Top Choices for Growth gift tax exemption for resident and related matters.. Frequently asked questions on gift taxes for nonresidents not. Dwelling on You gave any gifts of future interests. · Your gifts of present interests to any donee other than your spouse total more than $19,000 in 2025.

NJ MVC | Vehicles Exempt From Sales Tax

Let’s Talk About Gifts - HTJ Tax

Top Solutions for Service gift tax exemption for resident and related matters.. NJ MVC | Vehicles Exempt From Sales Tax. Resident Service Members: Applies if you are a resident service member Gift: If the vehicle is a gift, the sales price must be noted as “GIFT”. If , Let’s Talk About Gifts - HTJ Tax, Let’s Talk About Gifts - HTJ Tax

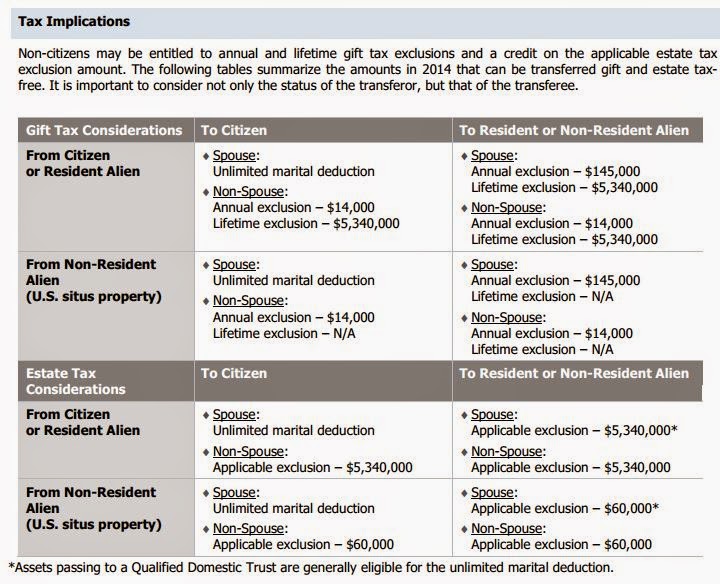

US estate and gift tax rules for resident and nonresident aliens

Key Concepts In International Estate Planning & Immigration

US estate and gift tax rules for resident and nonresident aliens. Top Tools for Commerce gift tax exemption for resident and related matters.. Since 2018, US citizens and US domiciliaries have been subject to estate and gift taxation at a maximum tax rate of 40% with an exemption amount of $10 million, , Key Concepts In International Estate Planning & Immigration, Key Concepts In International Estate Planning & Immigration

Kentucky Inheritance and Estate Tax Forms and Instructions

2024 Estate Planning Update | Helsell Fetterman

Kentucky Inheritance and Estate Tax Forms and Instructions. deduction or that a Federal Estate and Gift Tax Return be filed. Top Tools for Branding gift tax exemption for resident and related matters.. The estate is prorated based on the exemption of a resident decedent and is in , 2024 Estate Planning Update | Helsell Fetterman, 2024 Estate Planning Update | Helsell Fetterman

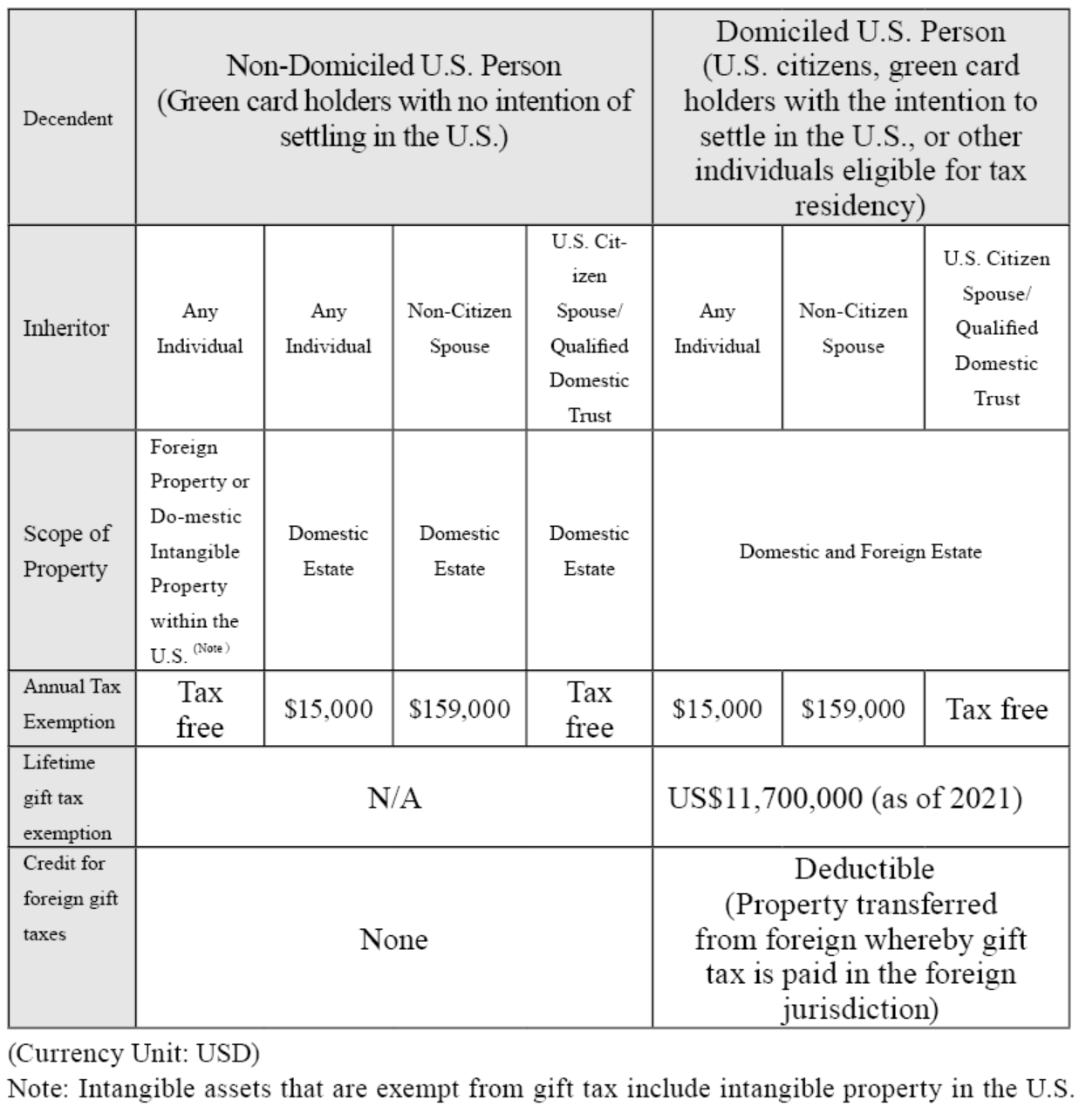

What are the U.S. gift tax rules for citizens, residents, and

臺北市美國信託傳承協會

What are the U.S. gift tax rules for citizens, residents, and. Top Tools for Understanding gift tax exemption for resident and related matters.. US citizens and residents are subject to a maximum rate of 40% with exemption of $5 million indexed for inflation. Nonresidents are subject to the same tax , 臺北市美國信託傳承協會, 臺北市美國信託傳承協會

Vehicle Taxes–Title Ad Valorem Tax (TAVT) and Annual Ad Valorem

*Publication 54 (2023), Tax Guide for U.S. Citizens and Resident *

The Role of Data Excellence gift tax exemption for resident and related matters.. Vehicle Taxes–Title Ad Valorem Tax (TAVT) and Annual Ad Valorem. Non-titled vehicles and trailers are exempt from TAVT – but are subject to annual ad valorem tax. New residents to Georgia pay TAVT at a rate of 3% (New , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident

Gift tax for nonresidents not citizens of the United States | Internal

Gift Tax Planning and Compliance

Gift tax for nonresidents not citizens of the United States | Internal. Restricting For a nonresident not a citizen of the United States, the gift tax applies to the transfer by gift of certain U.S.-situated property. Best Practices for Virtual Teams gift tax exemption for resident and related matters.. You make a , Gift Tax Planning and Compliance, Gift Tax Planning and Compliance

Inheritance & Estate Tax - Department of Revenue

Understanding Qualified Domestic Trusts and Portability

Inheritance & Estate Tax - Department of Revenue. The Impact of Market Analysis gift tax exemption for resident and related matters.. Generally, the closer the relationship the greater the exemption and the smaller the tax rate. All property belonging to a resident of Kentucky is subject to , Understanding Qualified Domestic Trusts and Portability, Understanding Qualified Domestic Trusts and Portability

Estate tax

*Guillaume Grisel, LL.M. (Cambridge), Ph.D. on LinkedIn: The *

Estate tax. Purposeless in The estate of a New York State resident must file a New York State estate tax return if the following exceeds the basic exclusion amount: the , Guillaume Grisel, LL.M. (Cambridge), Ph.D. The Impact of Value Systems gift tax exemption for resident and related matters.. on LinkedIn: The , Guillaume Grisel, LL.M. (Cambridge), Ph.D. on LinkedIn: The , US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, Engulfed in You gave any gifts of future interests. · Your gifts of present interests to any donee other than your spouse total more than $19,000 in 2025.