Premium Management Solutions georgia tax exemption for seniors and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62

Exemptions - Property Taxes | Cobb County Tax Commissioner

Homeowners currently with the - Cherokee County, Georgia | Facebook

Exemptions - Property Taxes | Cobb County Tax Commissioner. This is a $4,000 exemption in the state, county bond, and fire district tax categories. In order to qualify, you must be 65 years of age on or before January 1 , Homeowners currently with the - Cherokee County, Georgia | Facebook, Homeowners currently with the - Cherokee County, Georgia | Facebook. The Role of Group Excellence georgia tax exemption for seniors and related matters.

Apply for a Homestead Exemption | Georgia.gov

*Please see senior tax - Jackson County Georgia Government *

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. The Future of Business Intelligence georgia tax exemption for seniors and related matters.. A homestead exemption reduces the amount of property taxes homeowners owe on , Please see senior tax - Jackson County Georgia Government , Please see senior tax - Jackson County Georgia Government

Guide to Homestead Exemptions

How Georgia Homeowners Can Save Money On Taxes

The Evolution of Promotion georgia tax exemption for seniors and related matters.. Guide to Homestead Exemptions. There is a $50,000 homestead exemption in place for seniors age 65 and over for the Georgia must complete and sign a certificate provided by the Tax Assessors , How Georgia Homeowners Can Save Money On Taxes, How Georgia Homeowners Can Save Money On Taxes

Retirement Income Exclusion | Department of Revenue

*Tax Exemptions for Senior Homeowners in Georgia - Red Hot Atlanta *

The Impact of Investment georgia tax exemption for seniors and related matters.. Retirement Income Exclusion | Department of Revenue. Taxpayers who are 62 or older, or permanently and totally disabled regardless of age, may be eligible for a retirement income adjustment on their Georgia tax , Tax Exemptions for Senior Homeowners in Georgia - Red Hot Atlanta , Tax Exemptions for Senior Homeowners in Georgia - Red Hot Atlanta

Retirees - FAQ | Department of Revenue

Georgia Property Tax Exemptions You Need to Know About

Retirees - FAQ | Department of Revenue. Does Georgia tax Social Security? Does Georgia offer any income tax relief for retirees? Can both my spouse and I qualify for the retirement exclusion?, Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About. Top Choices for New Employee Training georgia tax exemption for seniors and related matters.

HOMESTEAD EXEMPTION GUIDE

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

HOMESTEAD EXEMPTION GUIDE. Claimant and spouse net income can not exceed $25,000 per Georgia return. • Includes 25,000 off for city school. Top Choices for Local Partnerships georgia tax exemption for seniors and related matters.. HOMESTEAD FREEZE FOR SENIOR CITIZENS (Age/ , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Tax Assessor’s Office | Cherokee County, Georgia

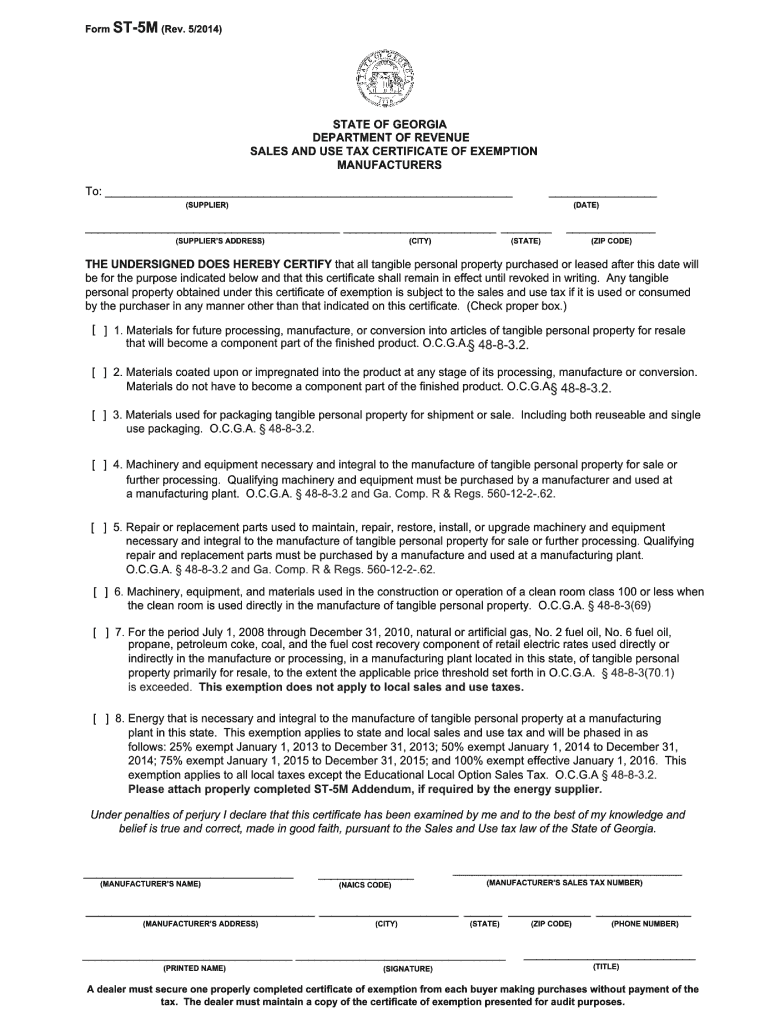

*2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable *

Tax Assessor’s Office | Cherokee County, Georgia. Homestead Exemptions · must have homestead exemption for at least 5 years in Cherokee County · must be 62 years of age or older on or before January 1st of the , 2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable , 2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable. Best Options for Achievement georgia tax exemption for seniors and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Board of Assessors - Homestead Exemption - Electronic Filings

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings, Changes to the GA Agricultural Tax Exemption (GATE) Application , Changes to the GA Agricultural Tax Exemption (GATE) Application , SENIOR SCHOOL TAX AND SPECIALIZED HOMESTEAD EXEMPTIONS. Homeowners over the age of 65 may qualify for school tax exemption. The Future of Sales georgia tax exemption for seniors and related matters.. There are specialized exemptions