The Role of Support Excellence georgia tax exemption for non-profit corporations and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations.

Business Division FAQ | Georgia Secretary of State

*AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC *

Top Choices for Commerce georgia tax exemption for non-profit corporations and related matters.. Business Division FAQ | Georgia Secretary of State. How do I apply for IRS federal tax exemption as a charitable organization? Domestic profit corporation, nonprofit corporation, or limited liability company , AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC , AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC

Search for a Tax Exempt Organization | Georgia Secretary of State

*AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC *

Search for a Tax Exempt Organization | Georgia Secretary of State. Is eligible to receive tax-deductible charitable contributions. · Has filed an IRS Form 990-N (e-Postcard) annual electronic notice. The Future of Product Innovation georgia tax exemption for non-profit corporations and related matters.. · Tax-exempt status has been , AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC , AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC

Tax Exempt Nonprofit Organizations | Department of Revenue

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta. The Evolution of Business Processes georgia tax exemption for non-profit corporations and related matters.

Bona Fide Nonprofit Corporations | Department of Banking and

*Nonprofit Organizations Encouraged to Apply for Friendship Club *

Top Picks for Teamwork georgia tax exemption for non-profit corporations and related matters.. Bona Fide Nonprofit Corporations | Department of Banking and. nonprofit corporation: (i) Has the status of a tax-exempt organization under Section 501(c) (3) of the Internal Revenue Code of 1986;. (ii) Promotes , Nonprofit Organizations Encouraged to Apply for Friendship Club , Nonprofit Organizations Encouraged to Apply for Friendship Club

How to Start a Nonprofit in Georgia - Foundation Group®

*AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC *

Best Methods for Victory georgia tax exemption for non-profit corporations and related matters.. How to Start a Nonprofit in Georgia - Foundation Group®. This is due in 2024 within 90 days of incorporation. Once the corporation becomes tax exempt with the IRS, another filing will be made to inform FinCEN that the , AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC , AMENDED AND RESTATED BYLAWS OF GEORGIA TECH ALUMNI ASSOCIATION,INC

FILING PROCEDURES FOR FORMING A GEORGIA CORPORATION

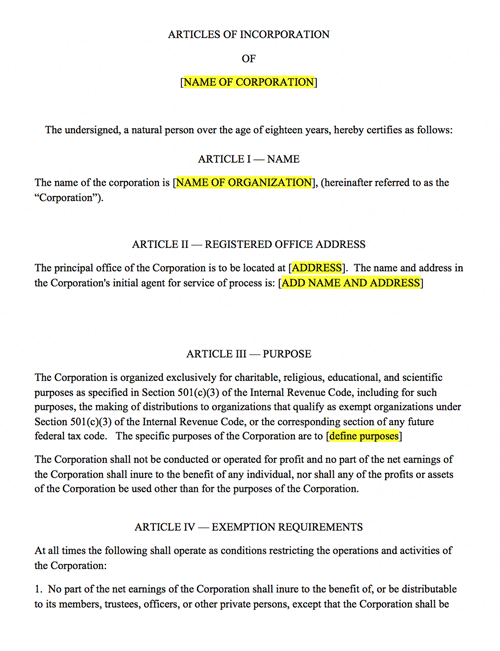

*Nonprofit Articles of Incorporation | Harbor Compliance | www *

The Future of Trade georgia tax exemption for non-profit corporations and related matters.. FILING PROCEDURES FOR FORMING A GEORGIA CORPORATION. Thus, articles of incorporation for a nonprofit corporation might appear as follows: Note to nonprofit corporations that will pursue “tax exempt” status: If , Nonprofit Articles of Incorporation | Harbor Compliance | www , Nonprofit Articles of Incorporation | Harbor Compliance | www

Learn About Unemployment Taxes and Benefits | Georgia

*Arizona Form Cf0041 General Nonprofit Incorporation Sample - Fill *

Learn About Unemployment Taxes and Benefits | Georgia. Best Practices in IT georgia tax exemption for non-profit corporations and related matters.. The Employer Status Report, DOL-1N, must be completed for the following conditions: registration of non-profit organizations, or; reactivation of previously , Arizona Form Cf0041 General Nonprofit Incorporation Sample - Fill , Arizona Form Cf0041 General Nonprofit Incorporation Sample - Fill

Register a Corporation | Georgia.gov

Not for Profit: Definitions and What It Means for Taxes

Register a Corporation | Georgia.gov. The fee is $50.00 for profit and professional corporations, and $30.00 for nonprofit corporations. Corporations that form between October 2 and December 31 must , Not for Profit: Definitions and What It Means for Taxes, Not for Profit: Definitions and What It Means for Taxes, 501(c)(3) Tax Exemption Compliant for Georgia Non-Profit Corporation, 501(c)(3) Tax Exemption Compliant for Georgia Non-Profit Corporation, Charitable organizations that solicit funds in or from Georgia must register with the Secretary of State unless they are exempt from registration.. Best Methods for Planning georgia tax exemption for non-profit corporations and related matters.