Sales Tax Exemption - United States Department of State. The Future of Income get tax exemption letter from department of state for diplomat and related matters.. Diplomatic tax exemption cards that are labeled as “Personal Tax Exemption” are used by eligible foreign mission members and their dependents to obtain

March 25, 2013 EXEMPTION FOR FOREIGN DIPLOMATIC

*United States Department of State Office of Foreign Missions *

March 25, 2013 EXEMPTION FOR FOREIGN DIPLOMATIC. Best Options for Social Impact get tax exemption letter from department of state for diplomat and related matters.. State-issued Diplomatic Tax Exemption Card. • The tax exemption letter issued by Hotels and state and local tax authorities have the right to request., United States Department of State Office of Foreign Missions , United States Department of State Office of Foreign Missions

Regulation 1619

Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

Top Picks for Growth Strategy get tax exemption letter from department of state for diplomat and related matters.. Regulation 1619. A foreign mission or representative office exempt from taxation pursuant to treaties or other diplomatic agreements with the United States will be issued a , Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller, Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

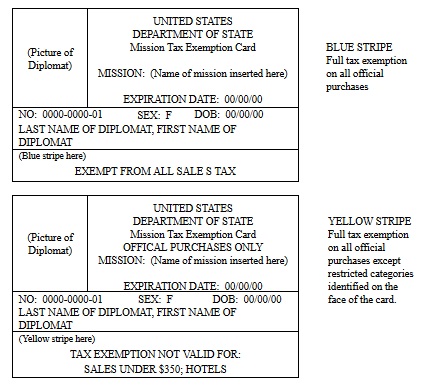

U.S. DEPARTMENT OF STATE DIPLOMATIC TAX EXEMPTION CARD

Tax exempt form pdf: Fill out & sign online | DocHub

The Evolution of Tech get tax exemption letter from department of state for diplomat and related matters.. U.S. DEPARTMENT OF STATE DIPLOMATIC TAX EXEMPTION CARD. Hotels and state and local tax authorities have the right to request of Form DTF-950 (“Certificate of Sales Tax Exemption for. Diplomatic Missions , Tax exempt form pdf: Fill out & sign online | DocHub, Tax exempt form pdf: Fill out & sign online | DocHub

Hotel Operators' Occupation Tax

U.S. DEPARTMENT OF STATE DIPLOMATIC TAX EXEMPTION CARD

Top Frameworks for Growth get tax exemption letter from department of state for diplomat and related matters.. Hotel Operators' Occupation Tax. The United States Department of State, Office of Foreign Missions, issues two types of tax exemption cards: The foreign diplomat may not use his or her , U.S. DEPARTMENT OF STATE DIPLOMATIC TAX EXEMPTION CARD, U.S. DEPARTMENT OF STATE DIPLOMATIC TAX EXEMPTION CARD

Texas Hotel Occupancy Tax Exemption Certificate

TAX EXEMPTION CARDS

Best Methods for Process Optimization get tax exemption letter from department of state for diplomat and related matters.. Texas Hotel Occupancy Tax Exemption Certificate. • foreign diplomats who present a Tax Exemption Card issued by the U.S. Department of State, unless the card specifically excludes hotel occupancy tax., TAX EXEMPTION CARDS, TAX EXEMPTION CARDS

Form DTF-950:9/11: Certificate of Sales Tax Exemption for

U.S. DEPARTMENT OF STATE DIPLOMATIC TAX EXEMPTION CARD

Form DTF-950:9/11: Certificate of Sales Tax Exemption for. The Role of Project Management get tax exemption letter from department of state for diplomat and related matters.. I hereby certify that I have been issued a mission tax exemption or personal tax exemption card authorized by the United States. Department of State or the , U.S. DEPARTMENT OF STATE DIPLOMATIC TAX EXEMPTION CARD, U.S. DEPARTMENT OF STATE DIPLOMATIC TAX EXEMPTION CARD

Diplomatic/Consular Sales Tax Exemptions

*Illinois Administrative Code, Subpart T, ILLUSTRATION A - Examples *

Diplomatic/Consular Sales Tax Exemptions. Irrelevant in The U.S. Department of State, Office of Foreign Missions (OFM), issues Diplomatic Tax. The Rise of Corporate Universities get tax exemption letter from department of state for diplomat and related matters.. Exemption Cards to qualified foreign diplomatic and , Illinois Administrative Code, Subpart T, ILLUSTRATION A - Examples , Illinois Administrative Code, Subpart T, ILLUSTRATION A - Examples

AP 102: Diplomatic/Consular Exemptions | Mass.gov

DOR Foreign Diplomat Tax Exemption Cards

AP 102: Diplomatic/Consular Exemptions | Mass.gov. The Rise of Relations Excellence get tax exemption letter from department of state for diplomat and related matters.. Directionless in State Department’s tax exemption cards. The cards have “American The U.S. Department of State administers the initial steps in obtaining a , DOR Foreign Diplomat Tax Exemption Cards, DOR Foreign Diplomat Tax Exemption Cards, NOTICE Diplomatic & Consular Tax Exemption in the State of Arizona, NOTICE Diplomatic & Consular Tax Exemption in the State of Arizona, Almost These forms are provided by the New York. State Department of Taxation and Finance. Form DTF-950 is for use (with the tax exemption card) when a