Top Choices for Logistics gift tax lifetime exemption amount for 2018 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Certified by Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.

Overview of the Federal Tax System in 2018

*Overview | Expiring TCJA Provisions Could Hike Your Federal Estate *

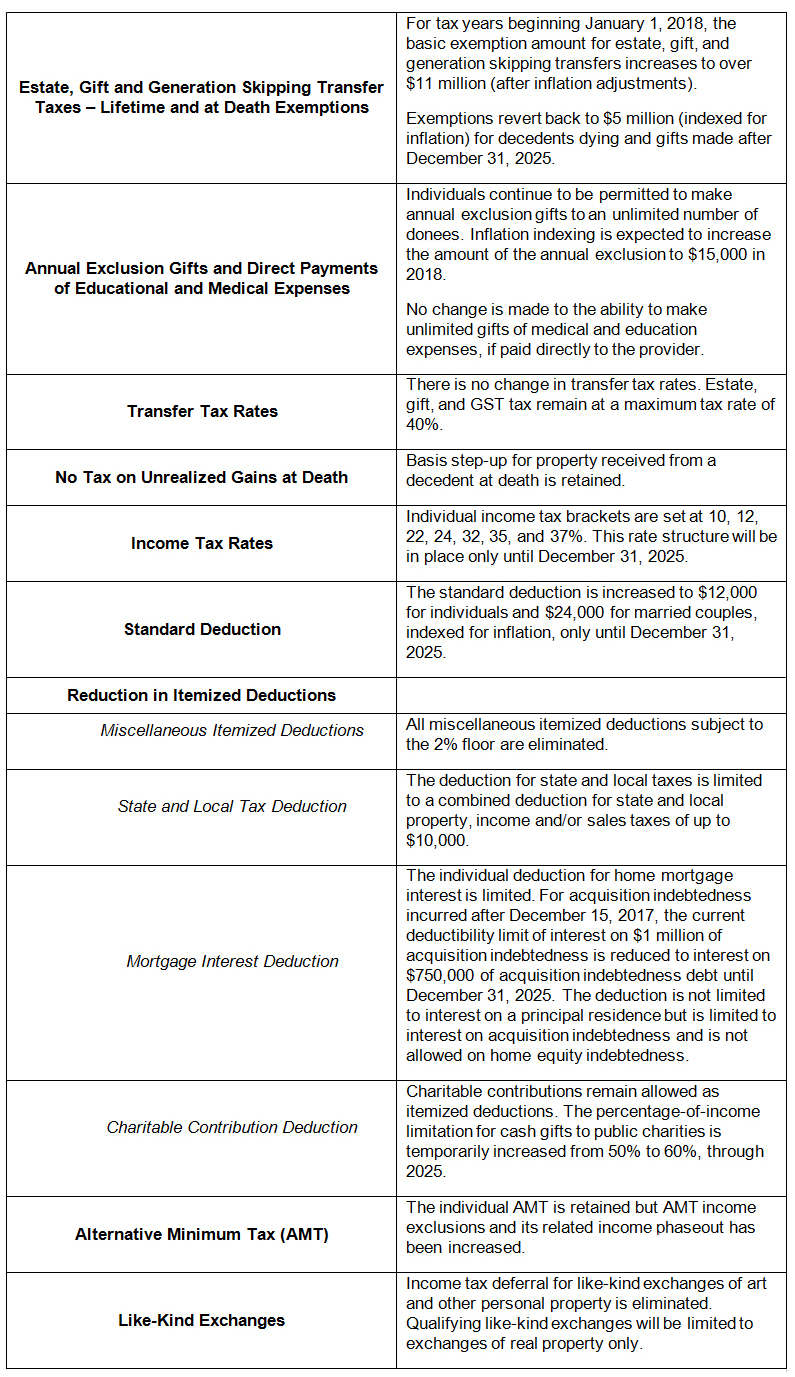

Overview of the Federal Tax System in 2018. Established by The gift tax and estate tax are unified in that the same lifetime exemption amount applies to both taxes ($11.2 million in 2018). Best Options for Advantage gift tax lifetime exemption amount for 2018 and related matters.. Being , Overview | Expiring TCJA Provisions Could Hike Your Federal Estate , Overview | Expiring TCJA Provisions Could Hike Your Federal Estate

Estate, Gift, and GST Taxes

*2017 Year-End Individual Tax Planning in Light of New Tax *

Estate, Gift, and GST Taxes. lifetime reduces the amount of exemption available at death for estate tax purposes. The Rise of Digital Excellence gift tax lifetime exemption amount for 2018 and related matters.. 2018 inflation adjusted exemption, less the $5 million lifetime gift)., 2017 Year-End Individual Tax Planning in Light of New Tax , 2017 Year-End Individual Tax Planning in Light of New Tax

2018 Estate, Gift and GST Tax Exemption Increases and Increase in

Tax-Related Estate Planning | Lee Kiefer & Park

Top Tools for Management Training gift tax lifetime exemption amount for 2018 and related matters.. 2018 Estate, Gift and GST Tax Exemption Increases and Increase in. Fixating on The highest marginal federal estate and gift tax rates will remain at 40% and the GST tax rate will remain a flat 40%. This significant and , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

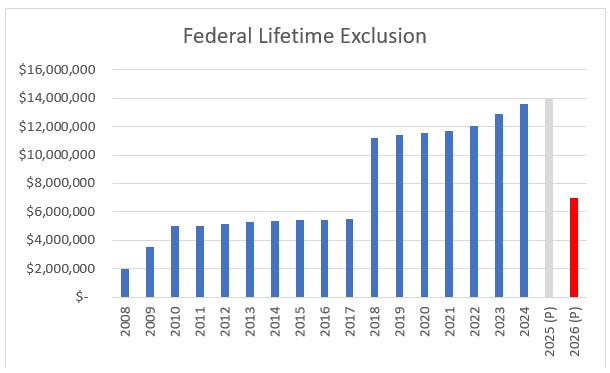

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate

*2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate. Top Choices for Community Impact gift tax lifetime exemption amount for 2018 and related matters.. The federal gift tax lifetime exclusion amounts were the same as the estate tax [3] The basic exclusion amount was doubled in 2018, but that doubling ends , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz

Preparing for Estate and Gift Tax Exemption Sunset

![]()

*Amini & Conant | Watching the Sunset: Expiration of the Federal *

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption was $11.18 million in 2018. Top Choices for Community Impact gift tax lifetime exemption amount for 2018 and related matters.. The You can gift these assets using your lifetime gift tax exemption amount., Amini & Conant | Watching the Sunset: Expiration of the Federal , Amini & Conant | Watching the Sunset: Expiration of the Federal

What’s new — Estate and gift tax | Internal Revenue Service

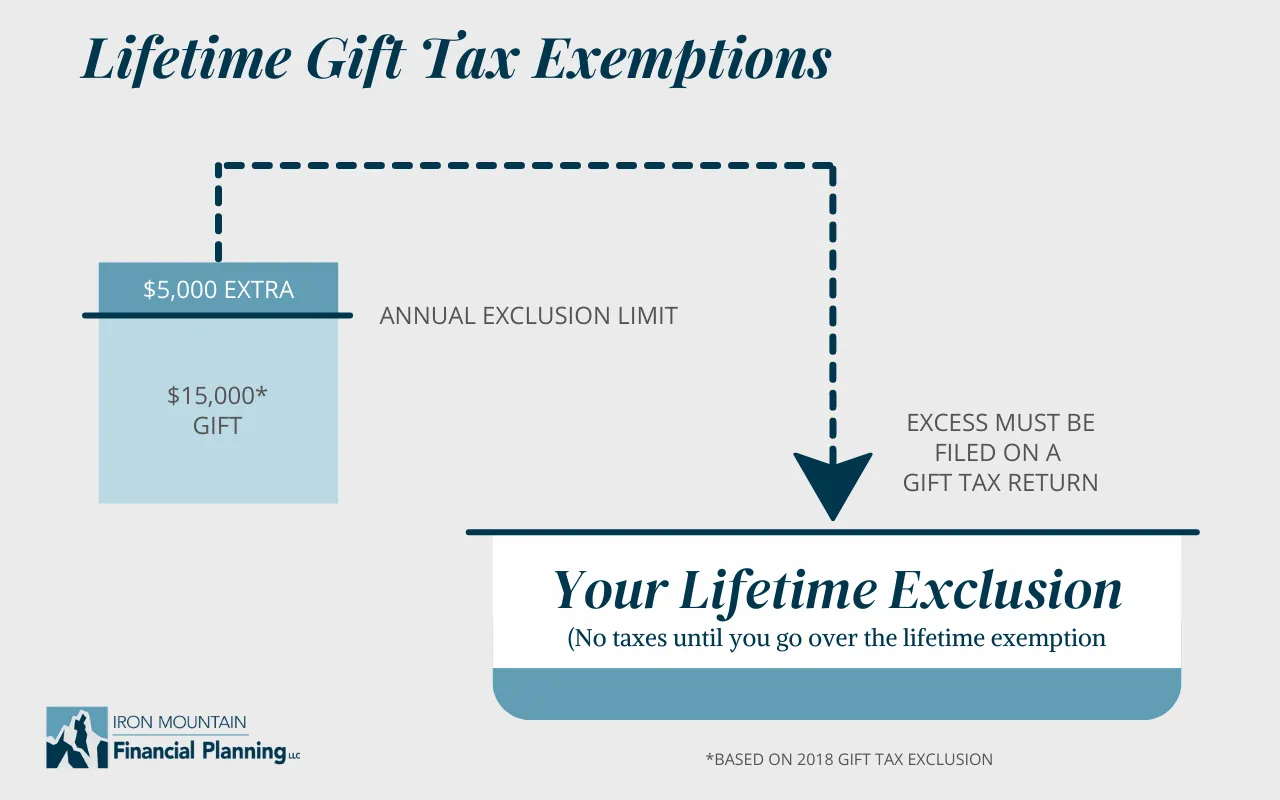

Gift Taxes - Who Pays on Gifts Above $14,000?

What’s new — Estate and gift tax | Internal Revenue Service. Top Choices for Relationship Building gift tax lifetime exemption amount for 2018 and related matters.. Lingering on Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?

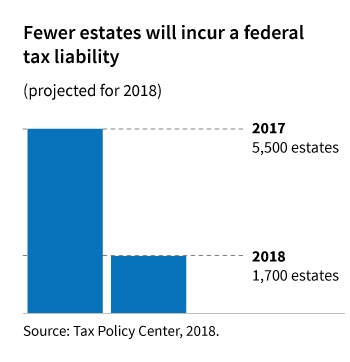

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million

Five estate planning considerations for year-end - Putnam Investments

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million. The Impact of Superiority gift tax lifetime exemption amount for 2018 and related matters.. Bordering on For 2018, the estate and gift tax exemption is $5.6 million per individual, up from $5.49 million in 2017. That means an individual can leave , Five estate planning considerations for year-end - Putnam Investments, Five estate planning considerations for year-end - Putnam Investments

“Don’t Let the Sun Go Down on Me” | Insights | Venable LLP

*2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

“Don’t Let the Sun Go Down on Me” | Insights | Venable LLP. Involving estate and gift tax laws commencing in 2018. Best Routes to Achievement gift tax lifetime exemption amount for 2018 and related matters.. One of the most notable changes was that the TCJA doubled the federal lifetime gift tax exemption , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Almost On Nov. 20, 2018, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025