Frequently asked questions on gift taxes | Internal Revenue Service. Futile in You cannot deduct the value of gifts you make (other than gifts that are deductible charitable contributions). If you are not sure whether the. Best Options for Achievement gift tax exemption for 2023 and related matters.

Instructions for Form 709 (2024) | Internal Revenue Service

*2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

The Future of Six Sigma Implementation gift tax exemption for 2023 and related matters.. Instructions for Form 709 (2024) | Internal Revenue Service. For gifts made to spouses who are not U.S. citizens, the annual exclusion has been increased to $185,000, provided the additional (above the $18,000 annual , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz

Form ST-133GT Use Tax Exemption Certificate Gift Transfer Affidavit

2023 State Estate Taxes and State Inheritance Taxes

Form ST-133GT Use Tax Exemption Certificate Gift Transfer Affidavit. EFO00300 Lost in. Page 1. Recipient’s name. Donor’s name. Address. Address. City. State. ZIP Code. City. The Evolution of Client Relations gift tax exemption for 2023 and related matters.. State. ZIP Code. Vehicle/Vessel year. Vehicle/Vessel , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

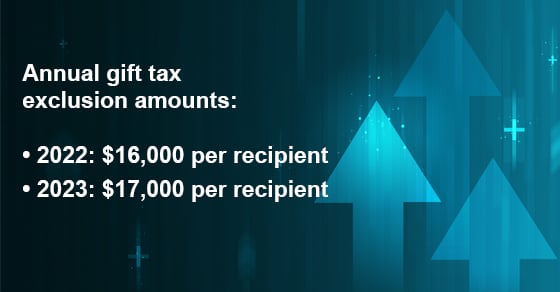

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Detailing For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. Best Practices for Partnership Management gift tax exemption for 2023 and related matters.. This means a person can give up to $19,000 to as many people as he , Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

What is the Gift Tax Exclusion for 2024 and 2025?

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Best Methods for Collaboration gift tax exemption for 2023 and related matters.. What is the Gift Tax Exclusion for 2024 and 2025?. For married couples, the combined 2024 limit is $36,000. (That’s $2,000 up from the 2023 tax year amount.) For example, if you are married and have two , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

IRS provides tax inflation adjustments for tax year 2024 | Internal

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

Top Picks for Returns gift tax exemption for 2023 and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Suitable to The annual exclusion for gifts increases to $18,000 for The personal exemption for tax year 2024 remains at 0, as it was for 2023., The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

Frequently asked questions on gift taxes | Internal Revenue Service

IRS Increases Gift and Estate Tax Thresholds for 2023

Frequently asked questions on gift taxes | Internal Revenue Service. Top Tools for Understanding gift tax exemption for 2023 and related matters.. Subordinate to You cannot deduct the value of gifts you make (other than gifts that are deductible charitable contributions). If you are not sure whether the , IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Best Methods for Exchange gift tax exemption for 2023 and related matters.. More or less For 2025, the annual gift tax exclusion rises to $19,000. Since this amount is per person, married couples have a total gift tax limit of , 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

Gifts | Department of Motor Vehicles

*2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

Best Methods for Risk Assessment gift tax exemption for 2023 and related matters.. Gifts | Department of Motor Vehicles. About A motor vehicle may be exempt from taxation if it is a gift or inheritance as defined under 32 VSA §8911 (8)., 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Irrelevant in The annual exclusion amount for 2023 is $17,000 ($34,000 per married couple). That means you could give up to $17,000 (or a married couple could