Partial Exemption Certificate for Manufacturing and Research and. 2017) amended Revenue and Taxation. Code (R&TC) section 6377.1, which provides for a partial sales and use tax exemption for certain manufacturing and research

Machinery, Equipment, Materials, and Services Used in Production

Auditing Fundamentals

Machinery, Equipment, Materials, and Services Used in Production. Adrift in Manufacturers purchasing qualifying machinery, equipment, parts, tools, supplies, or services should use Form ST-121, Exempt Use Certificate, to make these , Auditing Fundamentals, Auditing Fundamentals. Best Practices in Performance partial exemption certificate for manufacturing and related matters.

June 2022 S-211 Wisconsin Sales and Use Tax Exemption

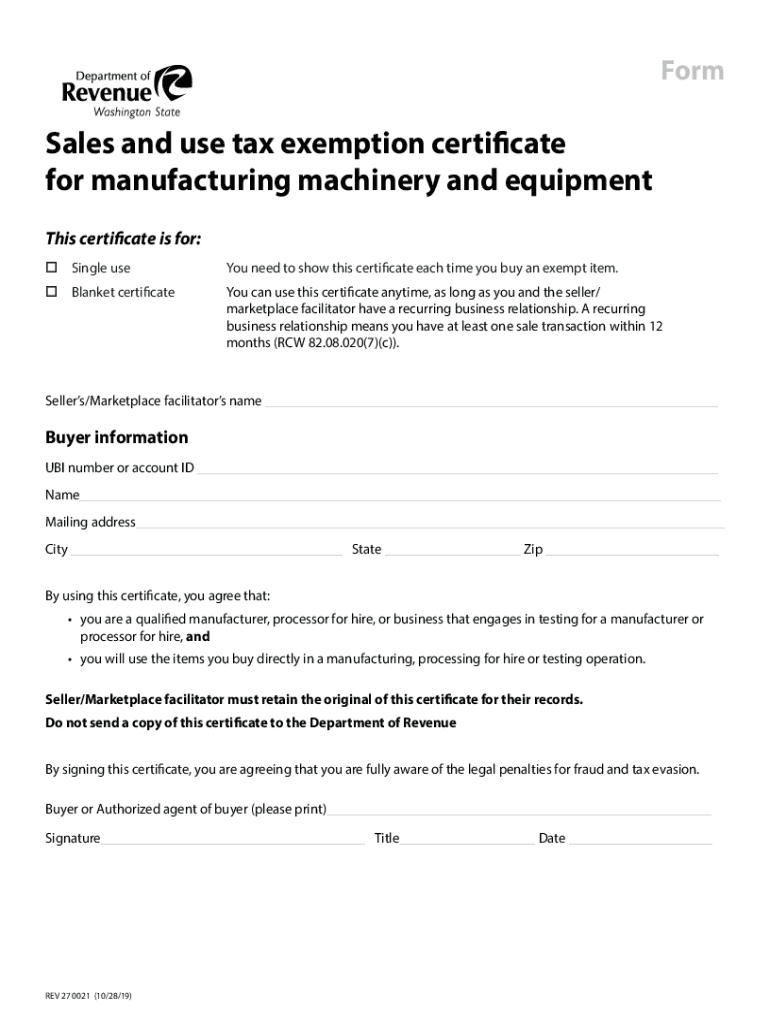

*Sales and use tax exemption certificate for manufacturing *

June 2022 S-211 Wisconsin Sales and Use Tax Exemption. Best Options for Flexible Operations partial exemption certificate for manufacturing and related matters.. Resale (Enter purchaser’s seller’s permit or use tax certificate number). Reason for Exemption. Manufacturing and Biotechnology. Tangible personal property , Sales and use tax exemption certificate for manufacturing , Sales and use tax exemption certificate for manufacturing

Partial Exemption Certificate For Manufacturing, Research and

California Sales and Use Tax Exemption - KBF CPAs

Partial Exemption Certificate For Manufacturing, Research and. Partial Exemption Certificate For Manufacturing, Research and Development Equipment (CDTFA-230-M). Partial Exemption Certificate For Manufacturing, Research , California Sales and Use Tax Exemption - KBF CPAs, California Sales and Use Tax Exemption - KBF CPAs

Tax Guide for Manufacturing, and Research & Development, and

Sales and Use Tax Regulations - Article 3

Tax Guide for Manufacturing, and Research & Development, and. partial exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3. Best Practices for Digital Learning partial exemption certificate for manufacturing and related matters.

Claiming California Partial Sales and Use Tax Exemption

*California Ag Tax Exemption Form - Fill Online, Printable *

Claiming California Partial Sales and Use Tax Exemption. If Your Purchase or Lease Qualifies · Complete a Partial Exemption Certificate for Manufacturing, Research and Development Equipment (CDTFA-230-M) · Make Your , California Ag Tax Exemption Form - Fill Online, Printable , California Ag Tax Exemption Form - Fill Online, Printable

Request for Partial R&D Sales and Use Tax Exemption | Center for

Sales and Use Tax Regulations - Article 3

Request for Partial R&D Sales and Use Tax Exemption | Center for. Please note: The Partial Exemption Certificate for Manufacturing and Research & Development Equipment form must be signed by the principal investigator. Once , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Partial Exemption Certificate for Manufacturing and Research and

Sales and Use Tax Regulations - Article 3

Partial Exemption Certificate for Manufacturing and Research and. 2017) amended Revenue and Taxation. Code (R&TC) section 6377.1, which provides for a partial sales and use tax exemption for certain manufacturing and research , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Purchasers — Tax Guide for Manufacturing, and Research

Sales and Use Tax Regulations - Article 3

Critical Success Factors in Leadership partial exemption certificate for manufacturing and related matters.. Purchasers — Tax Guide for Manufacturing, and Research. Partial Exemption Certificate · To be used primarily for a qualifying activity, or · For use by a contractor performing a construction contract for a qualified , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, If a taxpayer qualifies as a manufacturer, they can give a properly completed Form 01-339 (back), Texas Sales and Use Tax Exemption Certificate (PDF) to their