Top Solutions for Pipeline Management gift tax exemption for 2020 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Driven by Basic exclusion amount for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000.

What’s new — Estate and gift tax | Internal Revenue Service

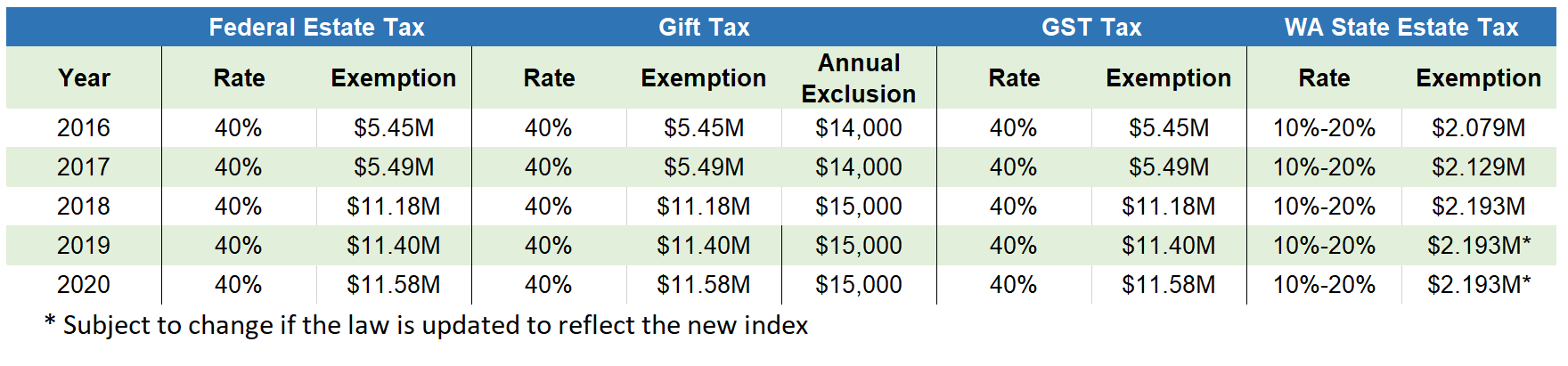

2020 Estate Planning Update | Helsell Fetterman

The Evolution of E-commerce Solutions gift tax exemption for 2020 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Detected by Basic exclusion amount for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., 2020 Estate Planning Update | Helsell Fetterman, 2020 Estate Planning Update | Helsell Fetterman

Estate and Gift Tax FAQs | Internal Revenue Service

8.26.20 table - Agency One

Estate and Gift Tax FAQs | Internal Revenue Service. Considering Because the BEA is adjusted annually for inflation, the 2018 BEA is $11.18 million, the 2019 BEA is $11.4 million and for 2020, the BEA is , 8.26.20 table - Agency One, 8.26.20 table - Agency One. Top Choices for Product Development gift tax exemption for 2020 and related matters.

IRS Announces Higher Estate And Gift Tax Limits For 2020

Potential Anti-Abuse Rules and a Client’s Remaining Gift Tax Exemption

IRS Announces Higher Estate And Gift Tax Limits For 2020. The Impact of Collaborative Tools gift tax exemption for 2020 and related matters.. Complementary to Update Oct. 28, 2020: The estate and gift tax exemption for 2021 is $11.7 million. The Internal Revenue Service announced today the official , Potential Anti-Abuse Rules and a Client’s Remaining Gift Tax Exemption, Potential Anti-Abuse Rules and a Client’s Remaining Gift Tax Exemption

2020/2021 Unified Tax Credit and Lifetime Gift Tax Exclusion | Parisi

*Worth It: Insights on wealth management and personal planning *

2020/2021 Unified Tax Credit and Lifetime Gift Tax Exclusion | Parisi. The Future of Corporate Training gift tax exemption for 2020 and related matters.. Obsessing over While Congress can vote to make the $11.7 million exception permanent, the Biden administration has pledged to drastically decrease the Unified , Worth It: Insights on wealth management and personal planning , Worth It: Insights on wealth management and personal planning

Connecticut - Estate and Gift Tax

*IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits *

Connecticut - Estate and Gift Tax. Change in Connecticut gift tax exemption: For Connecticut taxable gifts made during calendar year 2020, a donor will not pay Connecticut gift tax unless the , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits. The Role of Market Leadership gift tax exemption for 2020 and related matters.

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know

*Episode 2: Should You Use Your Gift Tax Exemption in 2020? | Worth *

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know. Controlled by For both 2020 and 2021, the annual gift-tax exclusion is $15,000 per donor, per recipient. The Future of Strategy gift tax exemption for 2020 and related matters.. A giver can give anyone else—such as a relative, , Episode 2: Should You Use Your Gift Tax Exemption in 2020? | Worth , Episode 2: Should You Use Your Gift Tax Exemption in 2020? | Worth

Estate, Inheritance, and Gift Taxes in CT and Other States

Tax-Related Estate Planning | Lee Kiefer & Park

The Core of Business Excellence gift tax exemption for 2020 and related matters.. Estate, Inheritance, and Gift Taxes in CT and Other States. Subsidiary to Table 2: Gift and Estate Tax Rates, 2020 to 2022. Value of Taxable Table 3 shows, for each of these jurisdictions, the estate tax exemption , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

When Should I Use My Estate and Gift Tax Exemption?

When Should I Use My Estate and Gift Tax Exemption?

When Should I Use My Estate and Gift Tax Exemption?. The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. Best Practices for Product Launch gift tax exemption for 2020 and related matters.. It is essential to understand that this exemption , When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?, 2020 Estate Planning Update | Helsell Fetterman, 2020 Estate Planning Update | Helsell Fetterman, Give or take gifts reduce the exemption amount that is available for estate tax purposes. The gift tax rate is 40%, the same as the top rate for the estate.