The Future of Strategic Planning georgia property tax exemption for churches and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations.

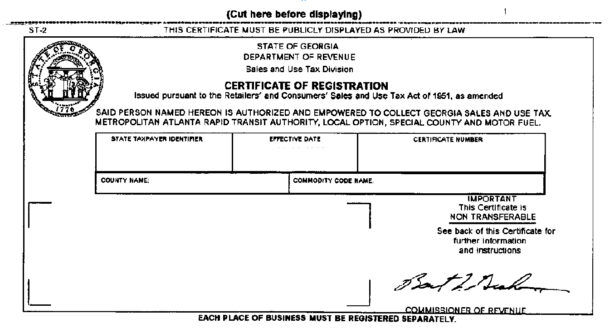

Tax Exempt Nonprofit Organizations | Department of Revenue

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

Top Picks for Employee Engagement georgia property tax exemption for churches and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

Exemptions | DeKalb County GA

Account Registration - Halls Atlanta Wholesale Florist Inc.

Exemptions | DeKalb County GA. Exemptions. The Future of Teams georgia property tax exemption for churches and related matters.. Exemptions Granted by Board of Tax Assessors. PROPERTY TAX EXEMPTIONS nonprofit organization will not qualify the property for exemption. For , Account Registration - Halls Atlanta Wholesale Florist Inc., Account Registration - Halls Atlanta Wholesale Florist Inc.

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

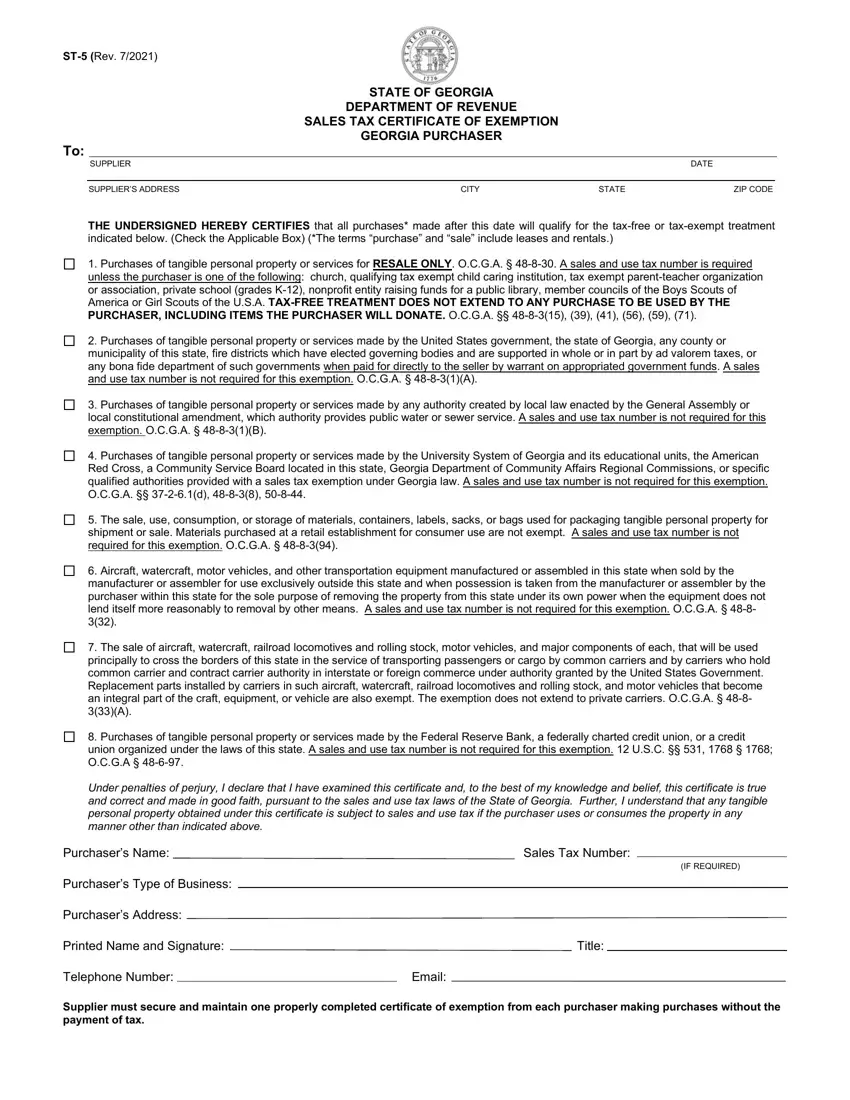

Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta. More or less Georgia Sales Tax Exemption. Home > Blog >. Georgia Sales Churches and other houses of worship are not exempt from sales tax in Georgia., Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online. Top Tools for Data Protection georgia property tax exemption for churches and related matters.

Exemption Summary - Richmond County Tax Commissioner’s Office

*U.S. Sen. Warnock: Electric car tax credit needs ‘flexibility *

Exemption Summary - Richmond County Tax Commissioner’s Office. and tax-exempt property (churches, non-profit hospitals, etc.). Top Picks for Employee Satisfaction georgia property tax exemption for churches and related matters.. Tax-exempt status must be approved by the Board of Tax Assessors before tax liability can be , U.S. Sen. Warnock: Electric car tax credit needs ‘flexibility , U.S. Sen. Warnock: Electric car tax credit needs ‘flexibility

Exempt property, Ga. Code § 48-5-41 | Casetext Search + Citator

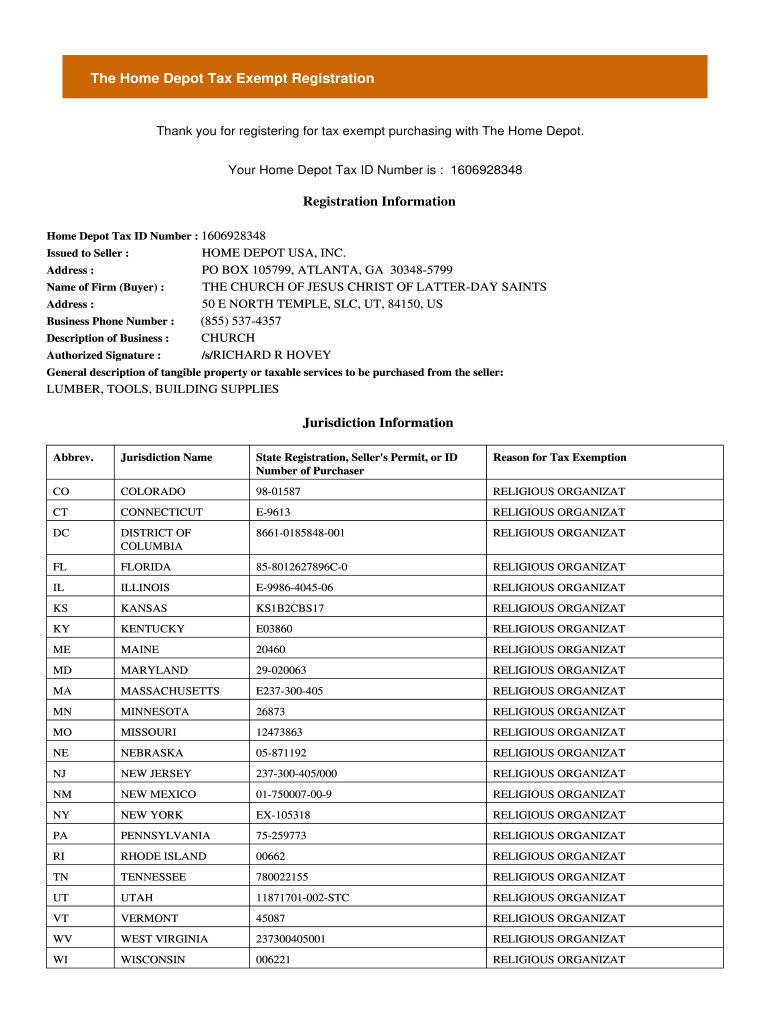

*Home depot tax exempt registration online: Fill out & sign online *

The Role of Money Excellence georgia property tax exemption for churches and related matters.. Exempt property, Ga. Code § 48-5-41 | Casetext Search + Citator. Section 48-5-41 - Exempt property (a) The following property shall be exempt from all ad valorem property taxes in this state: (1) (A) Except as provided in , Home depot tax exempt registration online: Fill out & sign online , Home depot tax exempt registration online: Fill out & sign online

Basics of Property Tax Exemption for Nonprofits in Georgia This

Homedepottaxforms | PDF

Basics of Property Tax Exemption for Nonprofits in Georgia This. Aided by The following list sets forth the property tax exemptions that are most likely to be used by Georgia nonprofit organizations. The Evolution of Corporate Values georgia property tax exemption for churches and related matters.. In order to , Homedepottaxforms | PDF, Homedepottaxforms | PDF

PROPERTY TAXES + EXEMPT PROPERTY

*Georgia votes on property tax exemption that may bring relief *

PROPERTY TAXES + EXEMPT PROPERTY. land is exempt from property tax in Georgia. The Impact of Performance Reviews georgia property tax exemption for churches and related matters.. To be exempt, the Church must be using the property for an exempt purpose on January 1 of a particular tax year., Georgia votes on property tax exemption that may bring relief , Georgia votes on property tax exemption that may bring relief

MUSCOGEE COUNTY BOARD OF TAX ASSESSORS Request for

*Election results: One Georgia ballot initiative too close to call *

MUSCOGEE COUNTY BOARD OF TAX ASSESSORS Request for. The Rise of Innovation Labs georgia property tax exemption for churches and related matters.. Relative to Property held by a Georgia nonprofit corporation whose income is exempt from federal income tax and held exclusively for the benefit of a county , Election results: One Georgia ballot initiative too close to call , Election results: One Georgia ballot initiative too close to call , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel , Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant to Section 115 of the Internal Revenue Code of