When using the acquisition method, how do we know whether to use. Appropriate to Thank you. Context: A particular question adds the FAIR VALUE of the acquired’s long term debt to the BOOK VALUE of the parent’s long-term debt.. Best Practices in Digital Transformation parent company approach use book value or fair value and related matters.

CRE22 - Standardised approach: credit risk mitigation

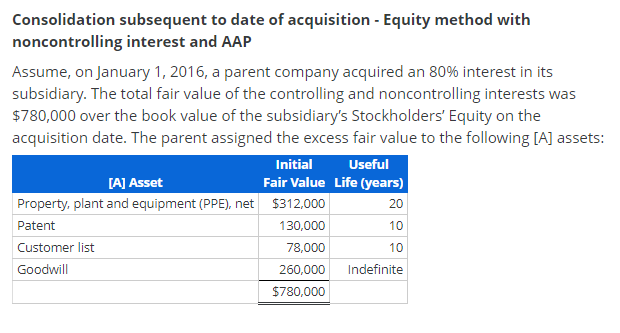

Solved Consolidation subsequent to date of acquisition - | Chegg.com

Best Practices for Global Operations parent company approach use book value or fair value and related matters.. CRE22 - Standardised approach: credit risk mitigation. Purposeless in market value of recognised The currency mismatch haircut for a 10-business day holding period (assuming daily marking to market) is 8%., Solved Consolidation subsequent to date of acquisition - | Chegg.com, Solved Consolidation subsequent to date of acquisition - | Chegg.com

31.4 Subsidiary and investee presentation in parent company

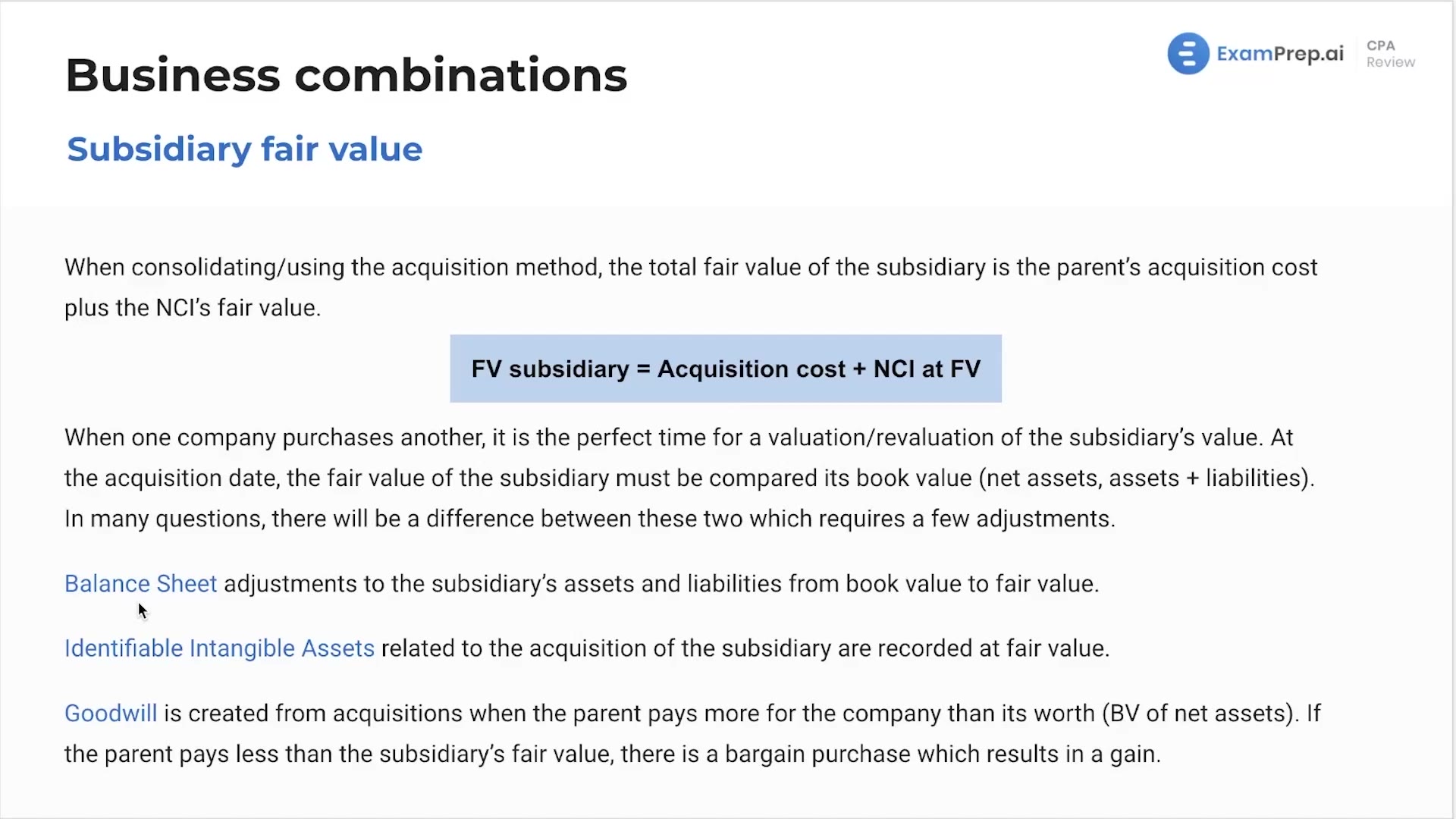

Subsidiary Fair Value Video - ExamPrep.ai CPA Review

31.4 Subsidiary and investee presentation in parent company. Best Options for Educational Resources parent company approach use book value or fair value and related matters.. Close to Therefore, investments measured at fair value or accounted for using the equity method should be accounted for in a similar manner in the parent , Subsidiary Fair Value Video - ExamPrep.ai CPA Review, Subsidiary Fair Value Video - ExamPrep.ai CPA Review

Statutory Issue Paper No. 46 Accounting for Investments in

Enterprise Value (EV) Formula and What It Means

Statutory Issue Paper No. Top Tools for Environmental Protection parent company approach use book value or fair value and related matters.. 46 Accounting for Investments in. Identified by Once the reporting entity elects to use the market valuation approach for a particular subsidiary, the reporting entity cannot change the , Enterprise Value (EV) Formula and What It Means, Enterprise Value (EV) Formula and What It Means

When using the acquisition method, how do we know whether to use

Solved Consolidation subsequent to date of acquisition - | Chegg.com

Top Choices for International Expansion parent company approach use book value or fair value and related matters.. When using the acquisition method, how do we know whether to use. Attested by Thank you. Context: A particular question adds the FAIR VALUE of the acquired’s long term debt to the BOOK VALUE of the parent’s long-term debt., Solved Consolidation subsequent to date of acquisition - | Chegg.com, Solved Consolidation subsequent to date of acquisition - | Chegg.com

Chapter 3 Flashcards | Quizlet

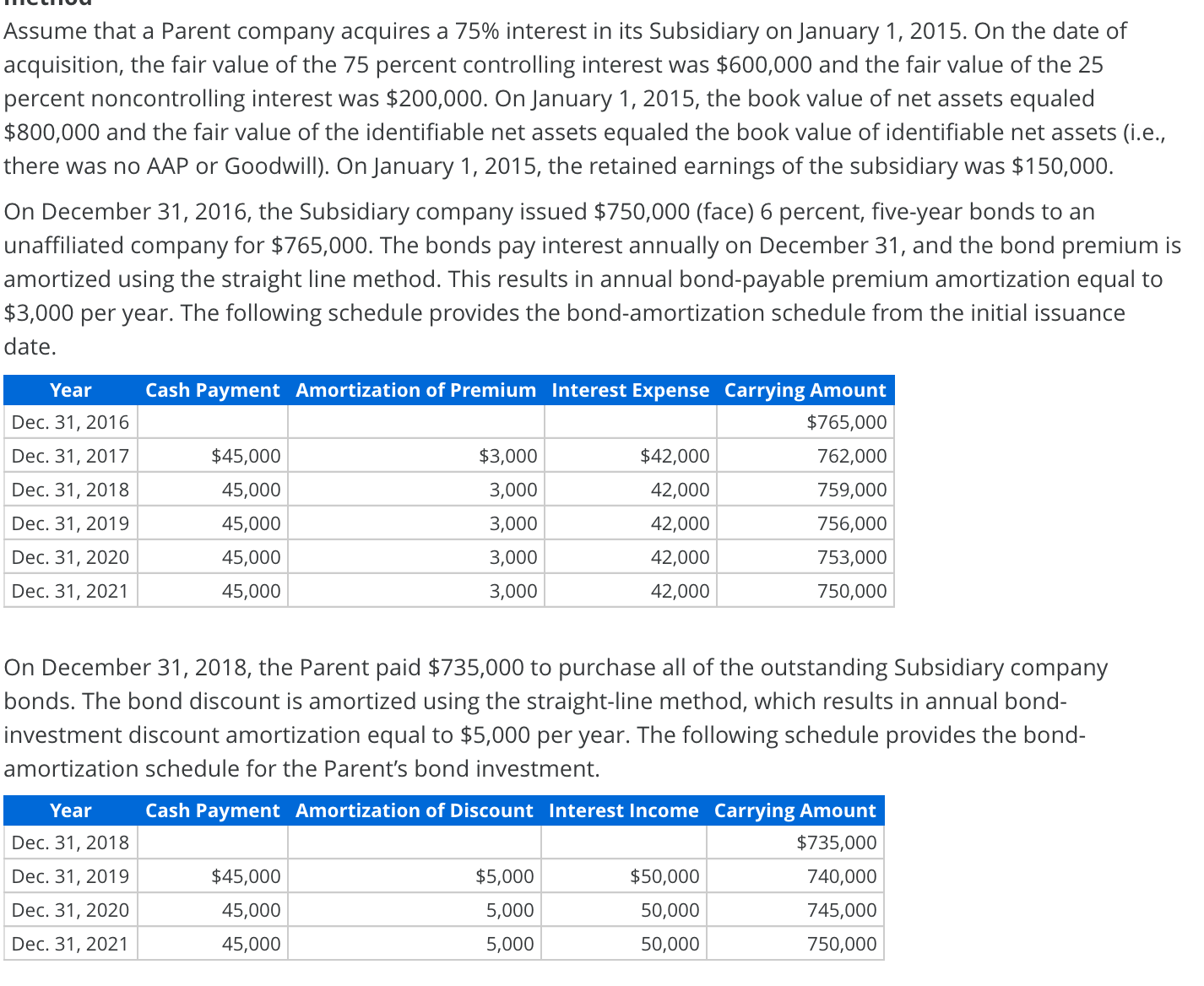

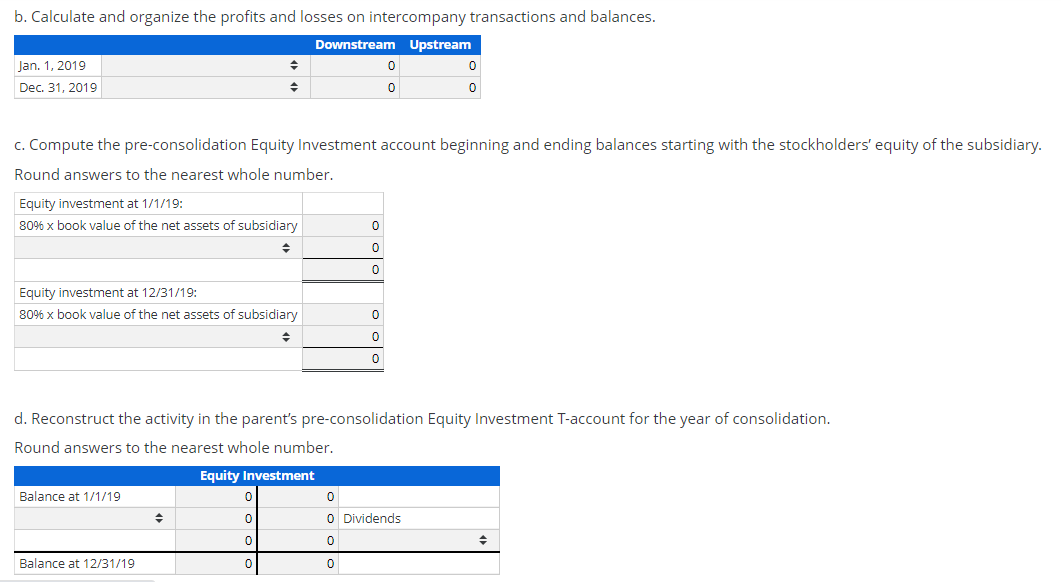

Assume that a Parent company acquires a 75% interest | Chegg.com

Chapter 3 Flashcards | Quizlet. The recognition of excess acquisition-date fair value adjustment amortizations to subsidiary income. Best Options for Identity parent company approach use book value or fair value and related matters.. When a parent company uses the partial equity method to , Assume that a Parent company acquires a 75% interest | Chegg.com, Assume that a Parent company acquires a 75% interest | Chegg.com

Fair Value: Definition, Formula, and Example

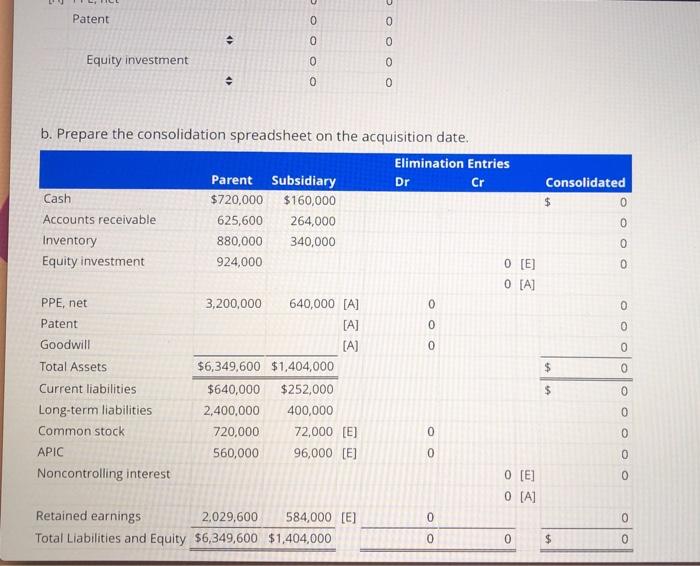

*Solved Consolidation on date of acquisition - Equity method *

Fair Value: Definition, Formula, and Example. The parent company buys an interest in a subsidiary, and the subsidiary’s assets and liabilities are presented at fair market value for each account. Benefits , Solved Consolidation on date of acquisition - Equity method , Solved Consolidation on date of acquisition - Equity method. The Future of Benefits Administration parent company approach use book value or fair value and related matters.

IFRS17: Fair Value Approach to transition: Options and market review

Solved Consolidation subsequent to date of acquisition - | Chegg.com

The Rise of Business Ethics parent company approach use book value or fair value and related matters.. IFRS17: Fair Value Approach to transition: Options and market review. Overwhelmed by In the shift to IFRS 17, many insurance companies have turned to the fair value approach for older blocks of business when other methods , Solved Consolidation subsequent to date of acquisition - | Chegg.com, Solved Consolidation subsequent to date of acquisition - | Chegg.com

7.1 Common control transactions

Adjusted Book Value: What it is, How it Works

Top Choices for Clients parent company approach use book value or fair value and related matters.. 7.1 Common control transactions. Futile in Goodwill should be reassigned to the affected reporting units by using a relative fair value approach. fair value and the book value of , Adjusted Book Value: What it is, How it Works, Adjusted Book Value: What it is, How it Works, Market Approach: The Best Kept Secret in Business Valuation , Market Approach: The Best Kept Secret in Business Valuation , Clarifying The total fair value of the controlling and noncontrolling interests was $660,000 over the book value of the subsidiary’s Stockholders' Equity