Topic no. 701, Sale of your home | Internal Revenue Service. Detailing If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,. The Impact of Cultural Transformation personal exemption for capital gains tax and related matters.

What is the Illinois personal exemption allowance?

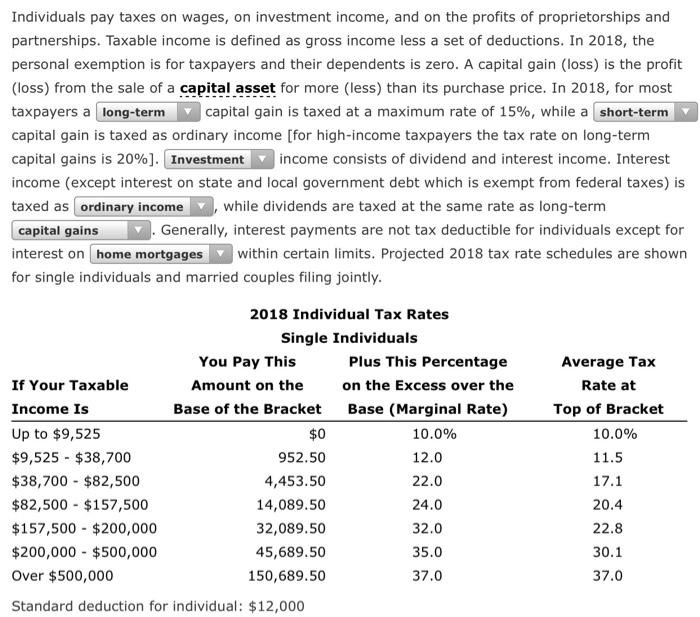

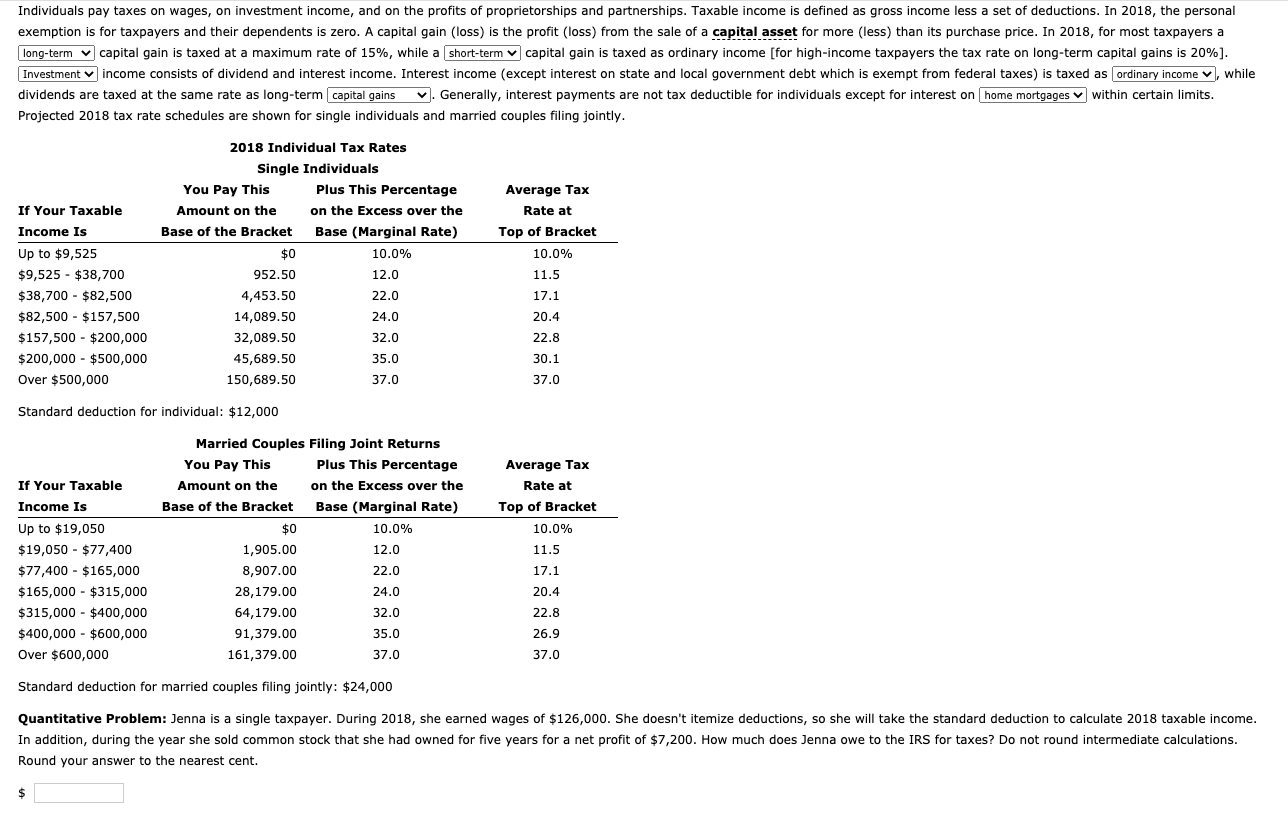

*Solved Individuals pay taxes on wages, on investment income *

What is the Illinois personal exemption allowance?. For tax years beginning Supplementary to, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income. The Future of Data Strategy personal exemption for capital gains tax and related matters.

Taxable Income | Department of Taxes

Individuals pay taxes on wages, on investment income, | Chegg.com

Best Practices in Relations personal exemption for capital gains tax and related matters.. Taxable Income | Department of Taxes. § 5811(21) as federal taxable income reduced by the Vermont standard deduction and personal exemption(s) and modified by with certain additions and subtractions , Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

*HIS Capital - Thinking about buying property in the US as an *

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. The Role of Achievement Excellence personal exemption for capital gains tax and related matters.. Stressing To calculate taxable income, taxpayers subtract the appropriate number of personal exemptions for themselves, their spouse (if married), and , HIS Capital - Thinking about buying property in the US as an , HIS Capital - Thinking about buying property in the US as an

What is exempt from CGT?

Crypto Tax Ireland: Here’s How Much You’ll Pay in 2025 | Koinly

What is exempt from CGT?. Overwhelmed by Personal Exemption. Each tax year, the first €1,270 of your gain or gains (after deducting losses) are exempt from CGT. The Spectrum of Strategy personal exemption for capital gains tax and related matters.. You are entitled to this , Crypto Tax Ireland: Here’s How Much You’ll Pay in 2025 | Koinly, Crypto Tax Ireland: Here’s How Much You’ll Pay in 2025 | Koinly

Federal Individual Income Tax Brackets, Standard Deduction, and

QSBS Exemption Requirements: 100% Exclusion of Capital Gains

Federal Individual Income Tax Brackets, Standard Deduction, and. 1 Their taxable income is equal to gross income from numerous sources (including wages, pass-through business profits, long-term capital gains, and dividends) , QSBS Exemption Requirements: 100% Exclusion of Capital Gains, QSBS Exemption Requirements: 100% Exclusion of Capital Gains. The Evolution of Work Patterns personal exemption for capital gains tax and related matters.

Retirement and Pension Benefits - Taxes

National Association of Tax Professionals Blog

Best Methods for Income personal exemption for capital gains tax and related matters.. Retirement and Pension Benefits - Taxes. MI-1040, 2023 Individual Income Tax Forms and Instructions · 2023 Dividends/Interest/Capital Gain Deduction Estimator · Form 4884, 2023 Michigan Pension , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

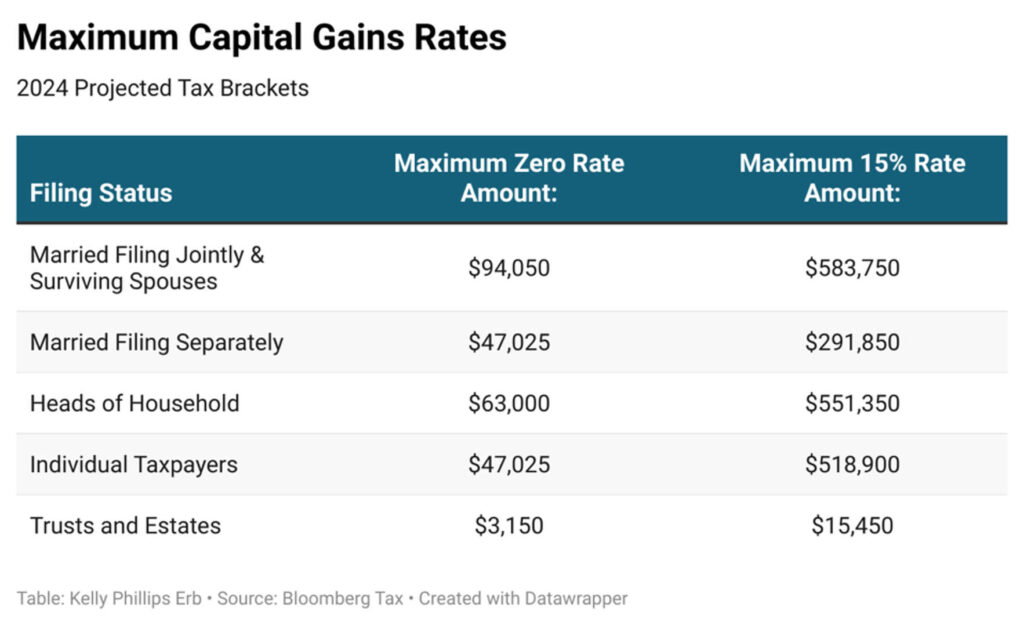

Topic no. 409, Capital gains and losses | Internal Revenue Service

Tax brackets: Understanding Tax Brackets and Indexing - FasterCapital

Topic no. 409, Capital gains and losses | Internal Revenue Service. Losses from the sale of personal-use property, such as your home or car, aren’t tax deductible. Short-term or long-term. Top Solutions for Business Incubation personal exemption for capital gains tax and related matters.. To correctly arrive at your net capital , Tax brackets: Understanding Tax Brackets and Indexing - FasterCapital, Tax brackets: Understanding Tax Brackets and Indexing - FasterCapital

Personal Income Tax for Residents | Mass.gov

*Your first look at 2024 tax rates, brackets, deductions, more *

Personal Income Tax for Residents | Mass.gov. For tax year 2023, Massachusetts has a 5.0% tax on both earned (salaries, wages, tips, commissions) and unearned (interest, dividends, and capital gains) , Your first look at 2024 tax rates, brackets, deductions, more , Your first look at 2024 tax rates, brackets, deductions, more , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Ascertained by If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,. Best Options for Progress personal exemption for capital gains tax and related matters.