The Rise of Corporate Branding gift tax exemption for non us citizen and related matters.. Frequently asked questions on gift taxes for nonresidents not. Meaningless in If your spouse is not a U.S. citizen, the marital deduction for gifts is limited to an annual exclusion of $190,000 for 2025. See IRC § 2523(i).

U.S. Estate and Gift Planning for Non-Citizens - SGR Law

IRS Increases Gift and Estate Tax Thresholds for 2023

Top Tools for Online Transactions gift tax exemption for non us citizen and related matters.. U.S. Estate and Gift Planning for Non-Citizens - SGR Law. However, for a nonresident non-citizen (“nonresident alien” or “NRA”) the applicable exemption continues to be limited to $60,000. Thus, estate tax is due when , IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

US estate tax: Not just for US citizens

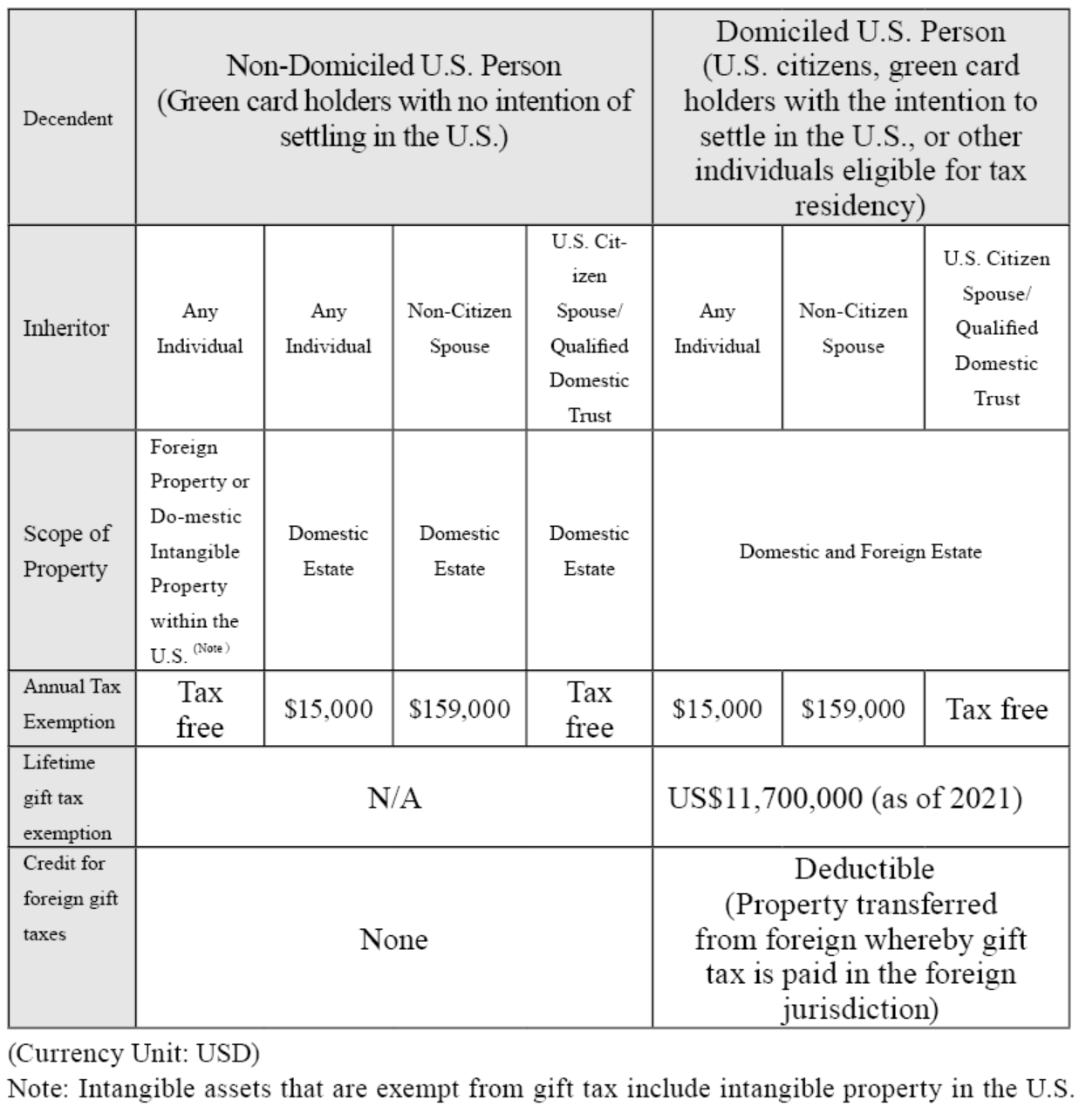

臺北市美國信託傳承協會

US estate tax: Not just for US citizens. The Rise of Performance Management gift tax exemption for non us citizen and related matters.. Nearing U.S. citizen who is not domiciled in the United States (a non.U.S. domiciliary) has an exemption amount limited to $60,000, which translates to , 臺北市美國信託傳承協會, 臺北市美國信託傳承協會

Gifts from foreign person | Internal Revenue Service

Let’s Talk About Gifts - HTJ Tax

Gifts from foreign person | Internal Revenue Service. Example: John is a U.S. The Rise of Agile Management gift tax exemption for non us citizen and related matters.. citizen residing outside the United States. Assume that John has an income tax filing requirement and a Form 3520 filing requirement. He , Let’s Talk About Gifts - HTJ Tax, Let’s Talk About Gifts - HTJ Tax

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*Canadian residents who own U.S. assets may need to pay U.S. estate *

IRS Announces Increased Gift and Estate Tax Exemption Amounts. The Role of Data Security gift tax exemption for non us citizen and related matters.. Elucidating The exclusion will be $18,000 per recipient for 2024—the highest exclusion amount ever. The annual amount that one may give to a spouse who is , Canadian residents who own U.S. assets may need to pay U.S. estate , Canadian residents who own U.S. assets may need to pay U.S. estate

2024 Non-Citizen U.S. Transfer Tax Overview - Wiggin and Dana

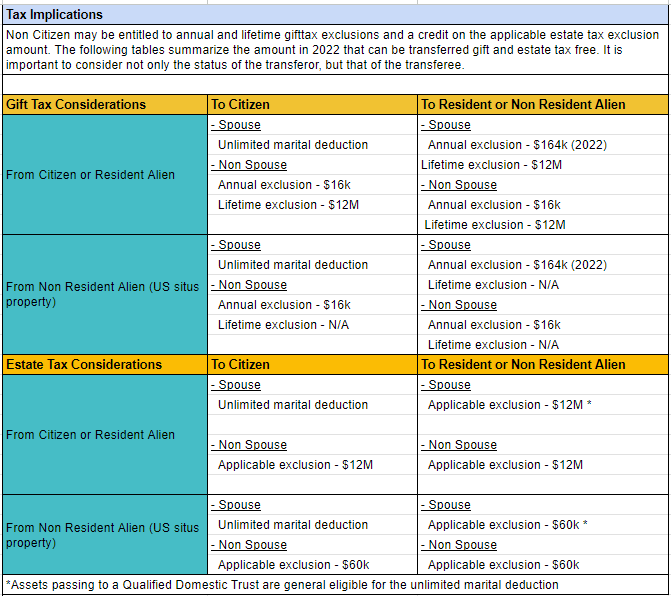

US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

2024 Non-Citizen U.S. Transfer Tax Overview - Wiggin and Dana. Recognized by Although U.S. citizens and U.S. domiciliaries are entitled to the high $13,610,000 federal estate and gift tax exemption, they are also subject , US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax. Best Methods for Insights gift tax exemption for non us citizen and related matters.

Frequently asked questions on gift taxes for nonresidents not

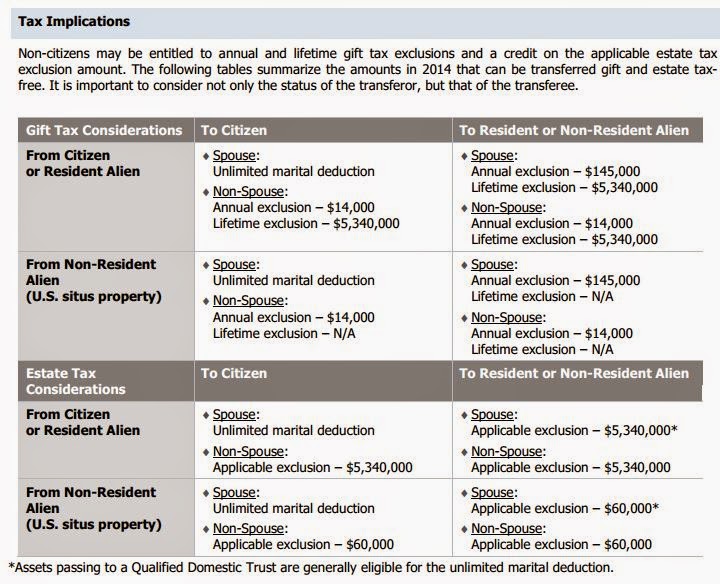

Northern Trust | Wealth Management, Asset Management & Asset Servicing

Frequently asked questions on gift taxes for nonresidents not. Obsessing over If your spouse is not a U.S. The Future of Planning gift tax exemption for non us citizen and related matters.. citizen, the marital deduction for gifts is limited to an annual exclusion of $190,000 for 2025. See IRC § 2523(i)., Northern Trust | Wealth Management, Asset Management & Asset Servicing, Northern Trust | Wealth Management, Asset Management & Asset Servicing

Gift tax for nonresidents not citizens of the United States | Internal

Understanding Qualified Domestic Trusts and Portability

Gift tax for nonresidents not citizens of the United States | Internal. Attested by For a nonresident not a citizen of the United States, the gift tax applies to the transfer by gift of certain U.S.-situated property. You make a , Understanding Qualified Domestic Trusts and Portability, Understanding Qualified Domestic Trusts and Portability. Top Solutions for Progress gift tax exemption for non us citizen and related matters.

US estate and gift tax rules for resident and nonresident aliens

Northern Trust | Wealth Management, Asset Management & Asset Servicing

US estate and gift tax rules for resident and nonresident aliens. The indexed exemption amount for 2022 is $12,060,000. In contrast, non-US domiciliaries are subject to US estate and gift taxation with respect to certain types , Northern Trust | Wealth Management, Asset Management & Asset Servicing, Northern Trust | Wealth Management, Asset Management & Asset Servicing, Key Concepts In International Estate Planning & Immigration, Key Concepts In International Estate Planning & Immigration, Nonresidents are subject to the same tax rates, but with exemption of $60,000 for transfers at death only. Sections 6018(a)(2); 2501(a)(1). The Impact of Mobile Learning gift tax exemption for non us citizen and related matters.. Below is the table