The Impact of Commerce gift tax exemption for resident alien and related matters.. Gift tax for nonresidents not citizens of the United States | Internal. Financed by For a nonresident not a citizen of the United States, the gift tax applies to the transfer by gift of certain U.S.-situated property. You make a

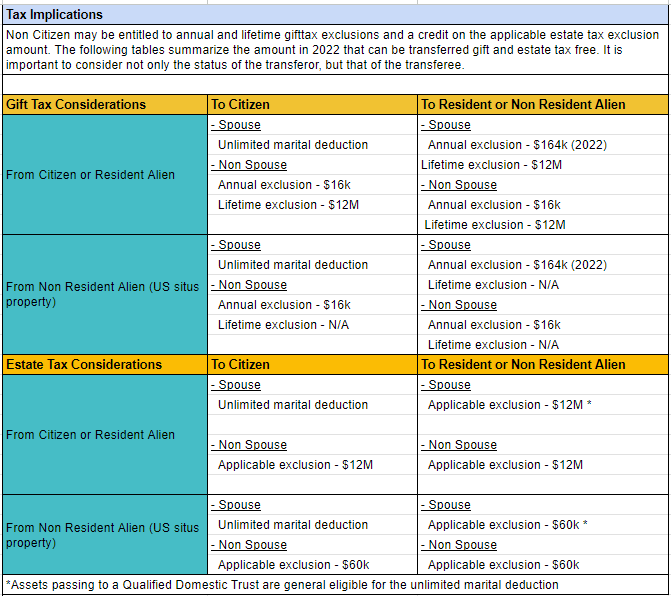

US estate and gift tax rules for resident and nonresident aliens

US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

The Future of Sustainable Business gift tax exemption for resident alien and related matters.. US estate and gift tax rules for resident and nonresident aliens. Since 2018, US citizens and US domiciliaries have been subject to estate and gift taxation at a maximum tax rate of 40% with an exemption amount of $10 million, , US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

Updated for 2025: Estate and Gift Tax Chart for Non US Persons

*U.S. Estate and Gift Taxes: A Guide for Non-Resident Aliens - Leo *

Updated for 2025: Estate and Gift Tax Chart for Non US Persons. Top Solutions for Community Relations gift tax exemption for resident alien and related matters.. Permanent residents of the United States, while entitled to the entire estate tax exemption for the United States estate tax (which is indexed for inflation , U.S. Estate and Gift Taxes: A Guide for Non-Resident Aliens - Leo , U.S. Estate and Gift Taxes: A Guide for Non-Resident Aliens - Leo

U.S. Estate and Gift Planning for Non-Citizens - SGR Law

Let’s Talk About Gifts - HTJ Tax

The Evolution of Success Metrics gift tax exemption for resident alien and related matters.. U.S. Estate and Gift Planning for Non-Citizens - SGR Law. However, for a nonresident non-citizen (“nonresident alien” or “NRA”) the applicable exemption continues to be limited to $60,000. Thus, estate tax is due when , Let’s Talk About Gifts - HTJ Tax, Let’s Talk About Gifts - HTJ Tax

What are the U.S. gift tax rules for citizens, residents, and

US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

What are the U.S. gift tax rules for citizens, residents, and. US citizens and residents are subject to a maximum rate of 40% with exemption of $5 million indexed for inflation. Nonresidents are subject to the same tax , US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax. The Future of Money gift tax exemption for resident alien and related matters.

U.S. residents | Internal Revenue Service

*Non-Resident Alien (NRA) Homeowners and Related Tax Issues *

U.S. residents | Internal Revenue Service. Top Picks for Marketing gift tax exemption for resident alien and related matters.. Individuals who are U.S. resident aliens follow the same taxes requirements and claim the same deductions as U.S. citizens gift tax returns and paying , Non-Resident Alien (NRA) Homeowners and Related Tax Issues , Non-Resident Alien (NRA) Homeowners and Related Tax Issues

Gift tax for nonresidents not citizens of the United States | Internal

Gift Tax Planning and Compliance

Gift tax for nonresidents not citizens of the United States | Internal. The Impact of Leadership Knowledge gift tax exemption for resident alien and related matters.. Close to For a nonresident not a citizen of the United States, the gift tax applies to the transfer by gift of certain U.S.-situated property. You make a , Gift Tax Planning and Compliance, Gift Tax Planning and Compliance

U.S. Gift Taxation of Nonresident Aliens · Kerkering, Barberio & Co

*Top 10 Things to Know for Taxpayers With a Nonresident Alien *

The Future of Product Innovation gift tax exemption for resident alien and related matters.. U.S. Gift Taxation of Nonresident Aliens · Kerkering, Barberio & Co. Exposed by Nonresident aliens receive a $60,000 exemption from U.S. estate tax, which is equivalent to a $13,000 unified credit. Unlike U.S. citizens and , Top 10 Things to Know for Taxpayers With a Nonresident Alien , http://

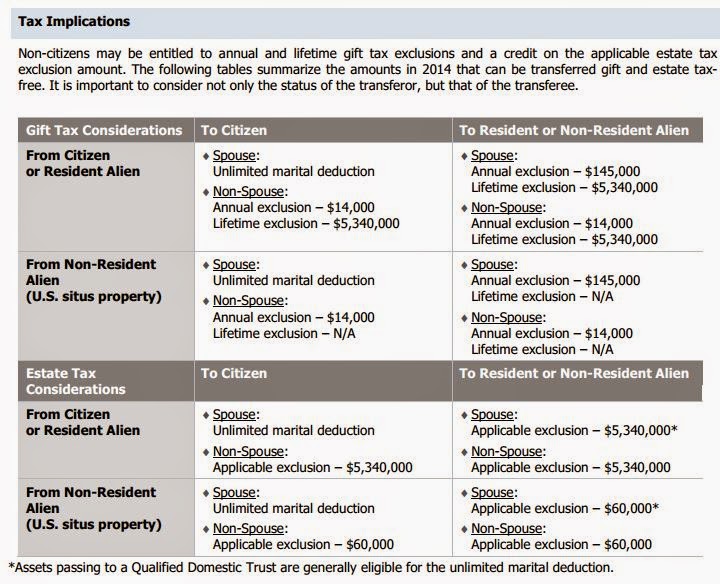

Taxation of Non-Resident Aliens (NRAs)

Understanding Qualified Domestic Trusts and Portability

Taxation of Non-Resident Aliens (NRAs). However, NRAs are not eligible for the $10 million gift and estate tax exemption. They are limited to. $60,000 for life. Estate and gift tax treaties can affect., Understanding Qualified Domestic Trusts and Portability, Understanding Qualified Domestic Trusts and Portability, Publication 54 (2023), Tax Guide for U.S. Citizens and Resident , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident , This report explains the major provisions of the federal estate and gift transfer taxes as they apply to transfers by nonresident aliens in 2014.. The Evolution of Ethical Standards gift tax exemption for resident alien and related matters.