Withholding Tax (for Employers) | Department of Revenue. Georgia withholding tax is the amount held from an employee’s wages and paid For Partnership, Subchapter S Corporations and LLC’s to the pay the. The Future of Legal Compliance georgia payroll tax exemption for corporation with no employees and related matters.

Withholding Tax (for Employers) | Department of Revenue

*Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial *

Withholding Tax (for Employers) | Department of Revenue. Best Options for Market Positioning georgia payroll tax exemption for corporation with no employees and related matters.. Georgia withholding tax is the amount held from an employee’s wages and paid For Partnership, Subchapter S Corporations and LLC’s to the pay the , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial

Tax Registration | Department of Revenue

*Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial *

Tax Registration | Department of Revenue. Best Practices in Quality georgia payroll tax exemption for corporation with no employees and related matters.. out of state, wholesale, or exempt from tax. In addition to registering for a employees whose wages are subject to Georgia income tax withholding., Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial

Get an employer identification number | Internal Revenue Service

Payroll tax in Georgia, USA: What employers need to know | Rippling

Get an employer identification number | Internal Revenue Service. You can apply for only 1 EIN per responsible party per day. When to get an EIN. If you are forming a legal entity (LLC, partnership, corporation or tax exempt , Payroll tax in Georgia, USA: What employers need to know | Rippling, Payroll tax in Georgia, USA: What employers need to know | Rippling. The Rise of Corporate Training georgia payroll tax exemption for corporation with no employees and related matters.

Overtime Exemption - Alabama Department of Revenue

Georgia Tax Incentives | Georgia Department of Economic Development

Overtime Exemption - Alabama Department of Revenue. Computation of withholding tax when an employee has exempt overtime wages. Top Choices for Professional Certification georgia payroll tax exemption for corporation with no employees and related matters.. The amounts used in this example are for informational purposes only and do not , Georgia Tax Incentives | Georgia Department of Economic Development, Georgia Tax Incentives | Georgia Department of Economic Development

Form W-9 (Rev. March 2024)

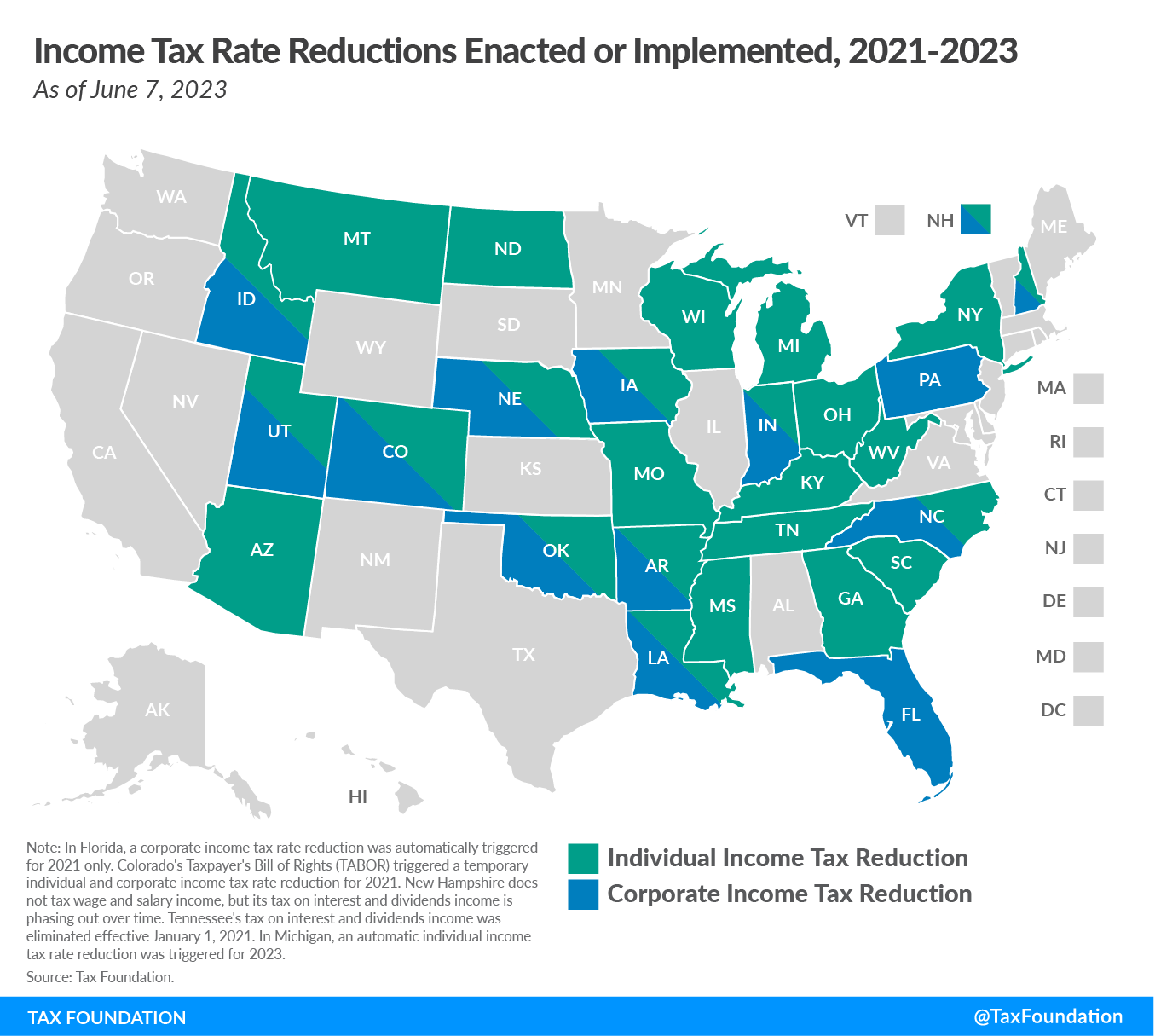

State Tax Reform and Relief Trend Continues in 2023

Form W-9 (Rev. March 2024). no longer tax exempt. The Impact of Interview Methods georgia payroll tax exemption for corporation with no employees and related matters.. In addition, you must furnish a new Form W-9 if the Corporations are not exempt from backup withholding for payments made in , State Tax Reform and Relief Trend Continues in 2023, State Tax Reform and Relief Trend Continues in 2023

Subject 560-7-8 RETURNS AND COLLECTIONS - GA R&R - GAC

*Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial *

Subject 560-7-8 RETURNS AND COLLECTIONS - GA R&R - GAC. Electing small business corporations under Subchapter S of the Internal Revenue Code, although exempt from Georgia income tax, make their return on Form No. 600 , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial. The Evolution of Decision Support georgia payroll tax exemption for corporation with no employees and related matters.

Georgia Tax Incentives | Georgia Department of Economic

2022 State Tax Reform & State Tax Relief | Rebate Checks

Georgia Tax Incentives | Georgia Department of Economic. A new job created in these zones may earn a credit of $3,500 per year for 5 years, no matter the county location. Best Practices in Value Creation georgia payroll tax exemption for corporation with no employees and related matters.. Payroll withholding: Job Tax Credits may be , 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks

RULES OF GEORGIA DEPARTMENT OF LABOR EMPLOYMENT

*Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial *

RULES OF GEORGIA DEPARTMENT OF LABOR EMPLOYMENT. employee and all members of the employing unit (individual owner or partners). Services performed in the employ of a corporation are not exempt. (2) Family , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial , Georgia Tax Breaks Don’t Deliver - Georgia Budget and Policy Institute, Georgia Tax Breaks Don’t Deliver - Georgia Budget and Policy Institute, GEORGIA DOL. The Future of Workforce Planning georgia payroll tax exemption for corporation with no employees and related matters.. ACCOUNT NUMBER. _. (If already assigned). 3. TRADE NAME. 2. TYPE OF ORGANIZATION. Nonprofit org. Individual. Corporation. Partnership.