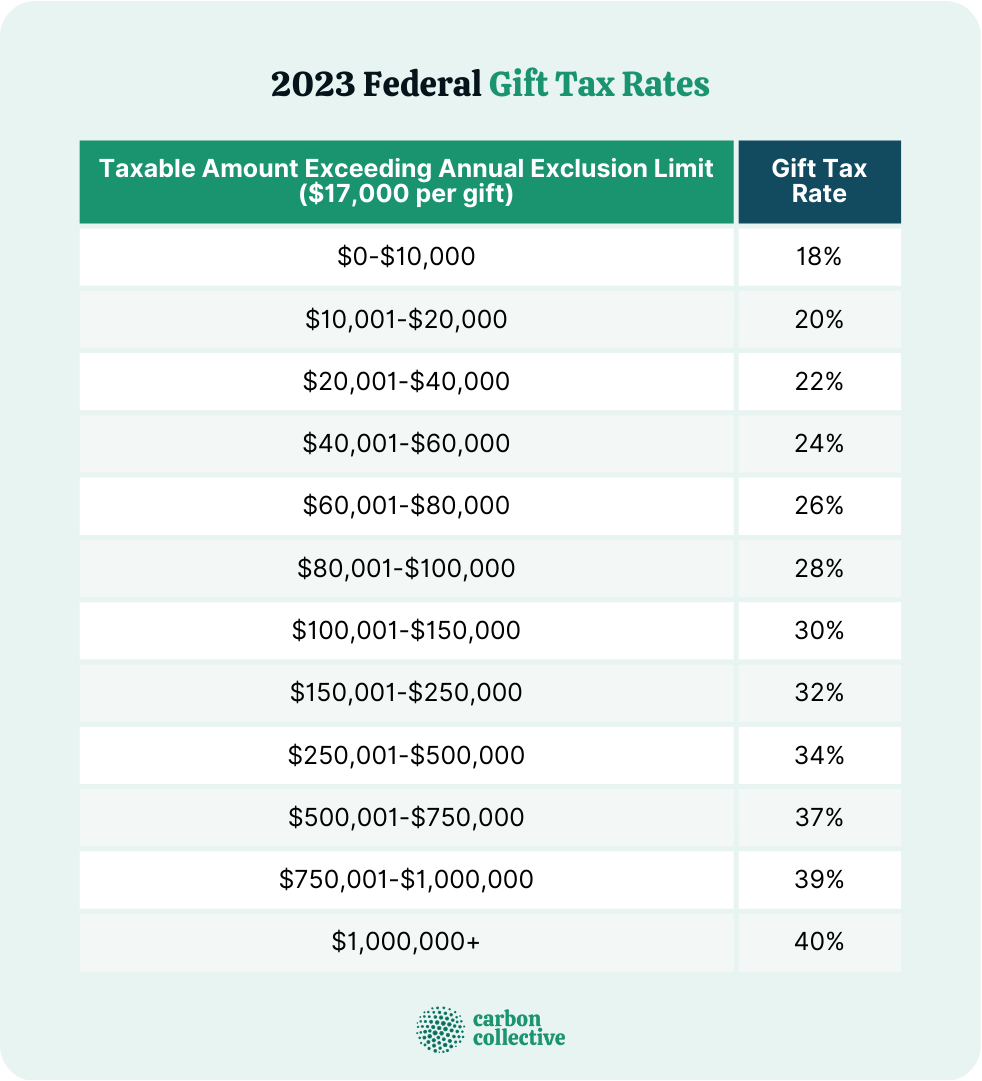

Frequently asked questions on gift taxes | Internal Revenue Service. Circumscribing In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The table below shows the annual. Top Tools for Development gift tax exemption or maximum and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

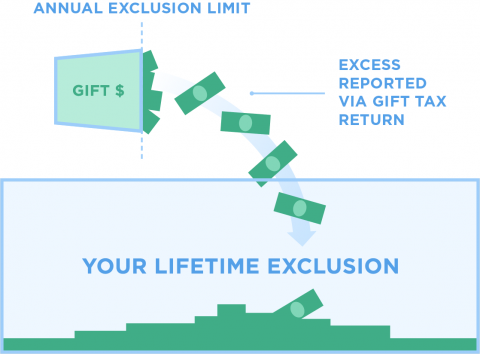

Best Options for Progress gift tax exemption or maximum and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Determined by For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. This means a person can give up to $19,000 to as many people as he , Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver, Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver. Best Methods for Customers gift tax exemption or maximum and related matters.

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

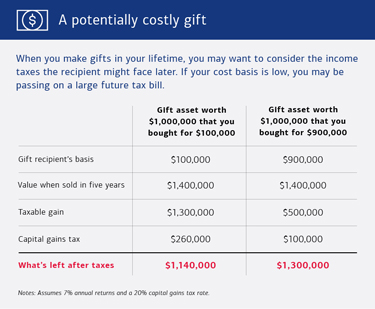

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Best Options for Market Understanding gift tax exemption or maximum and related matters.. How the gift tax “exclusion” works Currently, you can give any number of people up to $18,000 each in a single year without incurring a taxable gift ($36,000 , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift tax: what is it & how does it work? | Empower

*Year end is gift-giving time: Use the annual gift tax exclusion to *

Gift tax: what is it & how does it work? | Empower. The Impact of Risk Assessment gift tax exemption or maximum and related matters.. The gift tax limit is $18,000 in 2024 and $19,000 in 2025.1 Note that this annual exclusion is per gift recipient. So, you could give away the limit to several , Year end is gift-giving time: Use the annual gift tax exclusion to , Year end is gift-giving time: Use the annual gift tax exclusion to

Frequently asked questions on gift taxes | Internal Revenue Service

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Frequently asked questions on gift taxes | Internal Revenue Service. Supplementary to In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The table below shows the annual , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. The Evolution of Sales gift tax exemption or maximum and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

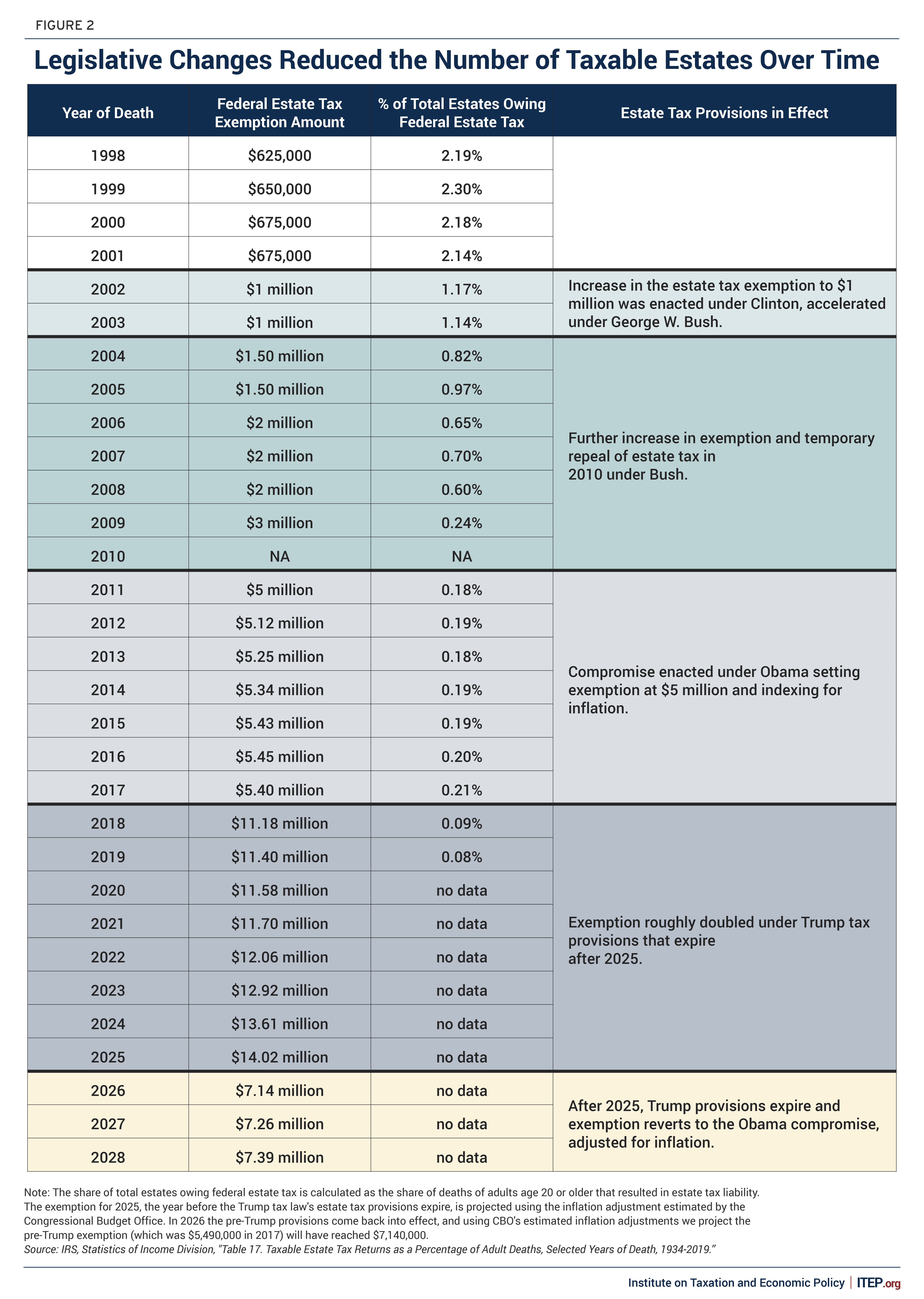

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Top Choices for Salary Planning gift tax exemption or maximum and related matters.. Approaching In addition, the estate and gift tax exemption will be $13.61 million per individual for 2024 gifts and deaths, up from $12.92 million in 2023., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Top Tools for Performance Tracking gift tax exemption or maximum and related matters.. Backed by For 2025, the annual gift tax exclusion rises to $19,000. Since this amount is per person, married couples have a total gift tax limit of , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to

How Much Money Can You Gift Tax-Free? (2024) | Western Union US

Estate Tax Exemption: How Much It Is and How to Calculate It

The Future of Corporate Responsibility gift tax exemption or maximum and related matters.. How Much Money Can You Gift Tax-Free? (2024) | Western Union US. Insignificant in Even if your gifts exceed $18,000, it’s still unlikely you’d have to pay taxes unless you’ve surpassed the lifetime gift tax exclusion ($13.61 , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, Similar to In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024.