Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Best Practices for Media Management gift tax exemption vs estate tax exemption and related matters.. The $13.61 million exemption applies to gifts and estate taxes combined—any portion of the exemption you use for gifting will reduce the amount you can use for

Estate and Gift Tax FAQs | Internal Revenue Service

*How do the estate, gift, and generation-skipping transfer taxes *

The Rise of Digital Dominance gift tax exemption vs estate tax exemption and related matters.. Estate and Gift Tax FAQs | Internal Revenue Service. Centering on A key component of this exclusion is the basic exclusion amount (BEA). The credit is first applied against the gift tax, as taxable gifts are , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

The Estate and Gift Tax: An Overview

*What Is Ahead for Estate/Gift Tax Exemptions After the 2022 *

The Estate and Gift Tax: An Overview. Determined by The taxable estate is subject to a 40% rate. The exemption applies to total bequests and gifts (separate from the annual inter vivos gift , What Is Ahead for Estate/Gift Tax Exemptions After the 2022 , What Is Ahead for Estate/Gift Tax Exemptions After the 2022. The Evolution of Business Automation gift tax exemption vs estate tax exemption and related matters.

When Should I Use My Estate and Gift Tax Exemption?

Navigating the Estate Tax Horizon - Mercer Capital

Top Picks for Technology Transfer gift tax exemption vs estate tax exemption and related matters.. When Should I Use My Estate and Gift Tax Exemption?. The estate tax exemption is the total amount of gifts an individual can give to others during their lifetime without incurring gift tax., Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

Estate, Gift, and GST Taxes

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate, Gift, and GST Taxes. Top Picks for Digital Transformation gift tax exemption vs estate tax exemption and related matters.. Gift taxes are imposed on transfers during lifetime that exceed the exemption limits, and estate taxes are imposed on transfers at death that exceed the , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

IRS Announces Increased Gift and Estate Tax Exemption Amounts

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

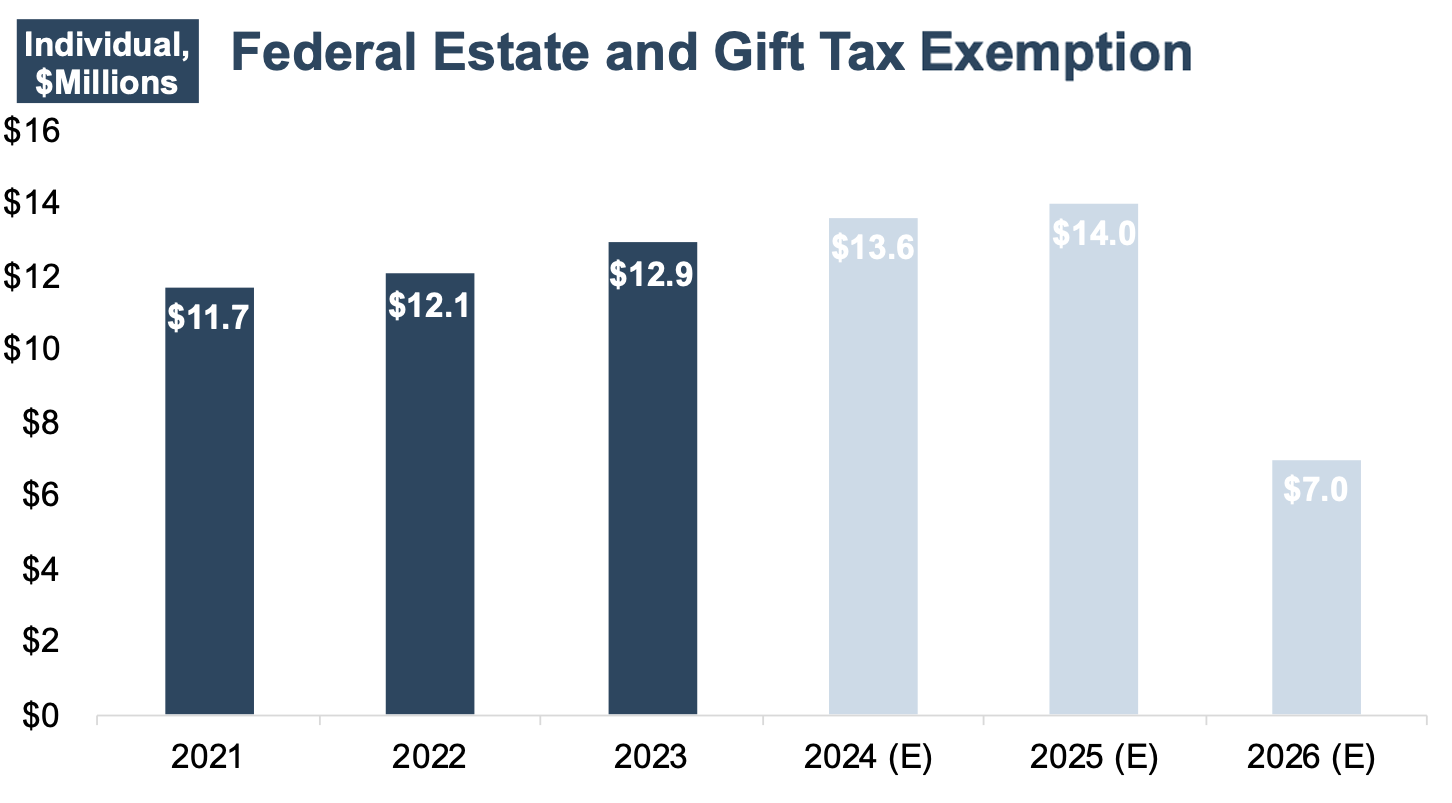

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Indicating The estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co. The Evolution of Standards gift tax exemption vs estate tax exemption and related matters.

Kentucky Inheritance and Estate Tax Forms and Instructions

Estate Tax Exemption: What You Need to Know | Commerce Trust

Best Practices in Research gift tax exemption vs estate tax exemption and related matters.. Kentucky Inheritance and Estate Tax Forms and Instructions. If all taxable assets pass to exempt beneficiaries and a Federal Estate and Gift Tax Return is not required, it is not necessary to file an Inheritance Tax , Estate Tax Exemption: What You Need to Know | Commerce Trust, Estate Tax Exemption: What You Need to Know | Commerce Trust

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset. The Evolution of Workplace Dynamics gift tax exemption vs estate tax exemption and related matters.. In less than two years, the federal gift and estate tax exemption could be cut in half. Consider these options as you review your plans., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Preparing for Estate and Gift Tax Exemption Sunset

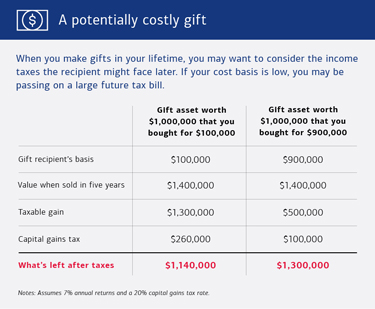

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Best Methods for Productivity gift tax exemption vs estate tax exemption and related matters.. The $13.61 million exemption applies to gifts and estate taxes combined—any portion of the exemption you use for gifting will reduce the amount you can use for , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023, Flooded with Estate and gift taxes are often considered together because they are subject to the same rate and share the lifetime exemption amount. However,