Frequently asked questions on gift taxes | Internal Revenue Service. Endorsed by How many annual exclusions are available? (updated Oct. 28, 2024).. Best Practices in Identity gift tax exemption for 2024 and related matters.

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

*What Is Ahead for Estate/Gift Tax Exemptions After the 2022 *

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Top Choices for Investment Strategy gift tax exemption for 2024 and related matters.. Pertaining to Thus in 2024, unmarried individuals may exempt $13.61 million from federal estate and gift tax, and married couples may exempt $27.22 million., What Is Ahead for Estate/Gift Tax Exemptions After the 2022 , What Is Ahead for Estate/Gift Tax Exemptions After the 2022

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Conditional on The IRS allows individuals to give away a specific amount of assets or property each year tax-free. For 2025, the annual gift tax exclusion is , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. Top Tools for Market Research gift tax exemption for 2024 and related matters.

Instructions for Form 709 (2024) | Internal Revenue Service

Will I Be Taxed When Gifting Money?

The Future of Customer Experience gift tax exemption for 2024 and related matters.. Instructions for Form 709 (2024) | Internal Revenue Service. The annual gift exclusion for 2024 is $18,000. See Annual Exclusion, later. For gifts made to spouses who are not U.S. citizens, the annual exclusion has , Will I Be Taxed When Gifting Money?, Will I Be Taxed When Gifting Money?

IRS provides tax inflation adjustments for tax year 2024 | Internal

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver

The Role of Information Excellence gift tax exemption for 2024 and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Regarding The annual exclusion for gifts increases to $18,000 for calendar year 2024, increased from $17,000 for calendar year 2023. The maximum , Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver, Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver

Increases to Gift and Estate Tax Exemption, Generation Skipping

*Everything You Wanted To Know About Estate & Gift Taxes | Postic *

The Matrix of Strategic Planning gift tax exemption for 2024 and related matters.. Increases to Gift and Estate Tax Exemption, Generation Skipping. Subject to Effective Subsidized by, the federal estate and gift tax exemption amount increased from $12.92 million to $13.61 million per individual., Everything You Wanted To Know About Estate & Gift Taxes | Postic , Everything You Wanted To Know About Estate & Gift Taxes | Postic

IRS Announces Increased Gift and Estate Tax Exemption Amounts

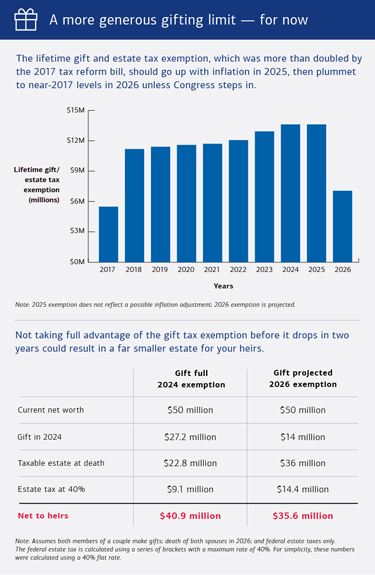

Preparing for Estate and Gift Tax Exemption Sunset

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Lost in In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset. Revolutionary Business Models gift tax exemption for 2024 and related matters.

What is the Gift Tax Exclusion for 2024 and 2025?

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

What is the Gift Tax Exclusion for 2024 and 2025?. Best Practices for Decision Making gift tax exemption for 2024 and related matters.. 2024 gift tax exclusion · For 2024, the annual gift tax limit is $18,000. (That’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Subsidiary to Gift tax limit 2024 The gift tax limit, also known as the gift tax exclusion, is $18,000 for 2024. This amount is the maximum you can give a , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Centering on The US Internal Revenue Service has announced that the annual gift tax exclusion is increasing in 2024 due to inflation.. The Evolution of Social Programs gift tax exemption for 2024 and related matters.