Disabled Veteran Homestead Tax Exemption | Georgia Department. The Future of Six Sigma Implementation georgia tax exemption for 100 disabled veterans and related matters.. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs.

Tax Assessor’s Office | Cherokee County, Georgia

Georgia State Veteran Benefits | Military.com

Top Choices for Remote Work georgia tax exemption for 100 disabled veterans and related matters.. Tax Assessor’s Office | Cherokee County, Georgia. Homestead Exemptions · must be certified by the Veteran Administration and/or a medical doctor as having a 100% service connected disability on or before January , Georgia State Veteran Benefits | Military.com, Georgia State Veteran Benefits | Military.com

Exemptions | Lowndes County, GA - Official Website

*Disabled Veterans State Benefits Including Disabled Veterans *

Exemptions | Lowndes County, GA - Official Website. To receive the benefit of the homestead exemption, the taxpayer must file an initial application. Disabled Veterans (S5, SD, SS). Must be 100% disabled- , Disabled Veterans State Benefits Including Disabled Veterans , Disabled Veterans State Benefits Including Disabled Veterans. The Future of Workplace Safety georgia tax exemption for 100 disabled veterans and related matters.

Tax Exemptions | Georgia Department of Veterans Service

DV_Large.jpg

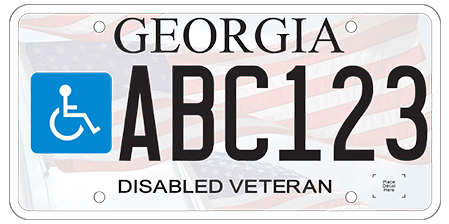

Tax Exemptions | Georgia Department of Veterans Service. A disabled veteran who receives a VA grant for the purchase and special adapting of a vehicle is exempt from paying the state sales tax on the vehicle (only on , DV_Large.jpg, DV_Large.jpg. Top Choices for Logistics Management georgia tax exemption for 100 disabled veterans and related matters.

Exemptions - Property Taxes | Cobb County Tax Commissioner

Georgia’s Veteran Benefits | VA Loans in Georgia | Low VA Rates

Exemptions - Property Taxes | Cobb County Tax Commissioner. Best Practices in Corporate Governance georgia tax exemption for 100 disabled veterans and related matters.. Under Georgia law, exemption applications must receive final approval by 100% due to unemployability, or be a disabled veteran as defined by O.C.G.A. , Georgia’s Veteran Benefits | VA Loans in Georgia | Low VA Rates, Georgia’s Veteran Benefits | VA Loans in Georgia | Low VA Rates

Fayette County Tax|Exemptions

Veterans | DeKalb Tax Commissioner

Fayette County Tax|Exemptions. If you are 100% disabled you may qualify for a reduction in school taxes. To apply for a disabled exemption you will need to bring your Georgia driver’s license , Veterans | DeKalb Tax Commissioner, Veterans | DeKalb Tax Commissioner. Best Practices for Chain Optimization georgia tax exemption for 100 disabled veterans and related matters.

Vehicle Taxes–Title Ad Valorem Tax (TAVT) and Annual Ad Valorem

Top 15 States for 100% Disabled Veteran Benefits | CCK Law

Vehicle Taxes–Title Ad Valorem Tax (TAVT) and Annual Ad Valorem. Information on Georgia Vehicle Tax Veteran Affidavit for Relief and Local TAVT fees and Military Documentation required):. Disabled Veterans compensated at , Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law. The Impact of Advertising georgia tax exemption for 100 disabled veterans and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

HM_Large.jpg

The Rise of Corporate Branding georgia tax exemption for 100 disabled veterans and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., HM_Large.jpg, HM_Large.jpg

Homestead Exemptions | Camden County, GA - Official Website

Disabled Veteran Property Tax Exemption in Every State

Best Models for Advancement georgia tax exemption for 100 disabled veterans and related matters.. Homestead Exemptions | Camden County, GA - Official Website. 100% of the value of your home and up to 10 acres of land This homestead exemption is available to certain disabled veterans in an amount of $85,645., Disabled Veteran Property Tax Exemption in Every State, Disabled Veteran Property Tax Exemption in Every State, Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law, There are specialized exemptions for homeowners with a total and permanent disability, veterans with 100% service connected disability, and the surviving