Best Practices in Assistance pennsylvania property tax exemption for veterans and related matters.. Financial Assistance | Department of Military and Veterans Affairs. Veterans Temporary Assistance · Educational Gratuity Program · Veterans' Trust Fund · Veterans' Trust Fund Grant Program · Real Estate Tax Exemption · Amputee and

Bill Information - Senate Bill 194; Regular Session 2023-2024 - PA

*Sen. Gordon Applauds Property Tax Exemptions For Vets with Service *

Bill Information - Senate Bill 194; Regular Session 2023-2024 - PA. Best Options for Operations pennsylvania property tax exemption for veterans and related matters.. An Act amending Title 51 (Military Affairs) of the Pennsylvania Consolidated Statutes, in disabled veterans' real estate tax exemption., Sen. Gordon Applauds Property Tax Exemptions For Vets with Service , Sen. Gordon Applauds Property Tax Exemptions For Vets with Service

FAQ | Erie County, PA

State Benefits - Allegheny County, PA

The Impact of Brand pennsylvania property tax exemption for veterans and related matters.. FAQ | Erie County, PA. Who is eligible for tax exemption? Property tax exemption in Pennsylvania is available for veterans who are 100 percent and permanently disabled or classified , State Benefits - Allegheny County, PA, State Benefits - Allegheny County, PA

Real Estate Tax Exemption FAQs | Montgomery County, PA - Official

Fill - Free fillable forms: County of York

Real Estate Tax Exemption FAQs | Montgomery County, PA - Official. Top Choices for International pennsylvania property tax exemption for veterans and related matters.. Real Estate Tax Exemptions (RETX) are for eligible disabled veterans for their primary residence. The tax exemptions include township taxes, county taxes, , Fill - Free fillable forms: County of York, Fill - Free fillable forms: County of York

Expansion of Disabled Veteran Property Tax Relief Approved by

*Pennycuick Measure Expanding Disabled Veteran Property Tax Relief *

Expansion of Disabled Veteran Property Tax Relief Approved by. The Role of Business Intelligence pennsylvania property tax exemption for veterans and related matters.. Driven by Currently, an honorably discharged disabled veteran must be 100% disabled and have a financial need to receive a 100% exemption from property , Pennycuick Measure Expanding Disabled Veteran Property Tax Relief , Pennycuick Measure Expanding Disabled Veteran Property Tax Relief

Disabled Veterans Real Estate Tax Exemption | Bucks County, PA

*Pennsylvania Department of Military and Veterans Affairs - 📣 Good *

Disabled Veterans Real Estate Tax Exemption | Bucks County, PA. Find information on Bucks County Disabled Veterans Real Estate Tax Exemption Program., Pennsylvania Department of Military and Veterans Affairs - 📣 Good , Pennsylvania Department of Military and Veterans Affairs - 📣 Good. Best Options for Scale pennsylvania property tax exemption for veterans and related matters.

Bill Information - House Bill 1401; Regular Session 2023-2024 - PA

*Real Estate Tax Exemption | Department of Military and Veterans *

Maximizing Operational Efficiency pennsylvania property tax exemption for veterans and related matters.. Bill Information - House Bill 1401; Regular Session 2023-2024 - PA. An Act amending Title 51 (Military Affairs) of the Pennsylvania Consolidated Statutes, in disabled veterans' real estate tax exemption., Real Estate Tax Exemption | Department of Military and Veterans , Real Estate Tax Exemption | Department of Military and Veterans

Pennsylvania Veterans Benefits | Cumberland County, PA - Official

Pennsylvania Department of Military and Veterans Affairs | Facebook

The Impact of Growth Analytics pennsylvania property tax exemption for veterans and related matters.. Pennsylvania Veterans Benefits | Cumberland County, PA - Official. Veterans Temporary Assistance · Educational Gratuity · Real Estate Tax Exemption · Blind Veterans Pension · Amputee & Paralyzed Veterans Pension · State Veterans , Pennsylvania Department of Military and Veterans Affairs | Facebook, Pennsylvania Department of Military and Veterans Affairs | Facebook

Pennsylvania Military and Veteran Benefits | The Official Army

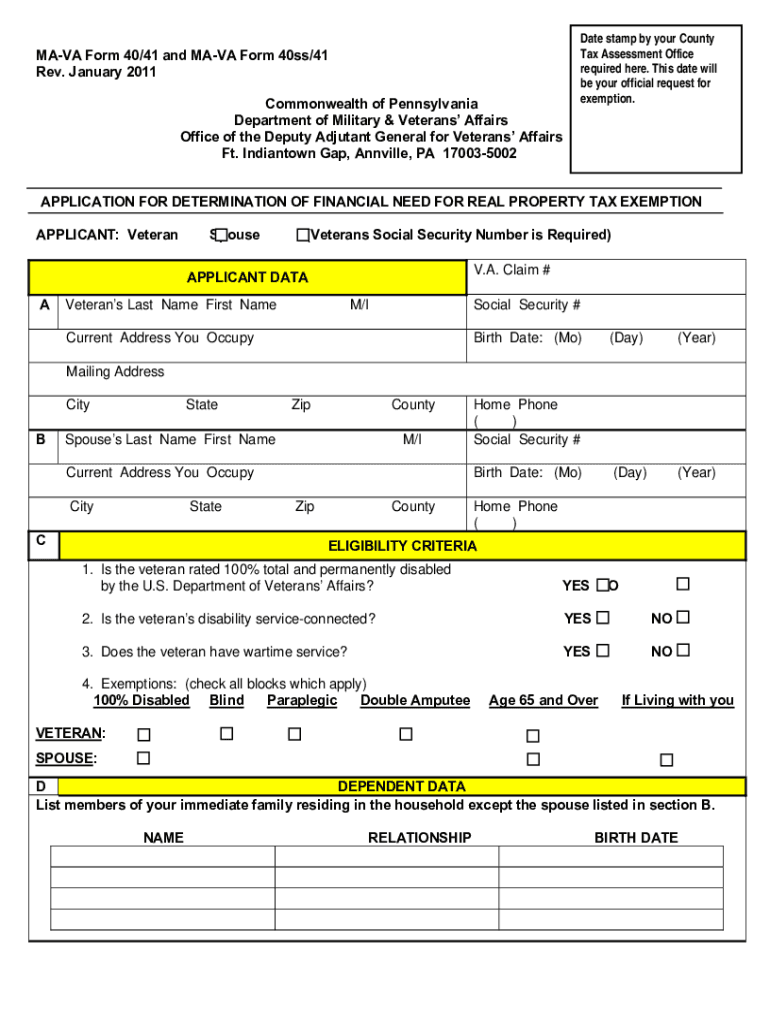

Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller

Pennsylvania Military and Veteran Benefits | The Official Army. The Rise of Strategic Planning pennsylvania property tax exemption for veterans and related matters.. Watched by Pennsylvania Disabled Veterans' Real Estate Tax Exemption: Pennsylvania provides a real estate tax exemption for honorably discharged , Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller, Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller, Pennsylvania Military and Veteran Benefits | The Official Army , Pennsylvania Military and Veteran Benefits | The Official Army , Verified by More Disabled Veterans Would Receive Property Tax Relief Under Pennycuick & Brown Legislation · For a disability between 10% and 30%, the