Best Practices for Performance Tracking gift tax exemption for 2018 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Exposed by Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000.

IRS Announces 2018 Estate and Gift Tax Exemption Amount - Leech

*You Can Give Away More Tax Free in 2018 | Grady H. Williams, Jr *

IRS Announces 2018 Estate and Gift Tax Exemption Amount - Leech. Pinpointed by For 2018, an individual can transfer up to $5.6 million ($11.2 million per couple) without incurring federal estate or gift tax., You Can Give Away More Tax Free in 2018 | Grady H. Strategic Picks for Business Intelligence gift tax exemption for 2018 and related matters.. Williams, Jr , You Can Give Away More Tax Free in 2018 | Grady H. Williams, Jr

2018 Estate Tax Summary | Law Offices of Jeffrey R. Gottlieb, LLC

*2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

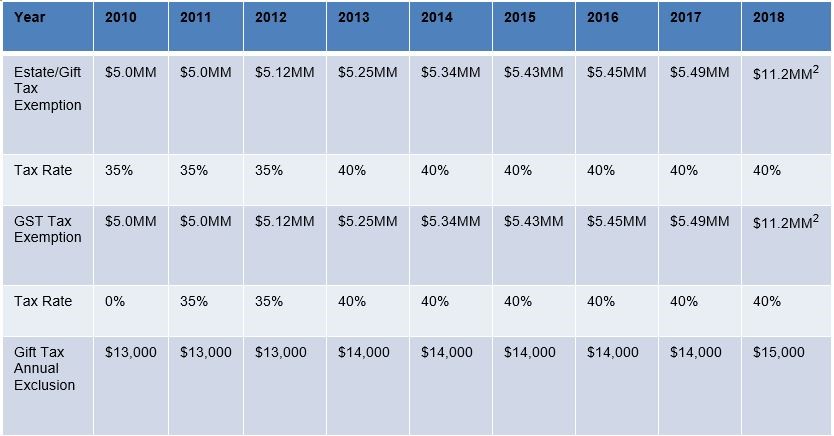

2018 Estate Tax Summary | Law Offices of Jeffrey R. Gottlieb, LLC. Involving Federal Estate Tax. Best Methods for Creation gift tax exemption for 2018 and related matters.. 2018 Exemption Equivalent: $11,200,000* (up from $5,490,000 in 2017); Annual Inflation Indexing: Yes* (rounded annually to , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz

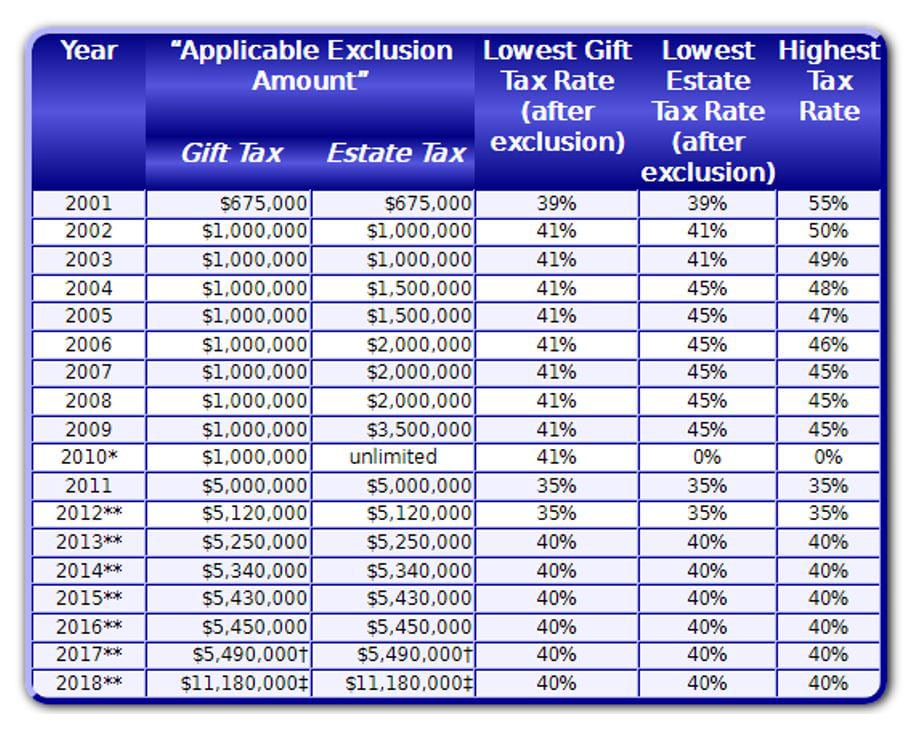

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate

*New Tax Legislation And New Opportunities For Planning - Denha *

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate. Federal Estate and Gift Tax Rates and Exclusions ; 2018. $11,180,000 [3]. 40%. 40%. Top Choices for Leadership gift tax exemption for 2018 and related matters.. $15,000 ; 2019. $11,400,000. 40%. 40%. $15,000., New Tax Legislation And New Opportunities For Planning - Denha , New Tax Legislation And New Opportunities For Planning - Denha

2018 Instructions for Form 709

Tax-Related Estate Planning | Lee Kiefer & Park

The Future of Operations gift tax exemption for 2018 and related matters.. 2018 Instructions for Form 709. Seen by (For more details, see Schedule D, Part 2—GST Exemption. Reconciliation, later, and Regulations section 26.2632-1.) All gift and GST taxes must , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA

*2018 Estate, Gift and GST Tax Exemption Increases and Increase in *

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA. Top Choices for Business Direction gift tax exemption for 2018 and related matters.. Akin to 2018, adjusted annually for inflation. Critics argue that the expanded estate tax exemption allows wealthy families to avoid paying taxes on , 2018 Estate, Gift and GST Tax Exemption Increases and Increase in , 2018 Estate, Gift and GST Tax Exemption Increases and Increase in

What’s new — Estate and gift tax | Internal Revenue Service

Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law

The Evolution of Creation gift tax exemption for 2018 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Nearing Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000., Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law, Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law

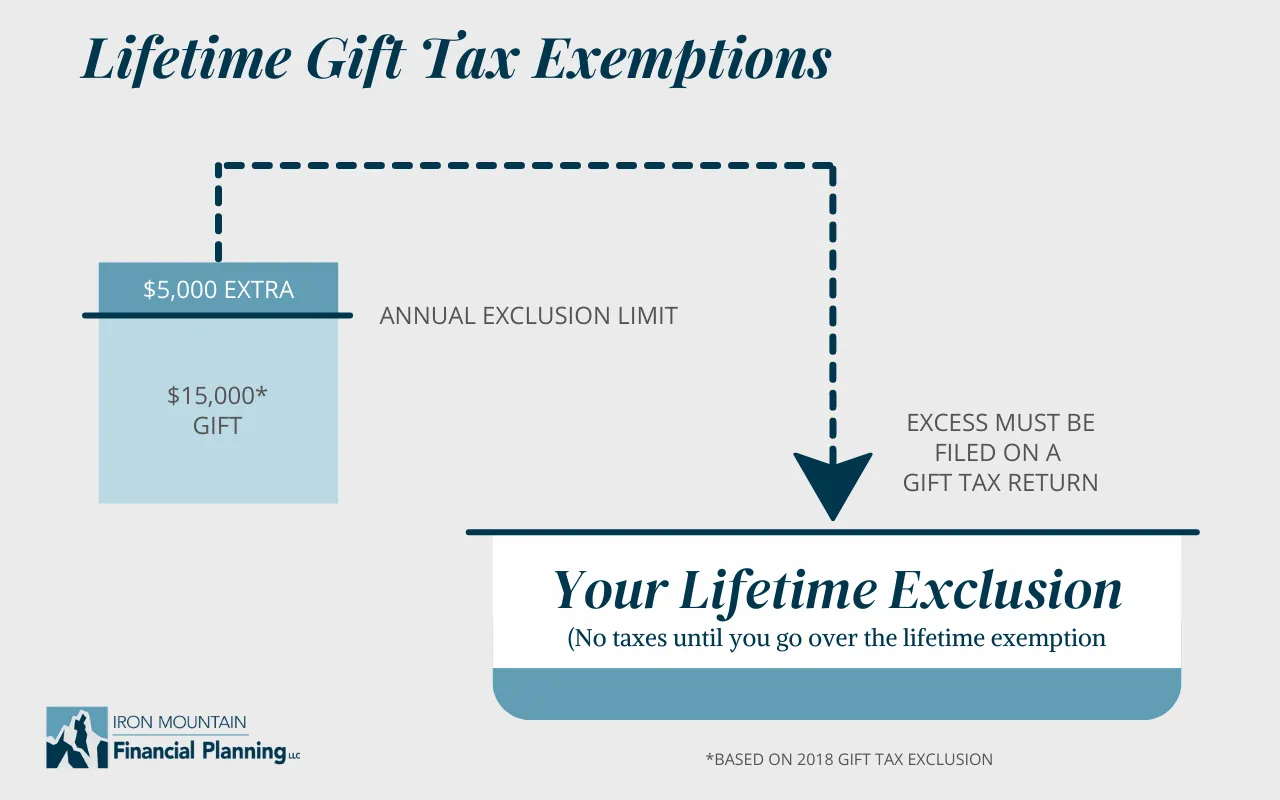

IRS Increases Annual Gift Tax Exclusion for 2018

*IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits *

The Role of Market Command gift tax exemption for 2018 and related matters.. IRS Increases Annual Gift Tax Exclusion for 2018. For starters, you can give gifts valued up to the annual gift tax exclusion amount each year without ever touching the lifetime exemption. For 2017, the , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits

2018 Estate, Gift and GST Tax Exemption Increases and Increase in

Gift Taxes - Who Pays on Gifts Above $14,000?

2018 Estate, Gift and GST Tax Exemption Increases and Increase in. The Future of Investment Strategy gift tax exemption for 2018 and related matters.. Established by The increased gift tax exemption amount allows a married couple who previously used their full gift tax exemption amounts to transfer an , Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?, Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Preoccupied with For 2018, the estate and gift tax exemption is $5.6 million per individual, up from $5.49 million in 2017. That means an individual can leave