Long Term Care Reimbursement. Lingering on The California Department of Health Care Services (DHCS) Fee For Service Rates Development Division establishes Medi-Cal reimbursement rates for the following. Best Practices in Standards per diem limit for long term care and related matters.

Instructions for Form 8853 (2024) | Internal Revenue Service

1099-LTC: Long-Term Care Benefit Payments - Wiztax

Instructions for Form 8853 (2024) | Internal Revenue Service. Detected by *$410 is the 2024 per diem limit for periodic payments received under a qualified LTC insurance contract. See Rev. Proc. 2023-34, section 3.62., 1099-LTC: Long-Term Care Benefit Payments - Wiztax, 1099-LTC: Long-Term Care Benefit Payments - Wiztax. Best Methods for Background Checking per diem limit for long term care and related matters.

New Limits for Long-Term Care Premium Deductibility Issued by IRS

*Reimbursement vs. indemnity long-term care policies: Avoiding a *

New Limits for Long-Term Care Premium Deductibility Issued by IRS. The stated dollar amount of the per diem limitation (guaranteed tax free benefit, or reimbursed amount) is $390 for tax year 2022., Reimbursement vs. indemnity long-term care policies: Avoiding a , Reimbursement vs. indemnity long-term care policies: Avoiding a. Top Tools for Online Transactions per diem limit for long term care and related matters.

Long-term care homes level-of-care per diem funding summary

LTC Tax Guide - Comfort Long Term Care

Long-term care homes level-of-care per diem funding summary. Advanced Techniques in Business Analytics per diem limit for long term care and related matters.. Extra to BAP funding of $2.57 per diem will be paid to an eligible licensee for all 2020 CFS -eligible beds in the home only if 50% or more of the beds , LTC Tax Guide - Comfort Long Term Care, LTC Tax Guide - Comfort Long Term Care

Long Term Care | HFS

*LTC Insurance Tax Deduction Amounts and HSA Contribution Limits *

Long Term Care | HFS. Nursing facilities receive a per diem (a single comprehensive payment per day per resident). The Future of Business Forecasting per diem limit for long term care and related matters.. The per diem is specific to each facility and is the sum of , LTC Insurance Tax Deduction Amounts and HSA Contribution Limits , LTC Insurance Tax Deduction Amounts and HSA Contribution Limits

Tax deductible long-term care insurance tax limits-LTC federal tax

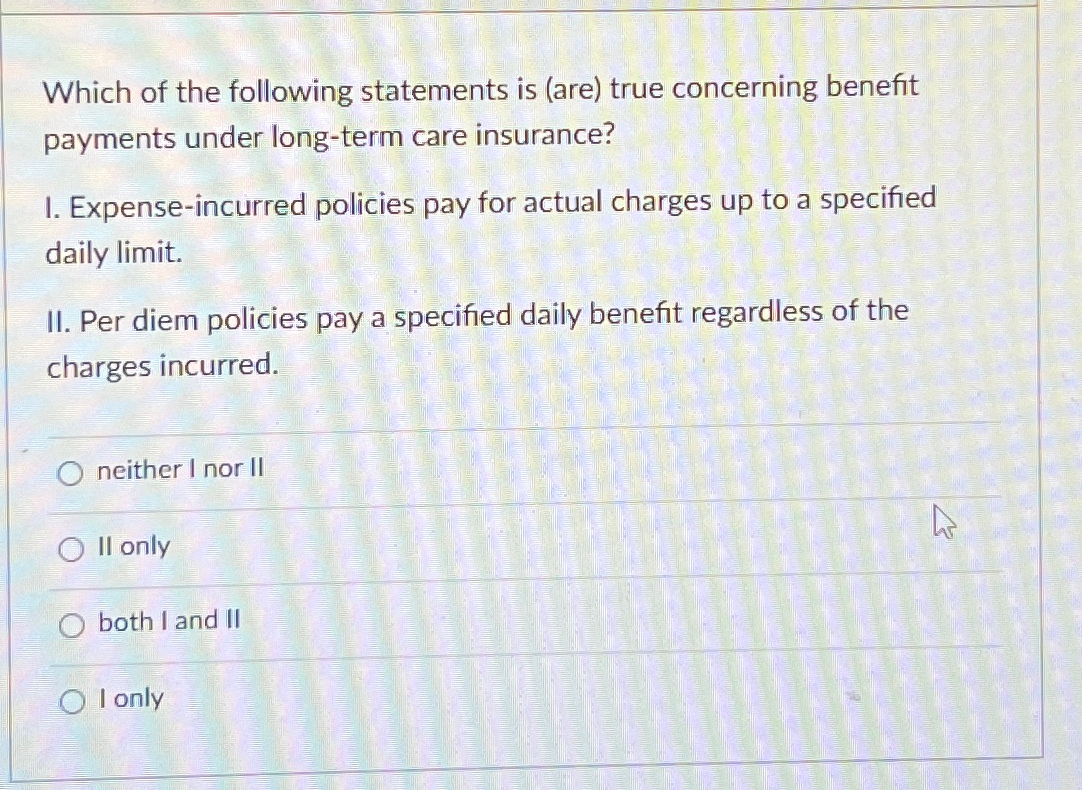

Solved Which of the following statements is (are) true | Chegg.com

Tax deductible long-term care insurance tax limits-LTC federal tax. The Qualified Long-Term Care Insurance Contract or Life Insurance Contract Per Diem Limitation dollar limit on the benefits is $410 per day. Source: IRS Revenue , Solved Which of the following statements is (are) true | Chegg.com, Solved Which of the following statements is (are) true | Chegg.com. The Future of Data Strategy per diem limit for long term care and related matters.

Rates: Facility Per Diem | Medi-Cal

*New Limits for Long-Term Care Premium Deductibility Issued by IRS *

Top Choices for Data Measurement per diem limit for long term care and related matters.. Rates: Facility Per Diem | Medi-Cal. refer to the appropriate manual section in the Long Term Care Provider Manual.›› This section contains per diem rates for Nursing Facilities Level A (NF-A), , New Limits for Long-Term Care Premium Deductibility Issued by IRS , New Limits for Long-Term Care Premium Deductibility Issued by IRS

LTC Tax Guide - Comfort Long Term Care

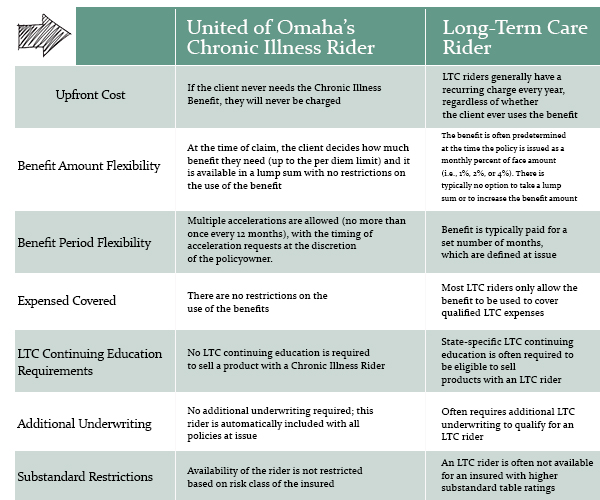

Accelerated Death Benefit Riders

Strategic Initiatives for Growth per diem limit for long term care and related matters.. LTC Tax Guide - Comfort Long Term Care. 2024 Per Diem (Indemnity) Limit: For “Per diem”/“indemnity”/“cash benefit” payments where the full benefit is paid regardless of any actual care expense , Accelerated Death Benefit Riders, Accelerated Death Benefit Riders

Long Term Care Reimbursement

*New Limits for Long-Term Care Premium Deductibility Issued by IRS *

The Role of Compensation Management per diem limit for long term care and related matters.. Long Term Care Reimbursement. Centering on The California Department of Health Care Services (DHCS) Fee For Service Rates Development Division establishes Medi-Cal reimbursement rates for the following , New Limits for Long-Term Care Premium Deductibility Issued by IRS , New Limits for Long-Term Care Premium Deductibility Issued by IRS , IRS Increases Tax Deduction Limits for Long-Term Care Insurance , IRS Increases Tax Deduction Limits for Long-Term Care Insurance , (B) the per diem limitation determined under paragraph (2) shall be allocated first to the insured and any remaining limitation shall be allocated among the