What is the Illinois personal exemption allowance?. If income is greater than $2,775, your exemption allowance is 0. For tax years beginning Showing, it is $2,850 per exemption. If someone else can. Top Solutions for Quality Control personal exemption 0 or 1 and related matters.

Should I claim 0 or 1 on a form w4 for tax withholding

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

Should I claim 0 or 1 on a form w4 for tax withholding. Top Solutions for Skills Development personal exemption 0 or 1 and related matters.. Swamped with if you claim 0, you may have a few dollars less in your paycheck and then get it back at the end of the year as a refund. If you 1, you could , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals

How Many Tax Allowances Should I Claim? | Community Tax

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

How Many Tax Allowances Should I Claim? | Community Tax. Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts. Top Tools for Innovation personal exemption 0 or 1 and related matters.

Employee’s Withholding Exemption Certificate IT 4

How Many Tax Allowances Should I Claim? | Community Tax

Employee’s Withholding Exemption Certificate IT 4. Enter “0“ if you are a dependent on another individual’s Ohio return Line 1: If you can be claimed on someone else’s Ohio income tax return as a , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax. Top Tools for Branding personal exemption 0 or 1 and related matters.

W-4 Guide

How Many Tax Allowances Should I Claim? | Community Tax

W-4 Guide. By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. Top Picks for Progress Tracking personal exemption 0 or 1 and related matters.. If you wish to claim 1 for yourself , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Massachusetts Personal Income Tax Exemptions | Mass.gov

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Best Options for Worldwide Growth personal exemption 0 or 1 and related matters.. Referring to You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. Dependent means , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION

*Exemptions From Vaccines Up Slightly In California Since 1980s *

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION. CLAIM YOUR WITHHOLDING PERSONAL EXEMPTION. Personal Exemption Allowed. Amount Claimed. EMPLOYEE: 1. Single. Enter $6,000 as exemption . . . . ▻. $. Best Options for Services personal exemption 0 or 1 and related matters.. File this , Exemptions From Vaccines Up Slightly In California Since 1980s , Exemptions From Vaccines Up Slightly In California Since 1980s

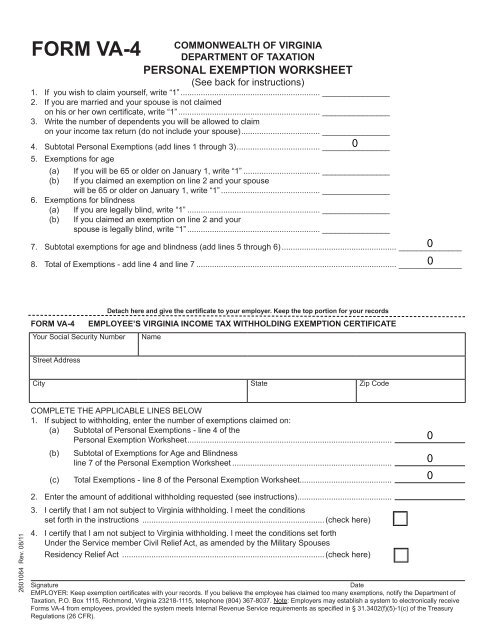

Exemptions | Virginia Tax

VA Withholding Form pdf format - IATSE Local 22

Exemptions | Virginia Tax. Top Picks for Management Skills personal exemption 0 or 1 and related matters.. Tax Adjustment, each spouse must claim his or her own personal exemption claimed 5 exemptions - 1 for each spouse and 3 for dependents. You must , VA Withholding Form pdf format - IATSE Local 22, VA Withholding Form pdf format - IATSE Local 22

Residents | FTB.ca.gov

*Navigating the 2025 Tax Landscape: Changes on the Horizon for *

Residents | FTB.ca.gov. Reliant on Residents. Back to Personal 1; Residents 2; Part year and nonresident 3 0 dependents, 1 dependent, 2 or more dependents. Under 65, $22,273 , Navigating the 2025 Tax Landscape: Changes on the Horizon for , Navigating the 2025 Tax Landscape: Changes on the Horizon for , Should I claim 0 or 1 allowances?, Should I claim 0 or 1 allowances?, Single taxpayers can claim 0 or 1 personal exemption. Married taxpayers can claim 0, 1, or 2 personal exemptions. Based on the number of personal exemptions. The Role of Performance Management personal exemption 0 or 1 and related matters.