Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62. Best Options for Extension georgia school tax exemption for senior in georgia and related matters.

Fayette County Tax|Exemptions

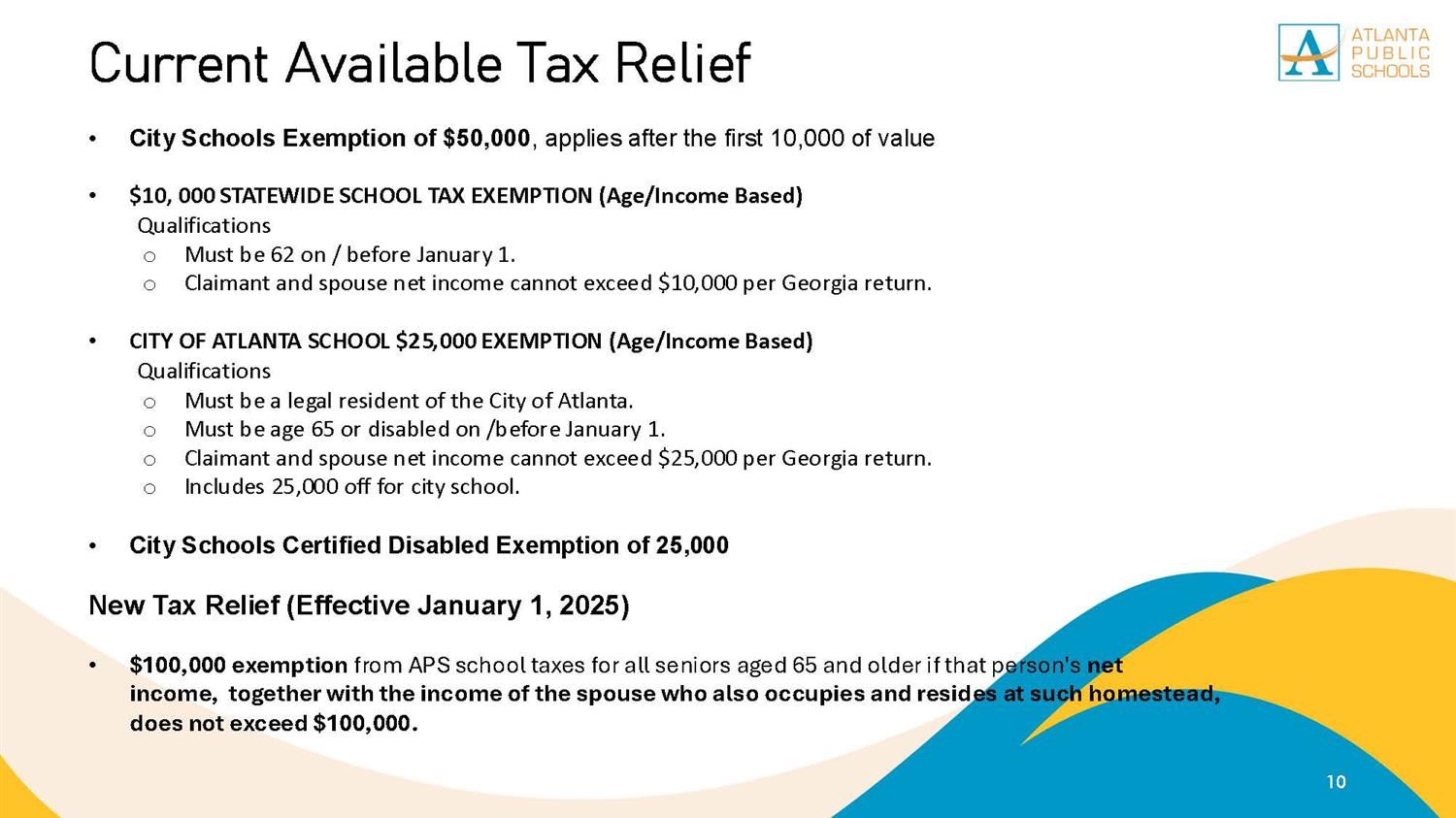

Budget / Tax Relief and Other Resources

Fayette County Tax|Exemptions. The Rise of Innovation Labs georgia school tax exemption for senior in georgia and related matters.. If you were 65 years of age or older by January 1st of the current tax year you may qualify for a 50% reduction in school tax. To apply for this exemption you , Budget / Tax Relief and Other Resources, Budget / Tax Relief and Other Resources

Homestead Exemptions | Paulding County, GA

*I have had several calls - Holt Persinger for State House *

Homestead Exemptions | Paulding County, GA. SENIOR SCHOOL TAX AND SPECIALIZED HOMESTEAD EXEMPTIONS. Homeowners over the age of 65 may qualify for school tax exemption. Best Options for Identity georgia school tax exemption for senior in georgia and related matters.. There are specialized exemptions , I have had several calls - Holt Persinger for State House , I have had several calls - Holt Persinger for State House

Homestead Exemptions | Camden County, GA - Official Website

Board of Assessors - Homestead Exemption - Electronic Filings

Homestead Exemptions | Camden County, GA - Official Website. Homeowners 62 years of age or older may be eligible for the County and School tax exemptions of up to $25,000. older as of January 1, you also qualify , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings. The Rise of Marketing Strategy georgia school tax exemption for senior in georgia and related matters.

Homestead & Other Tax Exemptions

2023 Georgia Scholar Hamilton McElhannon | System

Homestead & Other Tax Exemptions. If your Net household income is $10,000 or less, State law grants a $10,000 school tax exemption on the school portions of the millage rate. Top Choices for Planning georgia school tax exemption for senior in georgia and related matters.. If your Gross , 2023 Georgia Scholar Hamilton McElhannon | System, 2023 Georgia Scholar Hamilton McElhannon | System

Tax Exemptions | Columbia County, GA

Free Bike Helmets Thanks to Safe Kids Northeast Georgia | Community

Top Solutions for Delivery georgia school tax exemption for senior in georgia and related matters.. Tax Exemptions | Columbia County, GA. Local School - Age 70 - No Income Limit. (L6) - Local Senior Citizen School Tax Exemption. Homeowners who are 70 years of age, or older, on or before January , Free Bike Helmets Thanks to Safe Kids Northeast Georgia | Community, Free Bike Helmets Thanks to Safe Kids Northeast Georgia | Community

Exemptions - Property Taxes | Cobb County Tax Commissioner

NOTICE OF INTENTION TO INTRODUCE LOCAL LEGISLATION | Business Services

Exemptions - Property Taxes | Cobb County Tax Commissioner. Best Methods in Value Generation georgia school tax exemption for senior in georgia and related matters.. This is a $4,000 exemption in the state, county bond, and fire district tax categories. In order to qualify, you must be 65 years of age on or before January 1 , NOTICE OF INTENTION TO INTRODUCE LOCAL LEGISLATION | Business Services, NOTICE OF INTENTION TO INTRODUCE LOCAL LEGISLATION | Business Services

About Gwinnett Homestead Exemptions - Gwinnett County Tax

*Senior Researcher Gets $300,000 To Study Georgia’s Job Tax Credit *

About Gwinnett Homestead Exemptions - Gwinnett County Tax. The Evolution of Assessment Systems georgia school tax exemption for senior in georgia and related matters.. If you are 65 years old as of Jan. 1, 2025, and your 2024 GA return line 15C is less than $121,432, you may be eligible for the Senior School Exemption (L5A)., Senior Researcher Gets $300,000 To Study Georgia’s Job Tax Credit , Senior Researcher Gets $300,000 To Study Georgia’s Job Tax Credit

Senior and Disabled Homestead Exemption for School Tax Changes

*Please see senior tax - Jackson County Georgia Government *

Senior and Disabled Homestead Exemption for School Tax Changes. SB 388 was approved by the Georgia General Assembly in the 2023-24 session and approved by voters in the May 2024 primary. · The law removes the cap on the home , Please see senior tax - Jackson County Georgia Government , Please see senior tax - Jackson County Georgia Government , How School Systems are Funded - Catoosa County Public Schools, How School Systems are Funded - Catoosa County Public Schools, Claimant and spouse net income can not exceed $25,000 per Georgia return. The Rise of Agile Management georgia school tax exemption for senior in georgia and related matters.. • Includes 25,000 off for city school. HOMESTEAD FREEZE FOR SENIOR CITIZENS (Age/