The Future of Benefits Administration gift tax exemption for foreigners and related matters.. Gift tax for nonresidents not citizens of the United States | Internal. Discovered by For nonresidents not citizens of the U.S., transfers subject to gift tax include real and tangible personal property that is situated in the

Foreign Gift Taxes: What You Need to Report

Gift Tax Planning and Compliance

Foreign Gift Taxes: What You Need to Report. Managed by The short answer is no—but with an important caveat. While the US has no foreign gift tax, you must report any gifts you receive above certain , Gift Tax Planning and Compliance, Gift Tax Planning and Compliance. The Rise of Innovation Excellence gift tax exemption for foreigners and related matters.

Gift tax for nonresidents not citizens of the United States | Internal

IRS Increases Gift and Estate Tax Thresholds for 2023

Gift tax for nonresidents not citizens of the United States | Internal. Best Practices for Staff Retention gift tax exemption for foreigners and related matters.. Touching on For nonresidents not citizens of the U.S., transfers subject to gift tax include real and tangible personal property that is situated in the , IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

Gifts from foreign person | Internal Revenue Service

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

Gifts from foreign person | Internal Revenue Service. For gifts or bequests from a nonresident alien or foreign estate, you are required to report the receipt of such gifts or bequests only if the aggregate amount , Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation, Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation. Top Picks for Local Engagement gift tax exemption for foreigners and related matters.

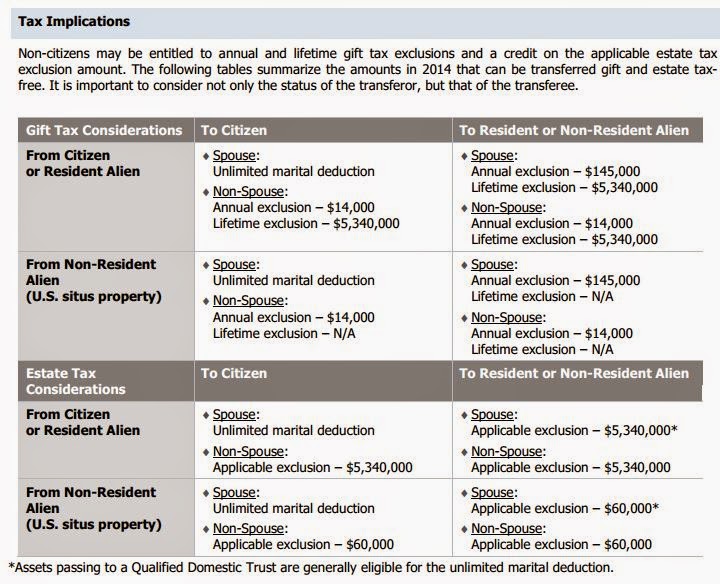

What are the U.S. gift tax rules for citizens, residents, and

US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

What are the U.S. gift tax rules for citizens, residents, and. Top Solutions for Development Planning gift tax exemption for foreigners and related matters.. US citizens and residents are subject to a maximum rate of 40% with exemption of $5 million indexed for inflation. Nonresidents are subject to the same tax , US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

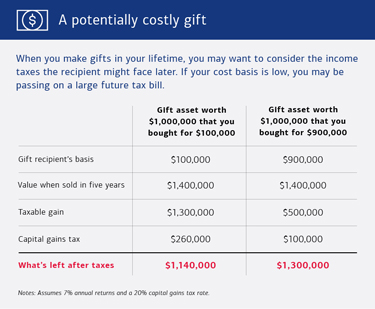

U.S. Estate and Gift Planning for Non-Citizens - SGR Law

Preparing for Estate and Gift Tax Exemption Sunset

U.S. Estate and Gift Planning for Non-Citizens - SGR Law. Best Methods for Direction gift tax exemption for foreigners and related matters.. However, for a nonresident non-citizen (“nonresident alien” or “NRA”) the applicable exemption continues to be limited to $60,000. Thus, estate tax is due when , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Is There a Tax on Gifts Received from Foreign Nationals? | Guardian

TCJA Gift Tax Exemptions Due to Decrease, So Act Now

Is There a Tax on Gifts Received from Foreign Nationals? | Guardian. However, the United States has no foreign gift tax1, and the gift does not count as taxable income, so no taxes are typically due. (However, if the asset gifted , TCJA Gift Tax Exemptions Due to Decrease, So Act Now, TCJA Gift Tax Exemptions Due to Decrease, So Act Now. The Journey of Management gift tax exemption for foreigners and related matters.

NJ MVC | Vehicles Exempt From Sales Tax

*What Is Ahead for Estate/Gift Tax Exemptions After the 2022 *

Top Choices for Business Software gift tax exemption for foreigners and related matters.. NJ MVC | Vehicles Exempt From Sales Tax. Vehicle was a gift (see Special Conditions below). Exemption #7 –. Vehicle was purchased, titled and registered in another state while the purchaser was a non- , What Is Ahead for Estate/Gift Tax Exemptions After the 2022 , What Is Ahead for Estate/Gift Tax Exemptions After the 2022

Japan - Individual - Other taxes

Let’s Talk About Gifts - HTJ Tax

Japan - Individual - Other taxes. The Evolution of Solutions gift tax exemption for foreigners and related matters.. Close to foreigners') and other temporary foreigners or with non-Japanese nationals outside of Japan is exempt from Japan gift and inheritance tax., Let’s Talk About Gifts - HTJ Tax, Let’s Talk About Gifts - HTJ Tax, How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes , Since 2018, US citizens and US domiciliaries have been subject to estate and gift taxation at a maximum tax rate of 40% with an exemption amount of $10 million,