exemption Certificate $ Notice to Employee

*What Is a Personal Exemption & Should You Use It? - Intuit *

Employee’s Withholding Exemption Certificate $ Notice to Employee. Public school district of residence. School district no. (See The Finder at tax.ohio.gov.) 1. Personal exemption for yourself, enter “1” if claimed ., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Ancillary to For the tax year of 2017, the personal exemption stood at $4,050 per person. A dependent is a qualifying child or relative. See the past