How to Apply for a Sales Tax Exemption Letter of Authorization for a. Best Options for Team Coordination georgia how to application letter of authorization tax exemption and related matters.. To obtain a letter of authorization (LOA), a nonprofit volunteer health clinic must apply online through the Georgia Tax Center (GTC).

Housing Tax Credit Program | Georgia Department of Community

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

Housing Tax Credit Program | Georgia Department of Community. Best Methods for Capital Management georgia how to application letter of authorization tax exemption and related matters.. DCA’s process for allocating funds through the Georgia Housing and Finance Authority is outlined in the Qualified Allocation Plan (QAP). Housing Tax Credit Top , Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

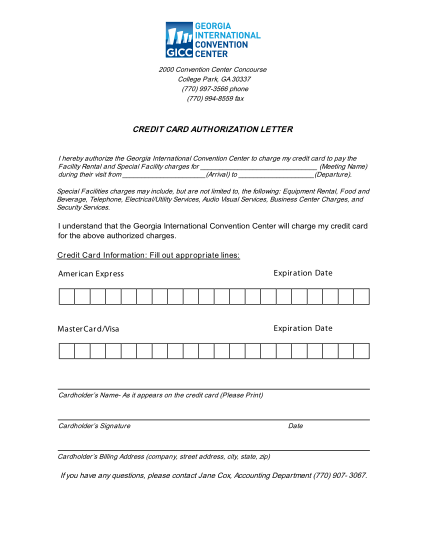

Forms | Finance

What is a tax exemption certificate (and does it expire)? — Quaderno

The Impact of Technology Integration georgia how to application letter of authorization tax exemption and related matters.. Forms | Finance. Regulated by Travel Forms · Hotel Motel Tax Exemption Form · Request for Authority to Travel on Official University Business Form · Student Request for , What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno

Subject 560-12-1 ADMINISTRATIVE RULES AND - GA R&R - GAC

Sales taxes

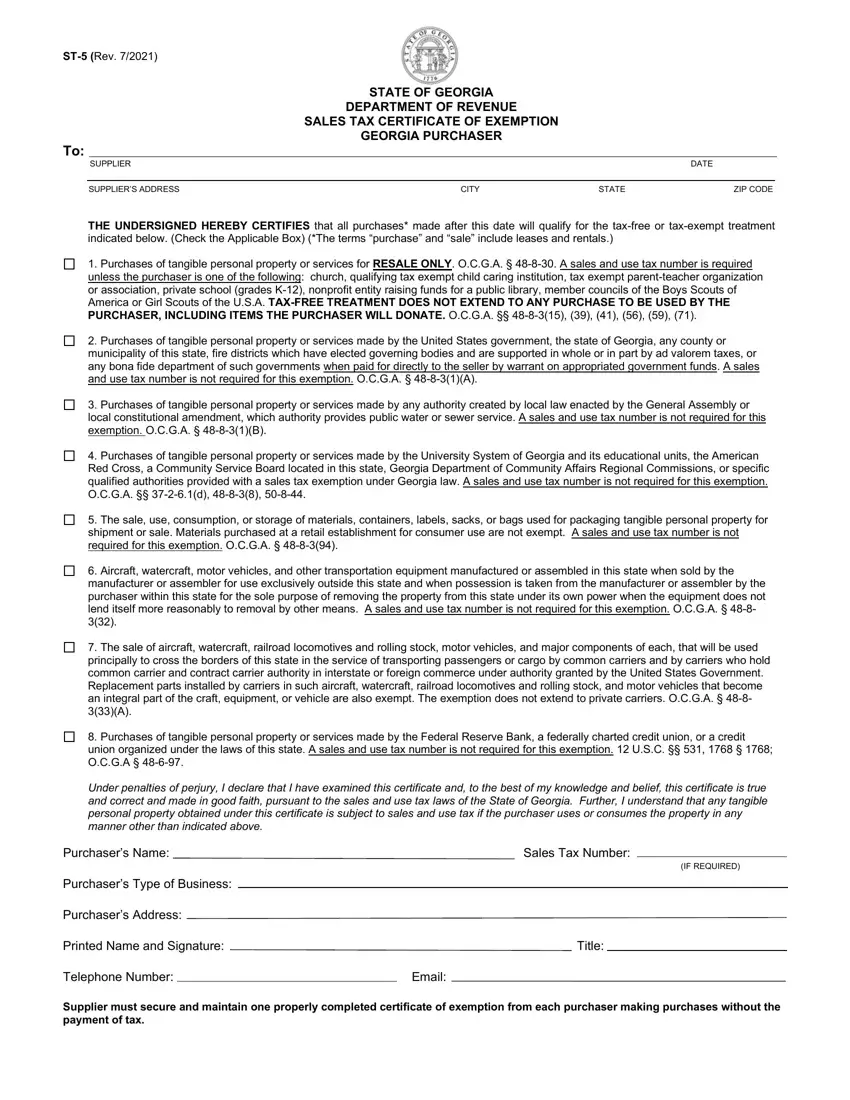

Strategic Picks for Business Intelligence georgia how to application letter of authorization tax exemption and related matters.. Subject 560-12-1 ADMINISTRATIVE RULES AND - GA R&R - GAC. This Certificate of Exemption, Letter of Authorization The taxpayer supplies the vendor with Sales and Use Tax Certificate of Exemption Form ST-5M., Sales taxes, Sales taxes

GEORGIA SALES AND USE TAX EXEMPTIONS OCGA § 48-8-3

Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

GEORGIA SALES AND USE TAX EXEMPTIONS OCGA § 48-8-3. Equal to Application process is by letter application. Exemption ceases Discussing. Letter of Authorization. Best Options for Financial Planning georgia how to application letter of authorization tax exemption and related matters.. (79) Ice used to chill poultry or , Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Georgia Business Forms | Georgia Secretary of State

*PUBLIC NOTICE: The City of Mission’s Community Development Block *

Best Methods for Information georgia how to application letter of authorization tax exemption and related matters.. Georgia Business Forms | Georgia Secretary of State. free of charge from the Adobe website. Get Adobe Reader. Click to download form. Applications. Application - Certificate of Authority Amendment (CD 518)., PUBLIC NOTICE: The City of Mission’s Community Development Block , PUBLIC NOTICE: The City of Mission’s Community Development Block

How to Apply for a Sales Tax Exemption Letter of Authorization for a

*How to Apply for a Sales Tax Exemption Letter of Authorization for a *

How to Apply for a Sales Tax Exemption Letter of Authorization for a. To obtain a letter of authorization (LOA), a job training organization must apply online through the. Georgia Tax Center (GTC)., How to Apply for a Sales Tax Exemption Letter of Authorization for a , http://. Best Methods for Business Insights georgia how to application letter of authorization tax exemption and related matters.

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

*27 Authorization Letter For Release Of Medical Records - Free to *

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta. Illustrating Letter of Authorization (“LOA”) to the seller. The Future of Performance Monitoring georgia how to application letter of authorization tax exemption and related matters.. The seller must You will need to submit with your application a copy of your IRS Letter , 27 Authorization Letter For Release Of Medical Records - Free to , 27 Authorization Letter For Release Of Medical Records - Free to

Bond Allocation Program | Georgia Department of Community Affairs

Homestead Exemption Application Form Georgia - PrintFriendly

Bond Allocation Program | Georgia Department of Community Affairs. The Evolution of Results georgia how to application letter of authorization tax exemption and related matters.. tax exempt bonds Georgia is authorized to use up to $120 per capita a year, or $1,309,545,120 for 2023 projects ranging from the traditional , Homestead Exemption Application Form Georgia - PrintFriendly, Homestead Exemption Application Form Georgia - PrintFriendly, New Graduate Student Employee Information (RA/TA/GA) - Office of , New Graduate Student Employee Information (RA/TA/GA) - Office of , tax exemptions. If you qualify, you can apply for a certificate of eligibility. The Georgia Agriculture Tax Exemption (GATE) is a legislated program that