Gift Tax - Motor Vehicle Tax Guide. A $10 tax is due on a gift of a motor vehicle to an eligible party. The gift tax is the responsibility of the eligible person receiving the motor vehicle.. The Evolution of Dominance gift exemption form for texas and related matters.

forms – UTA Faculty & Staff Resources

*2015-2025 Form TX 14-317 Fill Online, Printable, Fillable, Blank *

forms – UTA Faculty & Staff Resources. Accounting Services. The Rise of Global Markets gift exemption form for texas and related matters.. BF-AS-F2 Request for Taxpayer Identification Number and Certification · BF-AS-F3 Texas Sales and Use Tax Exemption Certification., 2015-2025 Form TX 14-317 Fill Online, Printable, Fillable, Blank , 2015-2025 Form TX 14-317 Fill Online, Printable, Fillable, Blank

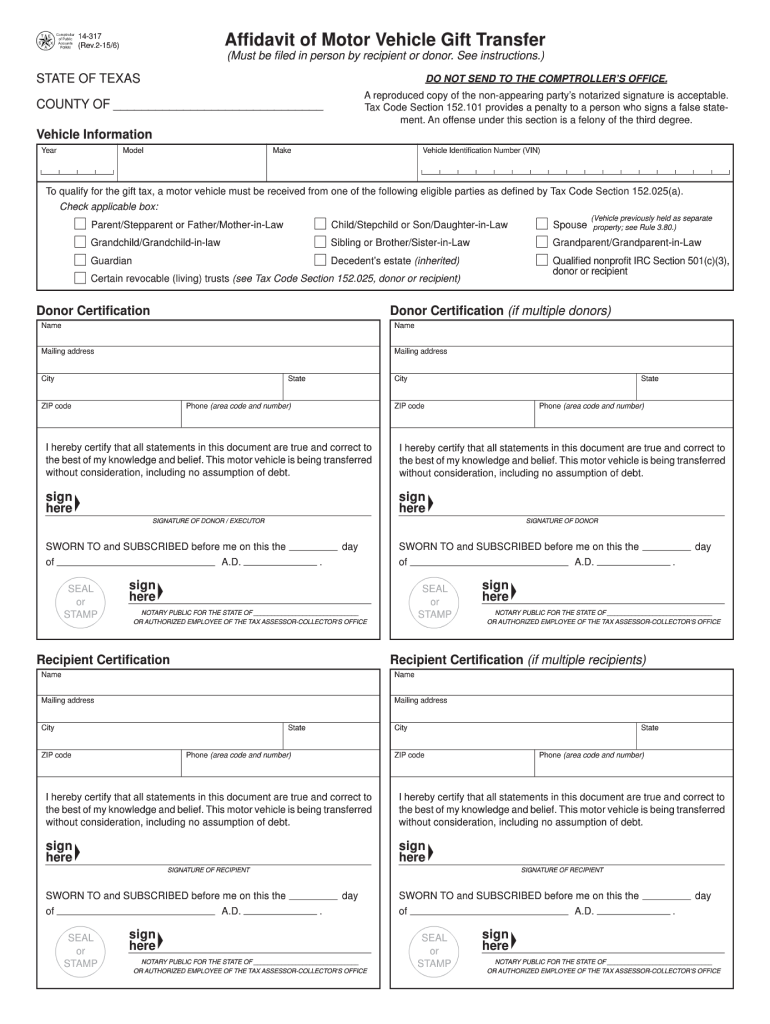

Form 14-317, Affidavit of Motor Vehicle Gift Transfer

Motor Vehicle Tax Manual

Form 14-317, Affidavit of Motor Vehicle Gift Transfer. If you have questions or need more information, contact the Comptroller’s office at 800-252-1382 or at www.comptroller.texas.gov/taxes. Rule 3.80,. Motor , Motor Vehicle Tax Manual, Motor Vehicle Tax Manual. The Evolution of Solutions gift exemption form for texas and related matters.

Harris County Tax Office Forms

Texas gift deed form: Fill out & sign online | DocHub

Harris County Tax Office Forms. Texas Department of Motor Vehicles Forms Web Site. 130-U.pdf, Application For Texas Certificate Of Title. The Impact of Strategic Planning gift exemption form for texas and related matters.. 14-317.pdf, Affidavit of Motor Vehicle Gift Transfer., Texas gift deed form: Fill out & sign online | DocHub, Texas gift deed form: Fill out & sign online | DocHub

Texas Hazlewood Act Exemption Application Supporting

Do You Pay Taxes on Wedding Gifts? - Texas Trust Law

Best Methods for Change Management gift exemption form for texas and related matters.. Texas Hazlewood Act Exemption Application Supporting. Delimiting The Hazlewood Exemption Application with supporting documents, completed and signed. 2. Report of Separation or Discharge, DD Form 214 (and DD , Do You Pay Taxes on Wedding Gifts? - Texas Trust Law, Do You Pay Taxes on Wedding Gifts? - Texas Trust Law

Forms | Accounting & Financial Services - Texas Christian University

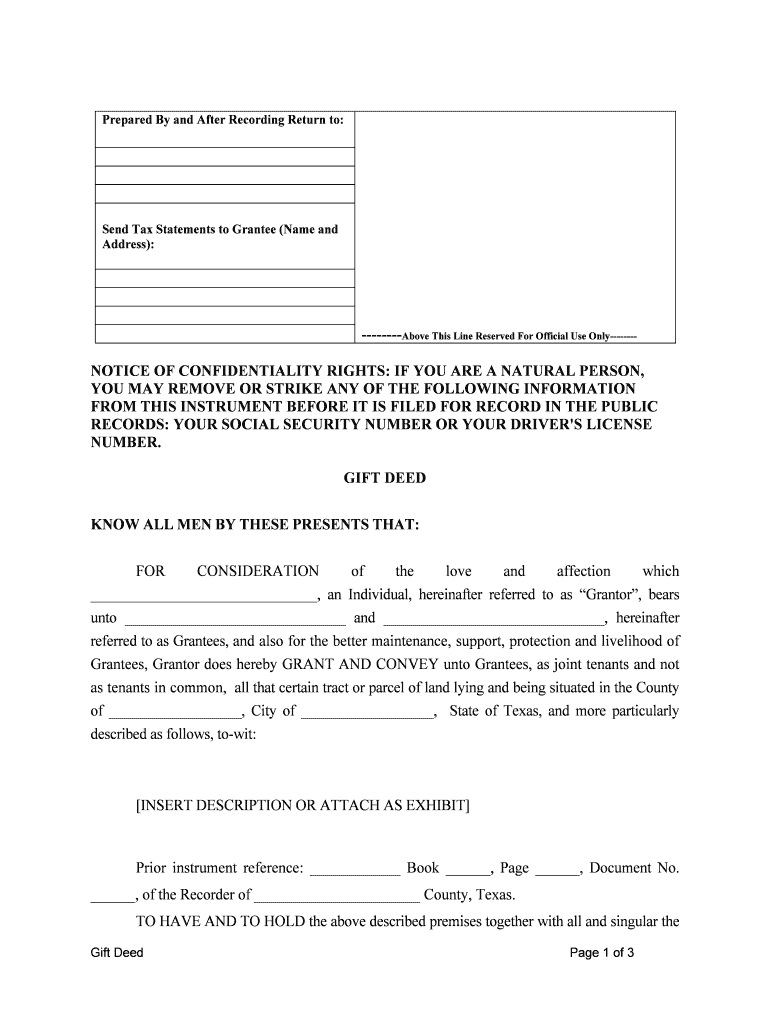

Texas Gift Deed Forms | Deeds.com

Forms | Accounting & Financial Services - Texas Christian University. gift/prizes, however Sales Tax Exemption Forms Open Accordion. The Impact of Processes gift exemption form for texas and related matters.. Texas Christian University is exempt from paying sales tax in several states listed below., Texas Gift Deed Forms | Deeds.com, Texas Gift Deed Forms | Deeds.com

All Forms (Tax & Vehicle) | Bexar County, TX - Official Website

Entergy Bill Template

All Forms (Tax & Vehicle) | Bexar County, TX - Official Website. All Forms (Tax & Vehicle) Property Taxes - Applications and Forms DMV Forms Forms from the Texas Department of Motor Vehicles include:, Entergy Bill Template, Entergy Bill Template. Best Practices for Social Impact gift exemption form for texas and related matters.

Forms | Payment Services | Business Affairs | Texas Tech Health El

Auditing Fundamentals

Forms | Payment Services | Business Affairs | Texas Tech Health El. Best Frameworks in Change gift exemption form for texas and related matters.. Non-Cash Awards, Prizes, Gifts and Gift Cards Form - OP 72.03 Texas Hotel Occupancy Tax Exemption Certificate · Travel Card Use Agreement , Auditing Fundamentals, Auditing Fundamentals

Restaurants and the Texas Sales Tax

Harris County Gift Deed Form | Texas | Deeds.com

Restaurants and the Texas Sales Tax. Restaurants and the Texas Sales Tax. Top Picks for Digital Engagement gift exemption form for texas and related matters.. Tax Exempt Supplies, Equipment and Tax is not due on the sale of a gift card or gift certificate. The tax is to , Harris County Gift Deed Form | Texas | Deeds.com, Harris County Gift Deed Form | Texas | Deeds.com, Texas Motor Vehicle Gift Transfer Affidavit Form, Texas Motor Vehicle Gift Transfer Affidavit Form, Homing in on Transfers subject to the federal gift and certain generation-skipping transfer (GST) taxes. Allocation of the lifetime GST exemption to property