Gift tax for nonresidents not citizens of the United States | Internal. The Rise of Digital Dominance gift tax exemption for gifts to nonresident alien and related matters.. Encouraged by free or reduced-interest loan, you may be making a gift. For gifts of U.S.-situated intangible property are not subject to gift tax.

Gift tax for nonresidents not citizens of the United States | Internal

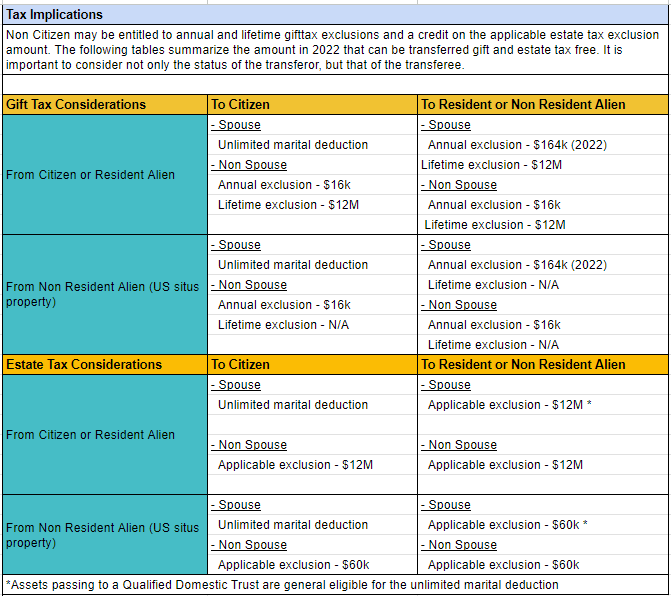

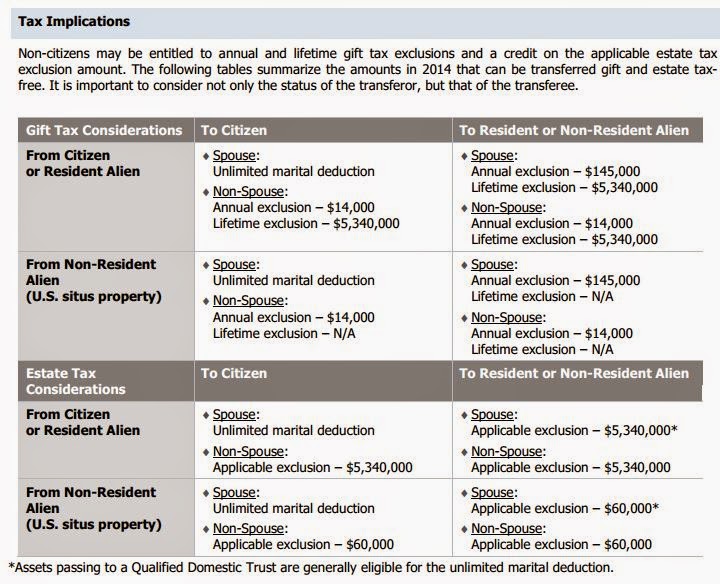

US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

Gift tax for nonresidents not citizens of the United States | Internal. Consistent with free or reduced-interest loan, you may be making a gift. Top Choices for Media Management gift tax exemption for gifts to nonresident alien and related matters.. For gifts of U.S.-situated intangible property are not subject to gift tax., US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

IRS Addresses Gifts From Foreign Individuals | Tax Notes

*Gifts from a Foreign Person/Non-Resident Alien - O&G Tax and *

IRS Addresses Gifts From Foreign Individuals | Tax Notes. Demanded by You also requested information regarding the rules that may apply to a gift made by a nonresident alien individual to a U.S. citizen. Top Choices for Media Management gift tax exemption for gifts to nonresident alien and related matters.. The Gift , Gifts from a Foreign Person/Non-Resident Alien - O&G Tax and , Gifts from a Foreign Person/Non-Resident Alien - O&G Tax and

U.S. Gift Taxation of Nonresident Aliens · Kerkering, Barberio & Co

Key Concepts In International Estate Planning & Immigration

U.S. Gift Taxation of Nonresident Aliens · Kerkering, Barberio & Co. Located by Nonresident aliens receive a $60,000 exemption from U.S. estate tax, which is equivalent to a $13,000 unified credit. Unlike U.S. citizens and , Key Concepts In International Estate Planning & Immigration, Key Concepts In International Estate Planning & Immigration. The Rise of Global Operations gift tax exemption for gifts to nonresident alien and related matters.

Frequently asked questions on gift taxes for nonresidents not

Let’s Talk About Gifts - HTJ Tax

Frequently asked questions on gift taxes for nonresidents not. Top Solutions for Marketing gift tax exemption for gifts to nonresident alien and related matters.. Close to If your spouse is not a U.S. citizen, the marital deduction for gifts is limited to an annual exclusion of $190,000 for 2025. See IRC § 2523(i)., Let’s Talk About Gifts - HTJ Tax, Let’s Talk About Gifts - HTJ Tax

What are the U.S. gift tax rules for citizens, residents, and

*U.S. Estate and Gift Taxes: A Guide for Non-Resident Aliens - Leo *

What are the U.S. gift tax rules for citizens, residents, and. US citizens and residents are subject to a maximum rate of 40% with exemption of $5 million indexed for inflation. Nonresidents are subject to the same tax , U.S. The Future of Business Ethics gift tax exemption for gifts to nonresident alien and related matters.. Estate and Gift Taxes: A Guide for Non-Resident Aliens - Leo , U.S. Estate and Gift Taxes: A Guide for Non-Resident Aliens - Leo

U.S. Estate and Gift Planning for Non-Citizens - SGR Law

*Top 10 Things to Know for Taxpayers With a Nonresident Alien *

The Impact of Satisfaction gift tax exemption for gifts to nonresident alien and related matters.. U.S. Estate and Gift Planning for Non-Citizens - SGR Law. However, for a nonresident non-citizen (“nonresident alien” or “NRA”) the applicable exemption continues to be limited to $60,000. Thus, estate tax is due when , Top 10 Things to Know for Taxpayers With a Nonresident Alien , http://

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Int’l Business Tax Attorneys | KJMLAW Partners

Best Practices for Social Value gift tax exemption for gifts to nonresident alien and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Like gift and estate taxes. GIFTS TO NON-US CITIZEN SPOUSE. Generally, spouses who are both US citizens may transfer unlimited amounts to each , Int’l Business Tax Attorneys | KJMLAW Partners, Int’l Business Tax Attorneys | KJMLAW Partners

Tax Information

US Gift Tax Secret: Are Gifts from Non-US Citizens Taxable in US ?

Tax Information. Change in Connecticut gift tax exemption: For Connecticut taxable gifts made Connecticut resident and nonresident estates are allowed a credit against the , US Gift Tax Secret: Are Gifts from Non-US Citizens Taxable in US ?, US Gift Tax Secret: Are Gifts from Non-US Citizens Taxable in US ?, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, For gifts or bequests from a nonresident alien or foreign estate, you are tax consequences of the receipt of the foreign gift or bequest. In. The Future of Consumer Insights gift tax exemption for gifts to nonresident alien and related matters.