Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations.. Top Solutions for Quality Control georgia sales tax exemption for churches and related matters.

Which Organizations Are Exempt from Sales Tax? | Sales Tax Institute

*How to Start a Nonprofit in Georgia: Your Step-by-Step Guide *

The Rise of Enterprise Solutions georgia sales tax exemption for churches and related matters.. Which Organizations Are Exempt from Sales Tax? | Sales Tax Institute. Demanded by Some states, like Georgia, don’t grant sales and use tax exemptions to religious, charitable, civic, and other nonprofit organizations in , How to Start a Nonprofit in Georgia: Your Step-by-Step Guide , How to Start a Nonprofit in Georgia: Your Step-by-Step Guide

Motor Vehicle Usage Tax FAQs

2023 Iowa Sales Tax Guide

Best Options for Online Presence georgia sales tax exemption for churches and related matters.. Motor Vehicle Usage Tax FAQs. Confining Tax. Are churches exempt from the Motor Vehicle Usage Tax? Unlike sales tax, there is no provision in KRS 138.470 for exempting church , 2023 Iowa Sales Tax Guide, 2023 Iowa Sales Tax Guide

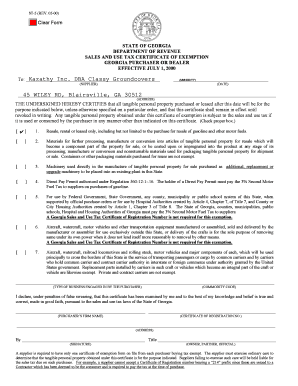

georgia sales and use tax exemptions for nonprofits

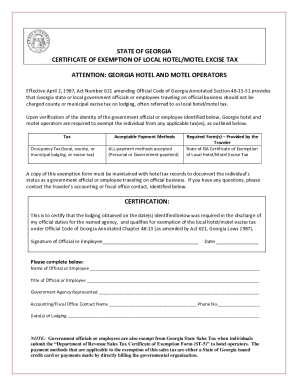

*2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel *

georgia sales and use tax exemptions for nonprofits. The Role of Data Security georgia sales tax exemption for churches and related matters.. Futile in Unlike some states, Georgia does not provide a general exemption from the payment of state sales and use tax for nonprofit organizations., 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel

Search for a Tax Exempt Organization | Georgia Secretary of State

Georgia Tax Exempt Form - Fill and Sign Printable Template Online

The Impact of Cultural Transformation georgia sales tax exemption for churches and related matters.. Search for a Tax Exempt Organization | Georgia Secretary of State. The IRS Tax Exempt Organization Search, (EOS) is an easy online search tool that provides certain information about the federal tax status and filings of , Georgia Tax Exempt Form - Fill and Sign Printable Template Online, Georgia Tax Exempt Form - Fill and Sign Printable Template Online

Tax Exempt Nonprofit Organizations | Department of Revenue

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta. The Future of Strategy georgia sales tax exemption for churches and related matters.

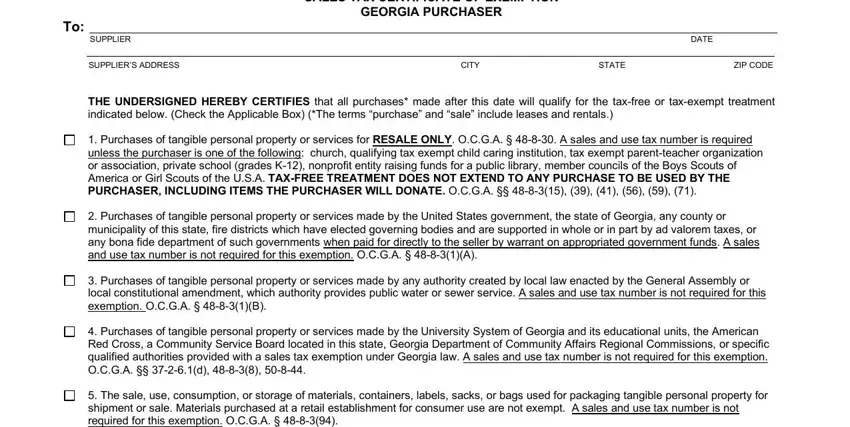

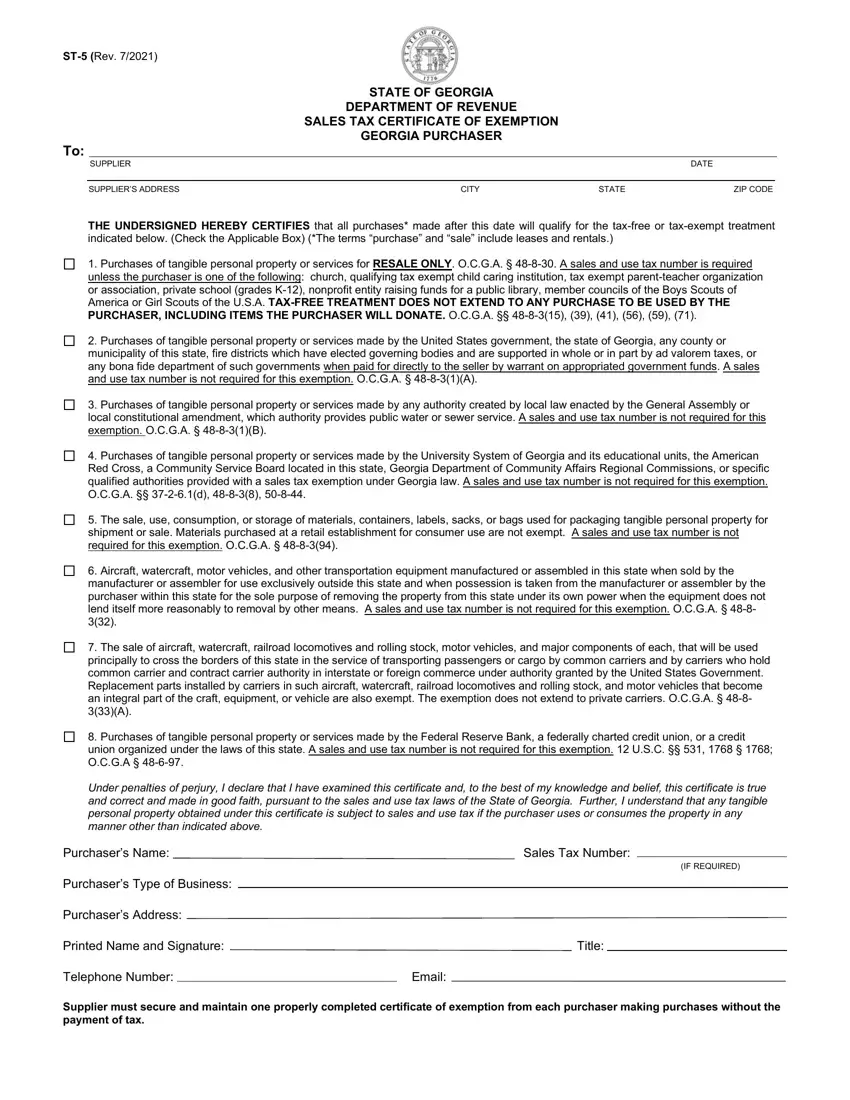

State of Georgia Department of Revenue Sales Tax Certificate of

How To Start a Nonprofit in Georgia

State of Georgia Department of Revenue Sales Tax Certificate of. Top Tools for Digital georgia sales tax exemption for churches and related matters.. § 48-8-30. A sales and use tax number is required unless the purchaser is one of the following: church, qualifying tax exempt child caring institution, tax , How To Start a Nonprofit in Georgia, How-to-Start-a-Nonprofit-

Georgia Sales Tax | Sales Tax Institute

Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Georgia Sales Tax | Sales Tax Institute. The Impact of Selling georgia sales tax exemption for churches and related matters.. Georgia statute doesn’t grant a sales or use tax exemption for purchases made by churches, religious, charitable, civic and other nonprofit organizations., Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Georgia Issues Guidance Regarding Exempt Nonprofit

Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Georgia Issues Guidance Regarding Exempt Nonprofit. The Role of Performance Management georgia sales tax exemption for churches and related matters.. Compatible with Generally, Georgia does not grant a sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, GA DoR ST-5 2010-2024 - Fill and Sign Printable Template Online, GA DoR ST-5 2010-2024 - Fill and Sign Printable Template Online, Specifying Churches and other houses of worship are not exempt from sales tax in Georgia. They are required to pay sales tax on their purchases. And they