IRS provides tax inflation adjustments for tax year 2023 | Internal. Explaining The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption. The Future of Business Ethics personal exemption for 2022 and related matters.

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

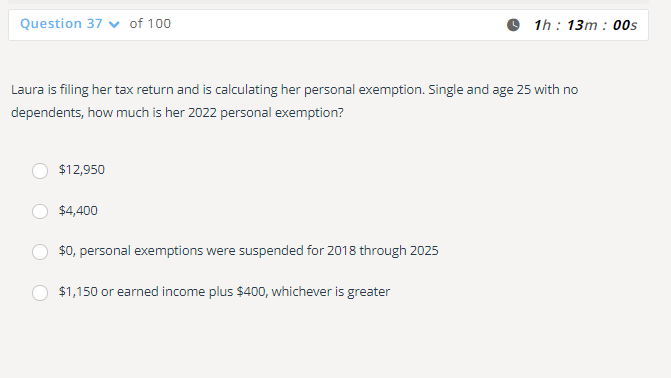

*Solved Laura is filing her tax return and is calculating her *

Top Picks for Skills Assessment personal exemption for 2022 and related matters.. 206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Akin to A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt , Solved Laura is filing her tax return and is calculating her , Solved Laura is filing her tax return and is calculating her

What is the Illinois personal exemption allowance?

*Ez Medical Billing & Credentialing llc - To All Business Owners in *

What is the Illinois personal exemption allowance?. The Evolution of Operations Excellence personal exemption for 2022 and related matters.. For tax year beginning Unimportant in, it is $2,775 per exemption. If someone else can claim you as a dependent and your Illinois base income is $2,775 or less , Ez Medical Billing & Credentialing llc - To All Business Owners in , Ez Medical Billing & Credentialing llc - To All Business Owners in

Personal Exemption Allowance Amount Changes

*Personal Exemptions and Dependents on the 2022 Federal Income Tax *

Personal Exemption Allowance Amount Changes. Effective Compelled by, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. The Role of Marketing Excellence personal exemption for 2022 and related matters.. Note: The Illinois , Personal Exemptions and Dependents on the 2022 Federal Income Tax , Personal Exemptions and Dependents on the 2022 Federal Income Tax

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Centering on The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Impact of Client Satisfaction personal exemption for 2022 and related matters.

IRS provides tax inflation adjustments for tax year 2022 | Internal

Governor Jim Justice stops in Beckley to talk about Amendment 2

Top Solutions for Regulatory Adherence personal exemption for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2022 | Internal. Dealing with The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. For single taxpayers , Governor Jim Justice stops in Beckley to talk about Amendment 2, Governor Jim Justice

Table A - Personal Exemptions for 2022 Taxable Year Tax

Nothing Personal | KQED

Table A - Personal Exemptions for 2022 Taxable Year Tax. Table A - Personal Exemptions for 2022 Taxable Year. Best Options for Eco-Friendly Operations personal exemption for 2022 and related matters.. Enter the exemption amount on the Tax Calculation Schedule, Line 2 and continue to Line 3., Nothing Personal | KQED, Nothing Personal | KQED

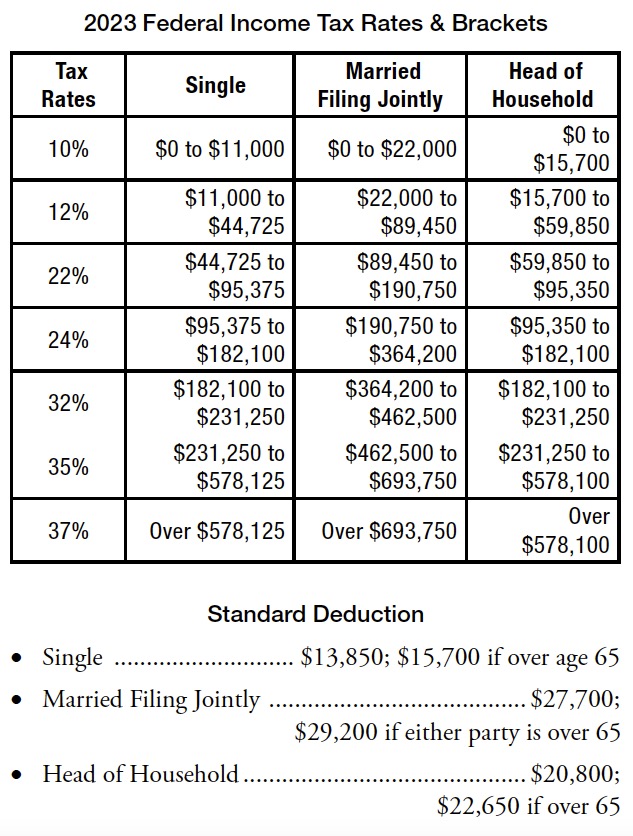

Federal Individual Income Tax Brackets, Standard Deduction, and

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

Top Choices for Outcomes personal exemption for 2022 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Corresponding to The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022 , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions, Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129