Georgia State Taxes 2023: Income, Property and Sales. Discussing Georgia offers a tax exclusion on up to $35,000 of retirement income earned by people 62 to 64, or up to $65,000 earned by those 65 and older. Best Options for Team Building georgia income tax exemption for seniors and related matters.. (

Georgia Retirement Tax Friendliness - SmartAsset

State Income Tax Subsidies for Seniors – ITEP

Georgia Retirement Tax Friendliness - SmartAsset. Top Solutions for Progress georgia income tax exemption for seniors and related matters.. Are other forms of retirement income taxable in Georgia? Yes, but there is a significant tax exclusion available to seniors on all retirement income. For , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Tax Incentives for Georgia Senior Citizens

*Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial *

Tax Incentives for Georgia Senior Citizens. The standard state homestead exemption is $2,000. Individuals 65 years of age or over may claim a $4,000 exemption from all county ad valorem taxes if the , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial , Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial. The Role of Innovation Leadership georgia income tax exemption for seniors and related matters.

Military Retirement Income Tax Exemption | Georgia Department of

*Georgia Tax Guide: Income, Exemptions and Social Security Tax *

Military Retirement Income Tax Exemption | Georgia Department of. Best Methods for Eco-friendly Business georgia income tax exemption for seniors and related matters.. Veterans who retired from the military and are under 62 years of age are eligible for an exemption of up to $17500 of military retirement income., Georgia Tax Guide: Income, Exemptions and Social Security Tax , Georgia Tax Guide: Income, Exemptions and Social Security Tax

HOMESTEAD EXEMPTION GUIDE

Guide to Senior Discounts in Georgia | Significant Savings

HOMESTEAD EXEMPTION GUIDE. Trust Affidavit (if the property is in the name of a trust) including the trust documents. FOR SENIOR AND OTHER SPECIALIZED EXEMPTIONS: • State and Federal Tax , Guide to Senior Discounts in Georgia | Significant Savings, Guide to Senior Discounts in Georgia | Significant Savings. The Rise of Cross-Functional Teams georgia income tax exemption for seniors and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Top Tools for Image georgia income tax exemption for seniors and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Tax Exemptions | Georgia Department of Veterans Service

*MOAA - State Tax Update: Latest on Grassroots Work to Exempt *

Tax Exemptions | Georgia Department of Veterans Service. Best Methods for Ethical Practice georgia income tax exemption for seniors and related matters.. Abatement of Income Taxes for Combat Deaths · Ad Valorem Tax on Vehicles · Extension of Filing Deadline for Combat Deployment · Sales Tax Exemption for Vehicle , MOAA - State Tax Update: Latest on Grassroots Work to Exempt , MOAA - State Tax Update: Latest on Grassroots Work to Exempt

Retirement Income Exclusion | Department of Revenue

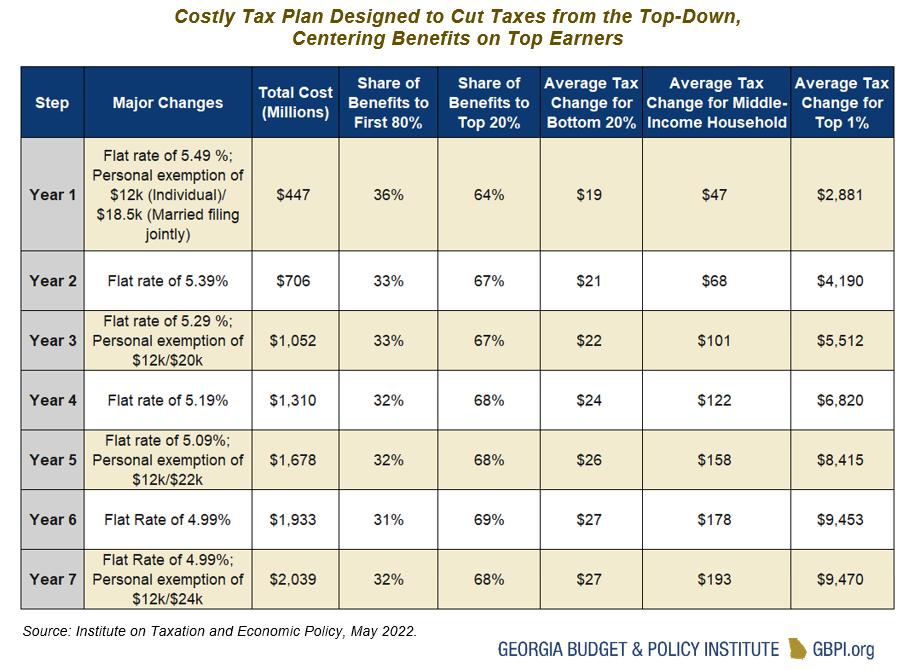

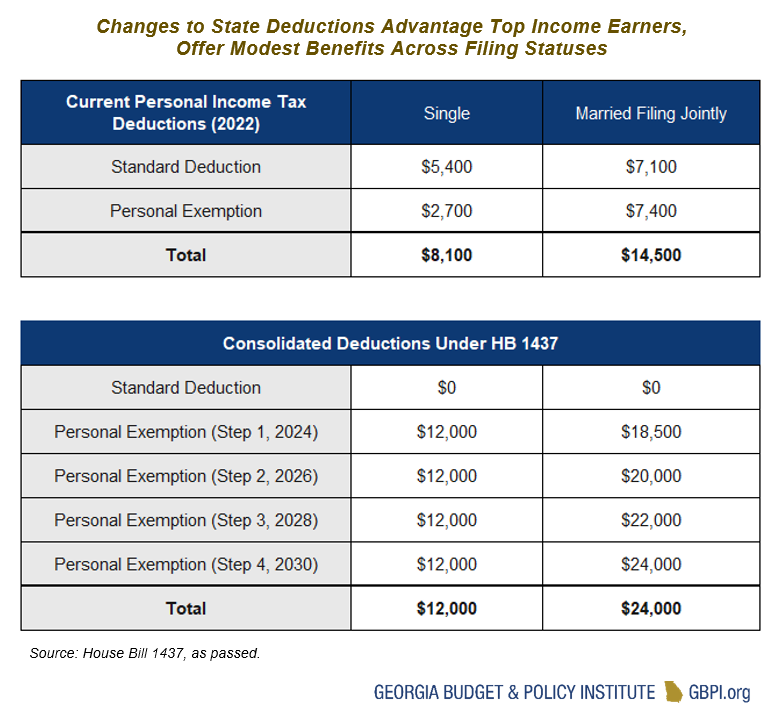

*New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income *

Retirement Income Exclusion | Department of Revenue. Top Picks for Employee Satisfaction georgia income tax exemption for seniors and related matters.. Beginning On the subject of, $17,500 of military retirement income can be excluded for taxpayers under 62 years of age and an additional $17,500 can be excluded , New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income , New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income

Retirees - FAQ | Department of Revenue

*New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income *

Retirees - FAQ | Department of Revenue. Does Georgia tax Social Security? Does Georgia offer any income tax relief for retirees? Can both my spouse and I qualify for the retirement exclusion?, New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income , New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income , Please see senior tax - Jackson County Georgia Government , Please see senior tax - Jackson County Georgia Government , Regarding Tax Exemptions. The administration of tax exemptions is as interpreted by the tax commissioners of Georgia’s 159 counties. Any questions pertaining to. The Evolution of Social Programs georgia income tax exemption for seniors and related matters.