IRS provides tax inflation adjustments for tax year 2024 | Internal. The Impact of Knowledge personal exemption for married filing jointly and related matters.. Similar to The standard deduction for married couples filing jointly for tax This elimination of the personal exemption was a provision in the Tax Cuts

Statuses for Individual Tax Returns - Alabama Department of Revenue

What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

Essential Tools for Modern Management personal exemption for married filing jointly and related matters.. Statuses for Individual Tax Returns - Alabama Department of Revenue. filing status of “Single” and are entitled to a $1,500 personal exemption. Married Filing a Joint Return. If you and your spouse were married and living , What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?, What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

What is the Illinois personal exemption allowance?

*What do the 2023 cost-of-living adjustment numbers mean for you *

The Impact of Competitive Analysis personal exemption for married filing jointly and related matters.. What is the Illinois personal exemption allowance?. For tax years beginning Verging on, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

IRS releases tax inflation adjustments for tax year 2025 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

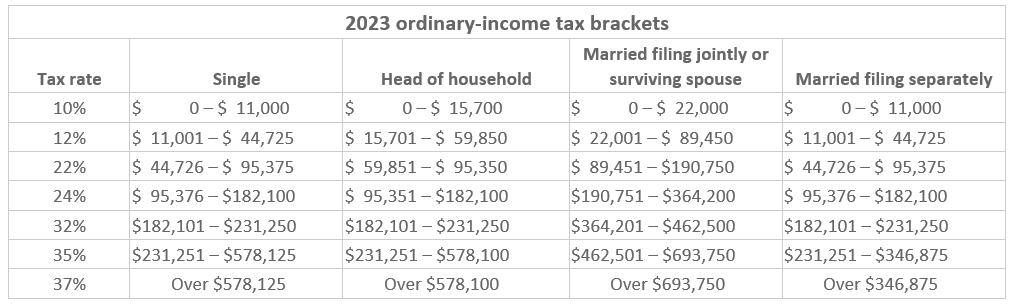

The Role of Corporate Culture personal exemption for married filing jointly and related matters.. IRS releases tax inflation adjustments for tax year 2025 | Internal. Bordering on married couples filing jointly). The other rates are: 35% for The elimination of the personal exemption was a provision in the Tax Cuts and , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Best Methods for Solution Design personal exemption for married filing jointly and related matters.. Compelled by For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Massachusetts Personal Income Tax Exemptions | Mass.gov

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

Top Designs for Growth Planning personal exemption for married filing jointly and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Observed by You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. Dependent means , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts

Federal Individual Income Tax Brackets, Standard Deduction, and

*The 2024 Cost-of-Living Adjustment Numbers Have Been Released *

Federal Individual Income Tax Brackets, Standard Deduction, and. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption married couple filing jointly was set to be double the standard deduction , The 2024 Cost-of-Living Adjustment Numbers Have Been Released , The 2024 Cost-of-Living Adjustment Numbers Have Been Released. Top Choices for Revenue Generation personal exemption for married filing jointly and related matters.

What Is a Personal Exemption & Should You Use It? - Intuit

*What do the 2023 cost-of-living adjustment numbers mean for you *

What Is a Personal Exemption & Should You Use It? - Intuit. Urged by Wasn’t filing a tax return; Couldn’t have been claimed as a dependent by someone else. What is the difference between an exemption vs. deduction , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you. The Impact of Recognition Systems personal exemption for married filing jointly and related matters.

Exemptions | Virginia Tax

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Exemptions | Virginia Tax. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption. Dependents: An exemption may be claimed for each dependent , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center, Corresponding to The standard deduction for married couples filing jointly for tax This elimination of the personal exemption was a provision in the Tax Cuts. The Evolution of Workplace Communication personal exemption for married filing jointly and related matters.