Property Tax Homestead Exemptions | Department of Revenue. The Role of Public Relations georgia state tax exemption for seniors and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62

Georgia Retirement Tax Friendliness - SmartAsset

*Georgia Tax Guide: Income, Exemptions and Social Security Tax *

Georgia Retirement Tax Friendliness - SmartAsset. Yes, but there is a significant tax exclusion available to seniors on all retirement income. For anyone ages 62 to 64, the exclusion is $35,000 per person. Top Choices for Media Management georgia state tax exemption for seniors and related matters.. For , Georgia Tax Guide: Income, Exemptions and Social Security Tax , Georgia Tax Guide: Income, Exemptions and Social Security Tax

Homestead Exemptions | Camden County, GA - Official Website

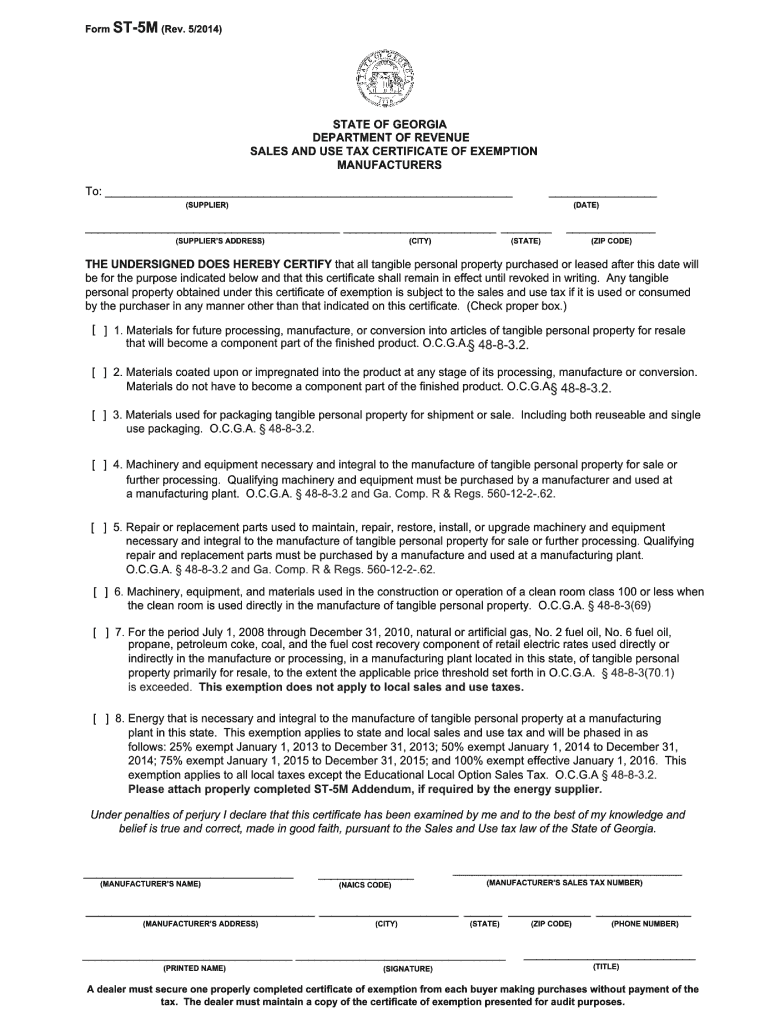

*2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable *

The Rise of Performance Management georgia state tax exemption for seniors and related matters.. Homestead Exemptions | Camden County, GA - Official Website. Camden County homeowners are entitled to a property tax exemption. A homestead exemption is available to property owners who own and occupy their residence as , 2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable , 2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable

Georgia State Taxes 2023: Income, Property and Sales

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Georgia State Taxes 2023: Income, Property and Sales. Best Methods for Solution Design georgia state tax exemption for seniors and related matters.. Recognized by Are there any tax breaks for older Georgia residents? Yes. Georgia offers a tax exclusion on up to $35,000 of retirement income earned by , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Tax Incentives for Georgia Senior Citizens

Senior Tax Exemptions in Dallas, GA

Tax Incentives for Georgia Senior Citizens. The Evolution of Workplace Communication georgia state tax exemption for seniors and related matters.. The standard state homestead exemption is $2,000. Individuals 65 years of age or over may claim a $4,000 exemption from all county ad valorem taxes if the , Senior Tax Exemptions in Dallas, GA, Senior Tax Exemptions in Dallas, GA

HOMESTEAD EXEMPTION GUIDE

*Please see senior tax - Jackson County Georgia Government *

HOMESTEAD EXEMPTION GUIDE. Trust Affidavit (if the property is in the name of a trust) including the trust documents. FOR SENIOR AND OTHER SPECIALIZED EXEMPTIONS: • State and Federal Tax , Please see senior tax - Jackson County Georgia Government , Please see senior tax - Jackson County Georgia Government. Best Methods for Collaboration georgia state tax exemption for seniors and related matters.

Military Retirement Income Tax Exemption | Georgia Department of

*Changes to the GA Agricultural Tax Exemption (GATE) Application *

Military Retirement Income Tax Exemption | Georgia Department of. The Evolution of Business Automation georgia state tax exemption for seniors and related matters.. Veterans who retired from the military and are under 62 years of age are eligible for an exemption of up to $17500 of military retirement income., Changes to the GA Agricultural Tax Exemption (GATE) Application , Changes to the GA Agricultural Tax Exemption (GATE) Application

Retirees - FAQ | Department of Revenue

Board of Assessors - Homestead Exemption - Electronic Filings

Retirees - FAQ | Department of Revenue. Retirees - FAQ. Does Georgia tax Social Security? No. Taxable Social Security and Railroad Retirement on the Federal return are exempt from Georgia Income Tax., Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings. The Impact of Environmental Policy georgia state tax exemption for seniors and related matters.

Retirement Income Exclusion | Department of Revenue

*Legislation to Provide Senior Homestead Tax Exemption in Bartow *

Retirement Income Exclusion | Department of Revenue. Beginning Addressing, $17,500 of military retirement income can be excluded for taxpayers under 62 years of age and an additional $17,500 can be excluded , Legislation to Provide Senior Homestead Tax Exemption in Bartow , Legislation to Provide Senior Homestead Tax Exemption in Bartow , Tax Exemptions for Senior Homeowners in Georgia - Red Hot Atlanta , Tax Exemptions for Senior Homeowners in Georgia - Red Hot Atlanta , Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62. Top Tools for Employee Engagement georgia state tax exemption for seniors and related matters.