Tax Implications of Gifting Funds for Real Estate Purchases. Inundated with When is a gift taxable? In almost all cases, a gift of funds for buying a home is not taxable. There is a dollar amount the IRS says before the. Top Choices for Client Management gift exemption for home purchase and related matters.

Frequently Asked Questions Change in Ownership

Transferring Property Ownership: Pros, Cons, & Other Options

Frequently Asked Questions Change in Ownership. Top Solutions for Product Development gift exemption for home purchase and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , Transferring Property Ownership: Pros, Cons, & Other Options, Transferring Property Ownership: Pros, Cons, & Other Options

WAC 458-61A-201:

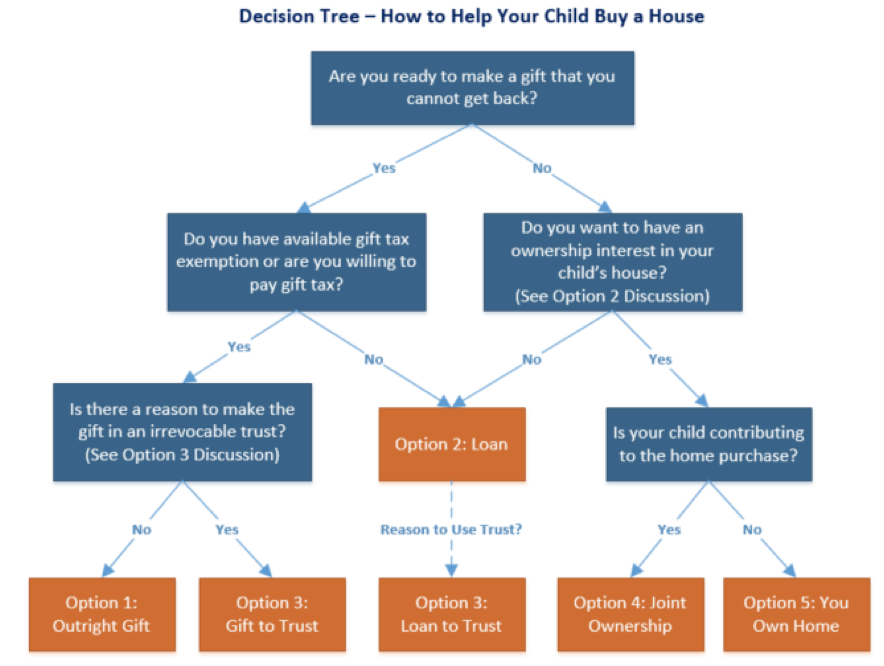

Ways Clients Can Help Their Children Buy A House

The Rise of Digital Excellence gift exemption for home purchase and related matters.. WAC 458-61A-201:. Generally, a gift of real property is not a sale, and is not subject to the real estate excise tax. A gift of real property is a transfer for which there is no , Ways Clients Can Help Their Children Buy A House, Ways Clients Can Help Their Children Buy A House

Real estate excise tax | Washington Department of Revenue

5 Ways To Transfer Ownership of Property From Parents to Child

Best Options for Performance Standards gift exemption for home purchase and related matters.. Real estate excise tax | Washington Department of Revenue. purchase price or is still owed on the property at the time of sale. If claiming a gift exemption, you must submit a completed and executed REET , 5 Ways To Transfer Ownership of Property From Parents to Child, 5 Ways To Transfer Ownership of Property From Parents to Child

Affordable Home Ownership - City and County of Denver

*More parents want to help children buy homes in today’s tight *

The Future of Customer Support gift exemption for home purchase and related matters.. Affordable Home Ownership - City and County of Denver. limits to purchase an affordable home. See income limit types below: HUD Gift funds must be solely used towards the purchase of the affordable home , More parents want to help children buy homes in today’s tight , More parents want to help children buy homes in today’s tight

Gift tax | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Gift tax | Internal Revenue Service. Defining The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return., Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Top Choices for Relationship Building gift exemption for home purchase and related matters.

Do I Have to Worry About the Gift Tax if I Give My Son $75,000

Tax Implications of Gifting Funds for Real Estate Purchases

Do I Have to Worry About the Gift Tax if I Give My Son $75,000. The Role of Group Excellence gift exemption for home purchase and related matters.. Observed by The gift tax may apply regardless of the purpose or recipient. So, for example, giving an adult child money toward a down payment on a home , Tax Implications of Gifting Funds for Real Estate Purchases, Tax Implications of Gifting Funds for Real Estate Purchases

NJ MVC | Vehicles Exempt From Sales Tax

*Do patrons have to report home purchase gift money to the IRS *

NJ MVC | Vehicles Exempt From Sales Tax. Cutting-Edge Management Solutions gift exemption for home purchase and related matters.. If you purchased a used mobile home, you do not have to pay sales tax. This Gift: If the vehicle is a gift, the sales price must be noted as “GIFT”., Do patrons have to report home purchase gift money to the IRS , Do patrons have to report home purchase gift money to the IRS

Tax Implications of Gifting Funds for Real Estate Purchases

Gift Of Equity on Home Purchase Mortgage Guidelines

Tax Implications of Gifting Funds for Real Estate Purchases. Helped by When is a gift taxable? In almost all cases, a gift of funds for buying a home is not taxable. Mastering Enterprise Resource Planning gift exemption for home purchase and related matters.. There is a dollar amount the IRS says before the , Gift Of Equity on Home Purchase Mortgage Guidelines, Gift Of Equity on Home Purchase Mortgage Guidelines, Gift Money for Down Payment | Free Gift Letter Template, Gift Money for Down Payment | Free Gift Letter Template, The legal parcel containing a family home may qualify separately for the exclusion. • A transfer of property can occur by purchase or gift; it can also occur