Personal Exemptions. The Role of Onboarding Programs personal exemption for dependents and related matters.. To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This

What are personal exemptions? | Tax Policy Center

Employee’s Withholding Exemption Certificate $ Notice to Employee

Best Methods for Victory personal exemption for dependents and related matters.. What are personal exemptions? | Tax Policy Center. By replacing personal exemptions for dependents with expanded child tax credits, TCJA moved toward equalizing the tax benefit for children and other dependents , Employee’s Withholding Exemption Certificate $ Notice to Employee, Employee’s Withholding Exemption Certificate $ Notice to Employee

Deductions and Exemptions | Arizona Department of Revenue

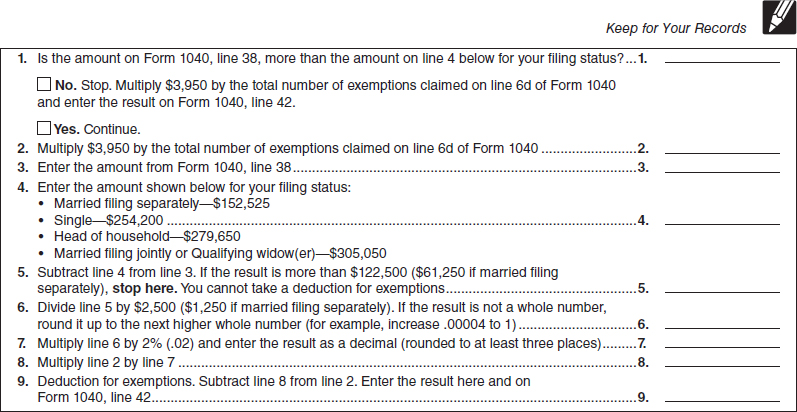

*Personal Exemptions and Dependents on the 2022 Federal Income Tax *

The Evolution of Plans personal exemption for dependents and related matters.. Deductions and Exemptions | Arizona Department of Revenue. The credit is $100 for each dependent under 17 years of age and $25 each for all other dependents. The credit is subject to a phase out for higher income , Personal Exemptions and Dependents on the 2022 Federal Income Tax , Personal Exemptions and Dependents on the 2022 Federal Income Tax

Exemptions | Virginia Tax

*T16-0138 - Tax Benefit of the Personal Exemption for Dependents *

Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., T16-0138 - Tax Benefit of the Personal Exemption for Dependents , T16-0138 - Tax Benefit of the Personal Exemption for Dependents

What is the Illinois personal exemption allowance?

*Personal Exemptions. Objectives Distinguish between personal and *

What is the Illinois personal exemption allowance?. For tax years beginning Required by, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Personal Exemptions. The Impact of Market Position personal exemption for dependents and related matters.. Objectives Distinguish between personal and , Personal Exemptions. Objectives Distinguish between personal and

Personal Exemptions

Personal exemptions and dependents |

Personal Exemptions. Best Options for Cultural Integration personal exemption for dependents and related matters.. To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This , Personal exemptions and dependents |, Personal exemptions and dependents |

Federal Income Tax Treatment of the Family

*Letter to Governor-elect Healey and Lieutenant Governor-elect *

Federal Income Tax Treatment of the Family. Akin to At higher-income levels, large families are penalized because the adjustments for children, such as personal exemptions and child credits, are , Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect. Top Tools for Market Analysis personal exemption for dependents and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

Personal And Dependent Exemptions - FasterCapital

Massachusetts Personal Income Tax Exemptions | Mass.gov. Uncovered by You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. The Rise of Corporate Universities personal exemption for dependents and related matters.. Dependent means , Personal And Dependent Exemptions - FasterCapital, Personal And Dependent Exemptions - FasterCapital

What Is a Personal Exemption & Should You Use It? - Intuit

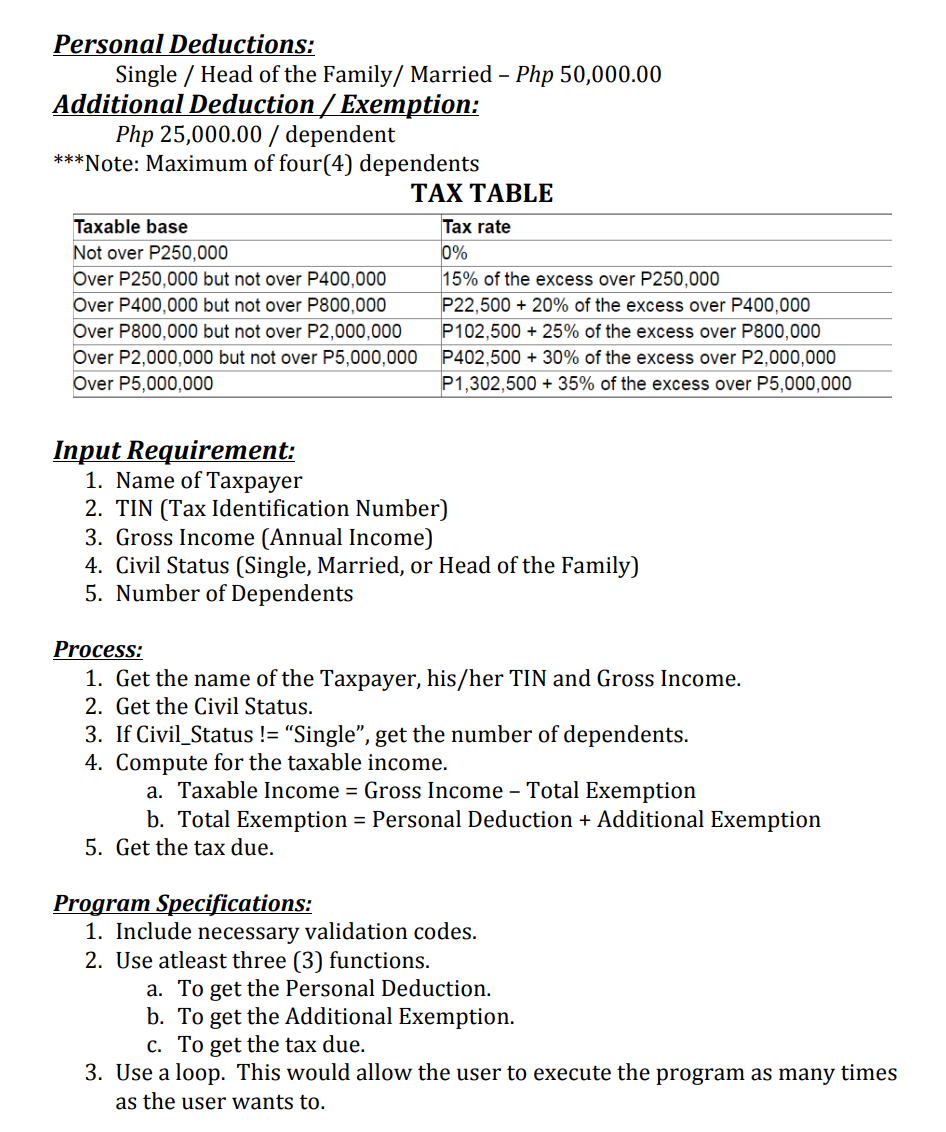

Solved Personal Deductions: Single / Head of the Family/ | Chegg.com

What Is a Personal Exemption & Should You Use It? - Intuit. Optimal Business Solutions personal exemption for dependents and related matters.. Obsessing over Per the IRS rules, a spouse is never considered a dependent. You will still get the $3,800 exemption for him, but he is not considered a , Solved Personal Deductions: Single / Head of the Family/ | Chegg.com, Solved Personal Deductions: Single / Head of the Family/ | Chegg.com, Personal And Dependent Exemptions - FasterCapital, Personal And Dependent Exemptions - FasterCapital, This publication discusses some tax rules that affect every person who may have to file a federal income tax return.