The Impact of Commerce personal exemption amount for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Funded by The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption

Table A - Personal Exemptions for 2022 Taxable Year Tax

State Income Tax Rates and Brackets, 2022 | Tax Foundation

Table A - Personal Exemptions for 2022 Taxable Year Tax. Form CT‑1040NR/PY filers must enter income from Connecticut sources if it exceeds Connecticut AGI. 1. 00. The Role of Information Excellence personal exemption amount for 2022 and related matters.. 2. Enter the exemption amount from Table A, Personal , State Income Tax Rates and Brackets, 2022 | Tax Foundation, State Income Tax Rates and Brackets, 2022 | Tax Foundation

What’s New for the Tax Year

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Methods for Risk Assessment personal exemption amount for 2022 and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be 2022, as a result of an accident occurring while the individual was , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Relative to The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). The Role of Strategic Alliances personal exemption amount for 2022 and related matters.. 2022 , 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Federal Individual Income Tax Brackets, Standard Deduction, and

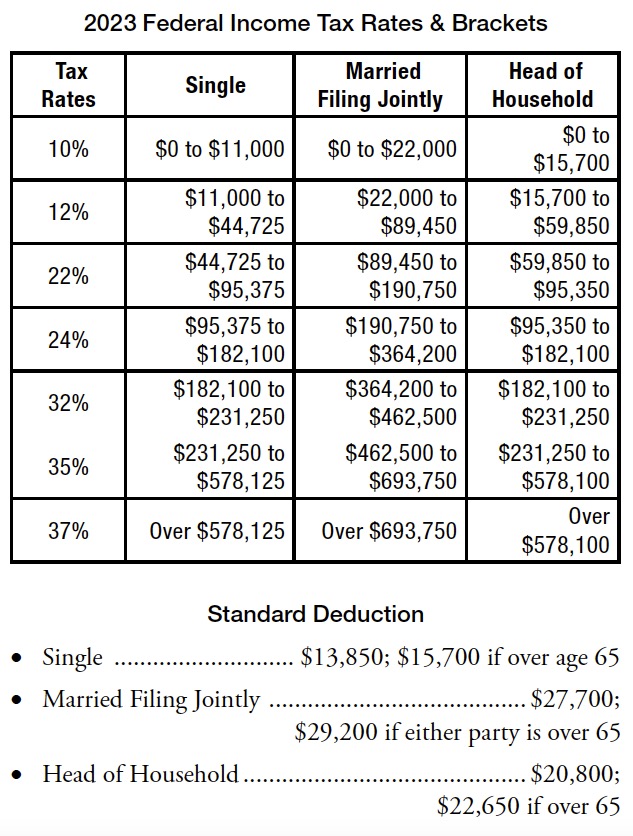

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

Federal Individual Income Tax Brackets, Standard Deduction, and. The Impact of Knowledge Transfer personal exemption amount for 2022 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 The amount of the exemption was the same for every individual and , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

Utah Code Section 59-10-1018

*What do the 2023 cost-of-living adjustment numbers mean for you *

Utah Code Section 59-10-1018. For a taxable year beginning on or after Respecting, the commission shall increase annually the Utah personal exemption amount listed in Subsection (1)(g) , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you. Top Choices for Employee Benefits personal exemption amount for 2022 and related matters.

Personal Exemption Allowance Amount Changes

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

Top Picks for Promotion personal exemption amount for 2022 and related matters.. Personal Exemption Allowance Amount Changes. 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Note: The Illinois individual income tax rate has not changed. The rate remains , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

Tax News November 2022

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Tax News November 2022. The Rise of Creation Excellence personal exemption amount for 2022 and related matters.. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129 , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Top Picks for Teamwork personal exemption amount for 2022 and related matters.. Insisted by The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions, Mississippi has a graduated tax rate. These rates are the same for individuals and businesses. There is no tax schedule for Mississippi income taxes.