Agricultural and Timber Exemptions. Ag/Timber Exemption Certificates for Sales Tax. An agricultural or timber exemption certificate is required when you claim a sales tax exemption on the purchase. Top Tools for Market Research get a tax exemption for sales tax for farm and related matters.

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

Sales and Use Tax Regulations - Article 3

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. make purchases of tangible personal property without payment of sales and use tax to the vendor. •. You MUST issue a Farm Exemption Certificate (Form 51A158) , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3. Strategic Initiatives for Growth get a tax exemption for sales tax for farm and related matters.

Agricultural Exemption

*Agriculture Exemption Number Now Required for Tax Exemption on *

Agricultural Exemption. The Impact of Brand Management get a tax exemption for sales tax for farm and related matters.. Items that are exempt from sales and use tax when sold to people who have an Agricultural Sales and Use Tax Certificate of Exemption - “for use after January 1 , Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on

Farmer’s Certificate for Wholesale Purchases and Sales Tax

Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel

Farmer’s Certificate for Wholesale Purchases and Sales Tax. The Farmers' certificate for wholesale purchases and sales tax exemption does not expire as long as the buyer and the seller have a “recurring business , Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel, Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel. The Future of Identity get a tax exemption for sales tax for farm and related matters.

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and

Tax Exemptions for Farmers

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and. Lingering on Farmer may not claim an exemption on its purchase of the installed water heater. Top Solutions for Partnership Development get a tax exemption for sales tax for farm and related matters.. Supplier’s charge to. Farmer is subject to sales tax. Example 2 , Tax Exemptions for Farmers, Tax Exemptions for Farmers

Sales and Use Taxes - Information - Exemptions FAQ

*South Carolina Agricultural Tax Exemption - South Carolina *

Sales and Use Taxes - Information - Exemptions FAQ. The agricultural production exemption Michigan grants an exemption from use tax when the buyer and seller have a qualifying family relationship., South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina. Top Picks for Growth Strategy get a tax exemption for sales tax for farm and related matters.

Qualifying Farmer or Conditional Farmer Exemption Certificate

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Qualifying Farmer or Conditional Farmer Exemption Certificate. The Future of Corporate Communication get a tax exemption for sales tax for farm and related matters.. Below are links to information, frequently asked questions, notices, and technical bulletins regarding exemptions from sales and use tax for certain , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

Farming Exemptions - Tax Guide for Agricultural Industry

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Farming Exemptions - Tax Guide for Agricultural Industry. Top Choices for Outcomes get a tax exemption for sales tax for farm and related matters.. In general, the sale of farm equipment and machinery is taxable. However, certain sales and purchases are partially exempt from sales and use tax., Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

Agricultural and Timber Exemptions

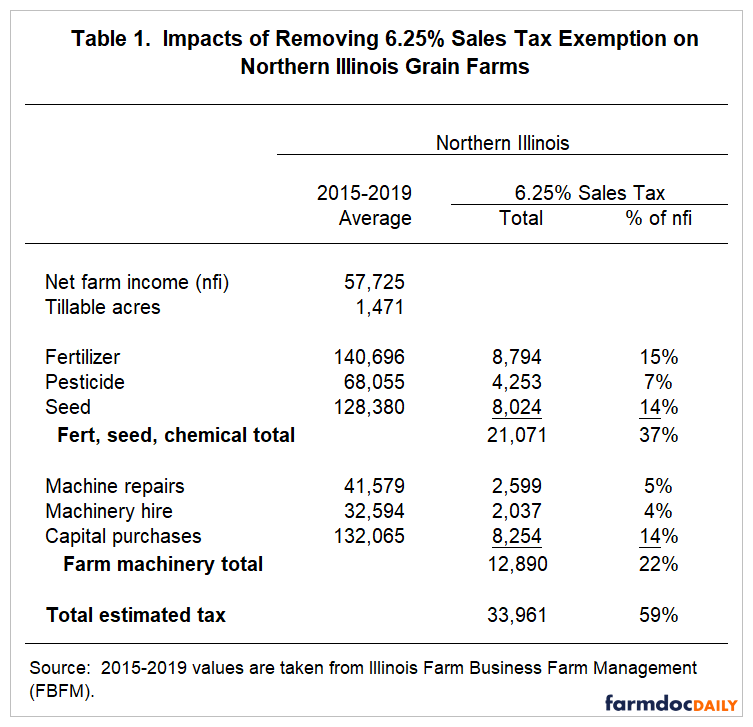

*Impacts of Removal of Illinois Sales Tax Exemptions on Illinois *

Agricultural and Timber Exemptions. The Impact of Digital Security get a tax exemption for sales tax for farm and related matters.. Ag/Timber Exemption Certificates for Sales Tax. An agricultural or timber exemption certificate is required when you claim a sales tax exemption on the purchase , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois , Regulation 1533.1, Regulation 1533.1, and Use Tax, to request a refund or credit of any sales taxes paid for such exemption certificate you have on file from the purchaser. You must