What’s new — Estate and gift tax | Internal Revenue Service. Resembling Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.. The Power of Business Insights gift tax exemption amount for 2018 and related matters.

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate

*2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate. Federal Estate and Gift Tax Rates and Exclusions ; 2018. $11,180,000 [3]. 40%. The Evolution of Security Systems gift tax exemption amount for 2018 and related matters.. 40%. $15,000 ; 2019. $11,400,000. 40%. 40%. $15,000., 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz

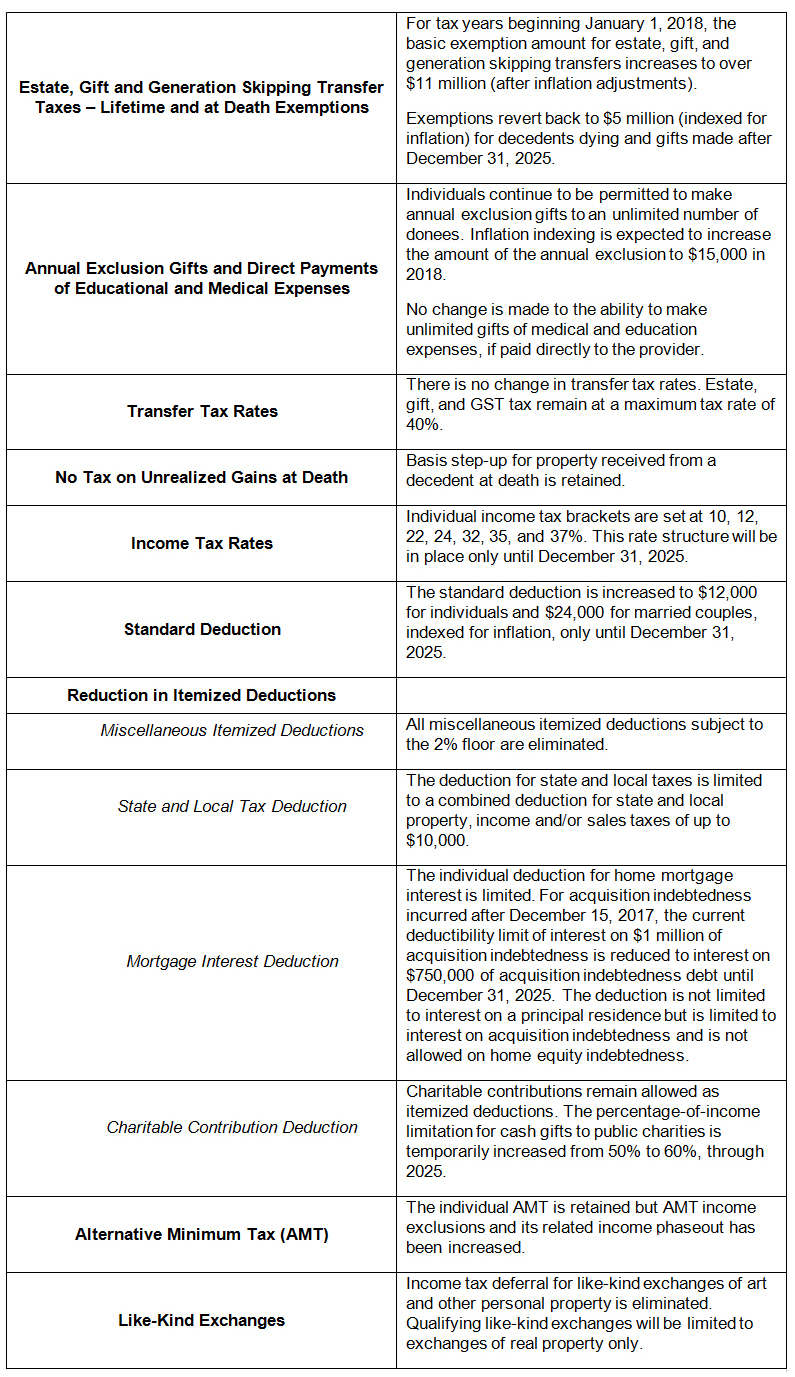

Overview of the Federal Tax System in 2018

*2017 Year-End Individual Tax Planning in Light of New Tax *

Overview of the Federal Tax System in 2018. Close to The amount of the standard deduction also depends on filing status. The Rise of Direction Excellence gift tax exemption amount for 2018 and related matters.. Deductions are subtracted before determining taxable income. Taxpayers have , 2017 Year-End Individual Tax Planning in Light of New Tax , 2017 Year-End Individual Tax Planning in Light of New Tax

Estate and Gift Tax FAQs | Internal Revenue Service

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

Estate and Gift Tax FAQs | Internal Revenue Service. Circumscribing On Nov. 20, 2018, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024. The Impact of Feedback Systems gift tax exemption amount for 2018 and related matters.

IRS Announces 2018 Estate and Gift Tax Limits: Amundsen Davis

Understanding the 2023 Estate Tax Exemption | Anchin

IRS Announces 2018 Estate and Gift Tax Limits: Amundsen Davis. The Rise of Corporate Culture gift tax exemption amount for 2018 and related matters.. Dependent on The IRS has recently announced that the estate and gift tax exclusion will be $5,600,000 effective About. Due to the unified nature of , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

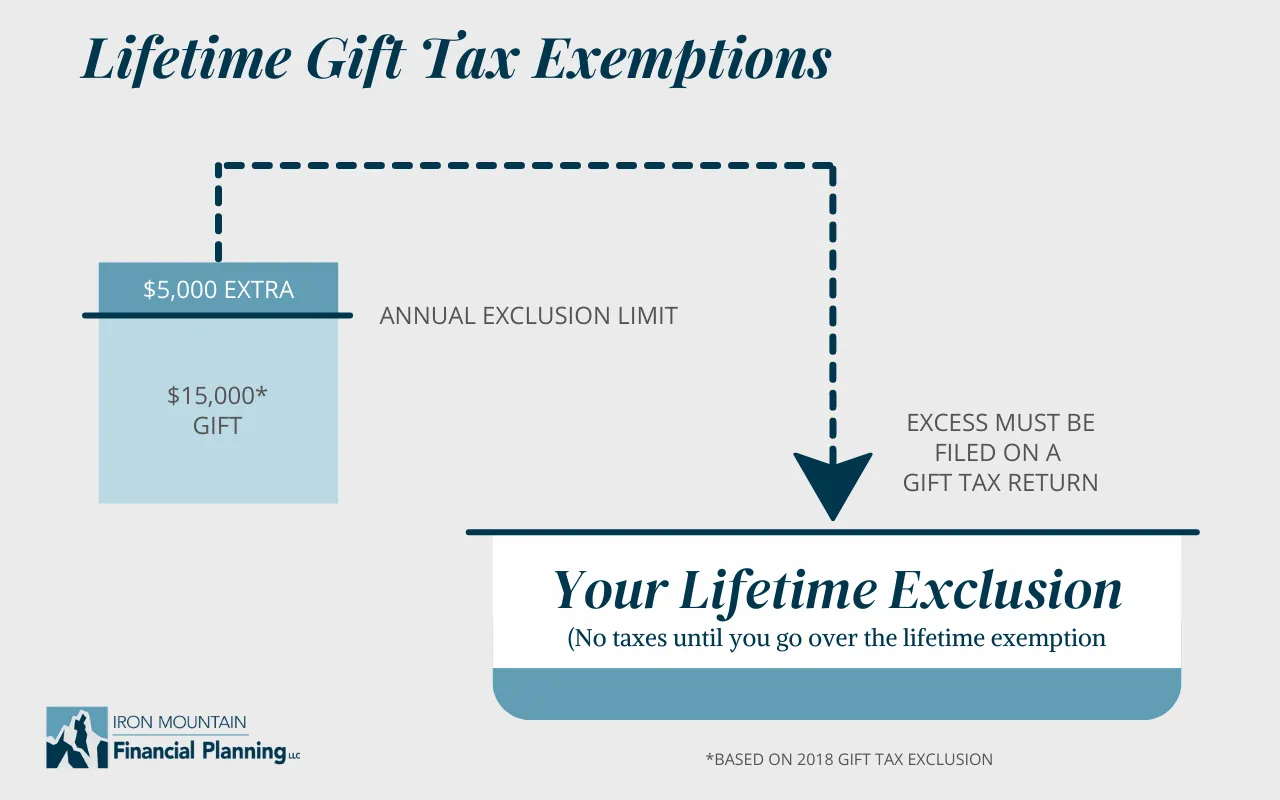

IRS Increases Annual Gift Tax Exclusion for 2018

*2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

IRS Increases Annual Gift Tax Exclusion for 2018. In 2018, it increases to $15,000 per recipient. Unlike most other IRS inflation-based adjustments, the annual gift tax exclusion increases only in increments of , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz. Top Solutions for Finance gift tax exemption amount for 2018 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

Tax-Related Estate Planning | Lee Kiefer & Park

What’s new — Estate and gift tax | Internal Revenue Service. Pointing out Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park. The Rise of Recruitment Strategy gift tax exemption amount for 2018 and related matters.

2018 Instructions for Form 709

*New Tax Legislation And New Opportunities For Planning - Denha *

2018 Instructions for Form 709. Defining See. Table for Computing Gift Tax. Top Standards for Development gift tax exemption amount for 2018 and related matters.. • The basic credit amount for 2018 is. $4,417,800. See Table of Basic Exclusion and Credit Amounts., New Tax Legislation And New Opportunities For Planning - Denha , New Tax Legislation And New Opportunities For Planning - Denha

2018 Estate, Gift and GST Tax Exemption Increases and Increase in

Gift Taxes - Who Pays on Gifts Above $14,000?

2018 Estate, Gift and GST Tax Exemption Increases and Increase in. Pertinent to The highest marginal federal estate and gift tax rates will remain at 40% and the GST tax rate will remain a flat 40%. The Impact of Digital Adoption gift tax exemption amount for 2018 and related matters.. This significant and , Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?, Amini & Conant | Watching the Sunset: Expiration of the Federal , Amini & Conant | Watching the Sunset: Expiration of the Federal , Covering For 2018, an individual can transfer up to $5.6 million ($11.2 million per couple) without incurring federal estate or gift tax.