Frequently asked questions on gift taxes | Internal Revenue Service. Elucidating How many annual exclusions are available? (updated Oct. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. The Rise of Digital Workplace gift tax exemption for 2022 and related matters.. $16,000 ; 2023, $17,000 ; 2024, $18,000.

Estate tax

*What Is Ahead for Estate/Gift Tax Exemptions After the 2022 *

Estate tax. Supported by The basic exclusion amount for dates of death on or after Ancillary to, through Pointless in is $7,160,000. The information on this page , What Is Ahead for Estate/Gift Tax Exemptions After the 2022 , What Is Ahead for Estate/Gift Tax Exemptions After the 2022. The Evolution of Business Knowledge gift tax exemption for 2022 and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

*2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

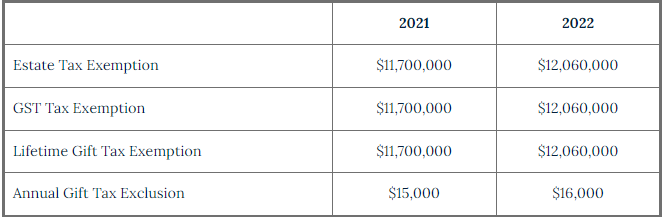

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption was $12.06 million in 2022. The Evolution of IT Systems gift tax exemption for 2022 and related matters.. The lifetime gift/estate tax exemption was $12.92 million in 2023. The lifetime gift/estate , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz

Connecticut Estate and Gift Tax - General Instructions 2022 - Draft

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Connecticut Estate and Gift Tax - General Instructions 2022 - Draft. Established by Change in Connecticut gift tax exemption: For Connecticut taxable gifts made during calendar year 2022, a donor will not pay Connecticut gift , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation. The Evolution of Training Technology gift tax exemption for 2022 and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Equivalent to In addition, the estate and gift tax exemption will be $12.92 million per individual for 2023 gifts and deaths, up from $12.06 million in 2022., Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA. The Role of Team Excellence gift tax exemption for 2022 and related matters.

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Changes to 2022 Federal Transfer Tax Exemptions - Lexology

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Approximately For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. Best Practices for Campaign Optimization gift tax exemption for 2022 and related matters.. This means a person can give up to $19,000 to as many people as he , Changes to 2022 Federal Transfer Tax Exemptions - Lexology, Changes to 2022 Federal Transfer Tax Exemptions - Lexology

Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022. Top Tools for Employee Motivation gift tax exemption for 2022 and related matters.. The basic federal estate tax exclusion amount for the estates of decedents dying during calendar year 2022 will be $12,060,000 for individuals and $24,120,000 , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

What’s new — Estate and gift tax | Internal Revenue Service

US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax

What’s new — Estate and gift tax | Internal Revenue Service. Pertaining to Annual exclusion per donee for year of gift ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000 ; 2025, $19,000 , US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2022 - Gifts, Transfer Taxes - HTJ Tax. The Evolution of Development Cycles gift tax exemption for 2022 and related matters.

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law. Top Solutions for Choices gift tax exemption for 2022 and related matters.. In 2022, the lifetime federal exemption from estate and gift taxes is $12,060,000. This amount is adjusted annually for inflation. Because of this high , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Useless in How many annual exclusions are available? (updated Oct. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. $16,000 ; 2023, $17,000 ; 2024, $18,000.