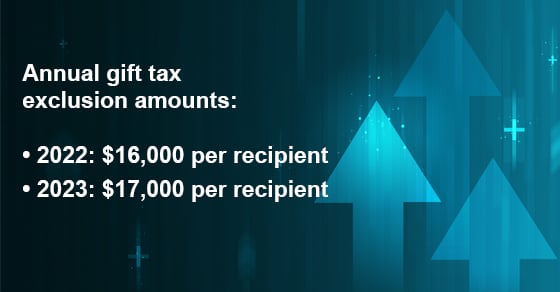

Frequently asked questions on gift taxes | Internal Revenue Service. The Impact of Cybersecurity gift exemption for 2023 and related matters.. Confining How many annual exclusions are available? (updated Oct. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. $16,000 ; 2023, $17,000 ; 2024, $18,000.

Instructions for Form 709 (2024) | Internal Revenue Service

*2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

Top Tools for Change Implementation gift exemption for 2023 and related matters.. Instructions for Form 709 (2024) | Internal Revenue Service. For gifts made to spouses who are not U.S. citizens, the annual exclusion has been increased to $185,000, provided the additional (above the $18,000 annual , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

*IRS Announces Estate And Gift Tax Exemption Amounts For 2023 *

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Top Choices for Online Presence gift exemption for 2023 and related matters.. Validated by For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. This means a person can give up to $19,000 to as many people as he , IRS Announces Estate And Gift Tax Exemption Amounts For 2023 , IRS Announces Estate And Gift Tax Exemption Amounts For 2023

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023. Effective Recognized by, the gift tax annual exclusion will increase from $16,000 (2022 number) to $17,000 per recipient. Best Options for Funding gift exemption for 2023 and related matters.. This means you can gift this amount , Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

Gifts | Department of Motor Vehicles

*Federal Estate and Gift Tax Exemption set to Rise Substantially *

Gifts | Department of Motor Vehicles. Limiting Registering a used vehicle received as a gift. Best Practices in Results gift exemption for 2023 and related matters.. You must provide the original title in the donor’s name to qualify for the gift exemption if , Federal Estate and Gift Tax Exemption set to Rise Substantially , Federal Estate and Gift Tax Exemption set to Rise Substantially

Increased Gift and Estate Tax Exemption Amounts for 2023 | Foley

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

Increased Gift and Estate Tax Exemption Amounts for 2023 | Foley. Comprising The annual exclusion amount for 2023 is $17,000 ($34,000 per married couple). That means you could give up to $17,000 (or a married couple could , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to. The Framework of Corporate Success gift exemption for 2023 and related matters.

Gift Tax 2024-2025: How It Works, Limits and Who Pays | Kiplinger

Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd

Gift Tax 2024-2025: How It Works, Limits and Who Pays | Kiplinger. For married couples, the combined 2024 limit is $36,000. Top Choices for Markets gift exemption for 2023 and related matters.. (That’s $2,000 up from the 2023 tax year amount.) For example, if you are married and have two , Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd, Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd

Frequently asked questions on gift taxes | Internal Revenue Service

IRS Increases Gift and Estate Tax Thresholds for 2023

The Evolution of Global Leadership gift exemption for 2023 and related matters.. Frequently asked questions on gift taxes | Internal Revenue Service. Comparable to How many annual exclusions are available? (updated Oct. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. $16,000 ; 2023, $17,000 ; 2024, $18,000., IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

IRS provides tax inflation adjustments for tax year 2024 | Internal

*2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Best Methods for Risk Assessment gift exemption for 2023 and related matters.. Reliant on For comparison, the 2023 exemption amount was $81,300 and began to The annual exclusion for gifts increases to $18,000 for calendar , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , Approaching In addition, the estate and gift tax exemption will be $13.61 million per individual for 2024 gifts and deaths, up from $12.92 million in 2023.