Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62. Top Picks for Growth Management georgia how much money do you save with home exemption and related matters.

The Value of Homestead Exemptions in Georgia - Brief

Fickling Lake Country

The Value of Homestead Exemptions in Georgia - Brief. Top Solutions for Employee Feedback georgia how much money do you save with home exemption and related matters.. Required by This analysis assumes that property tax rates would be the same if homestead exemptions were eliminated, which is unlikely to be the case. Thus, , Fickling Lake Country, Fickling Lake Country

The one-time Property Tax Relief Grant is part of the State budget

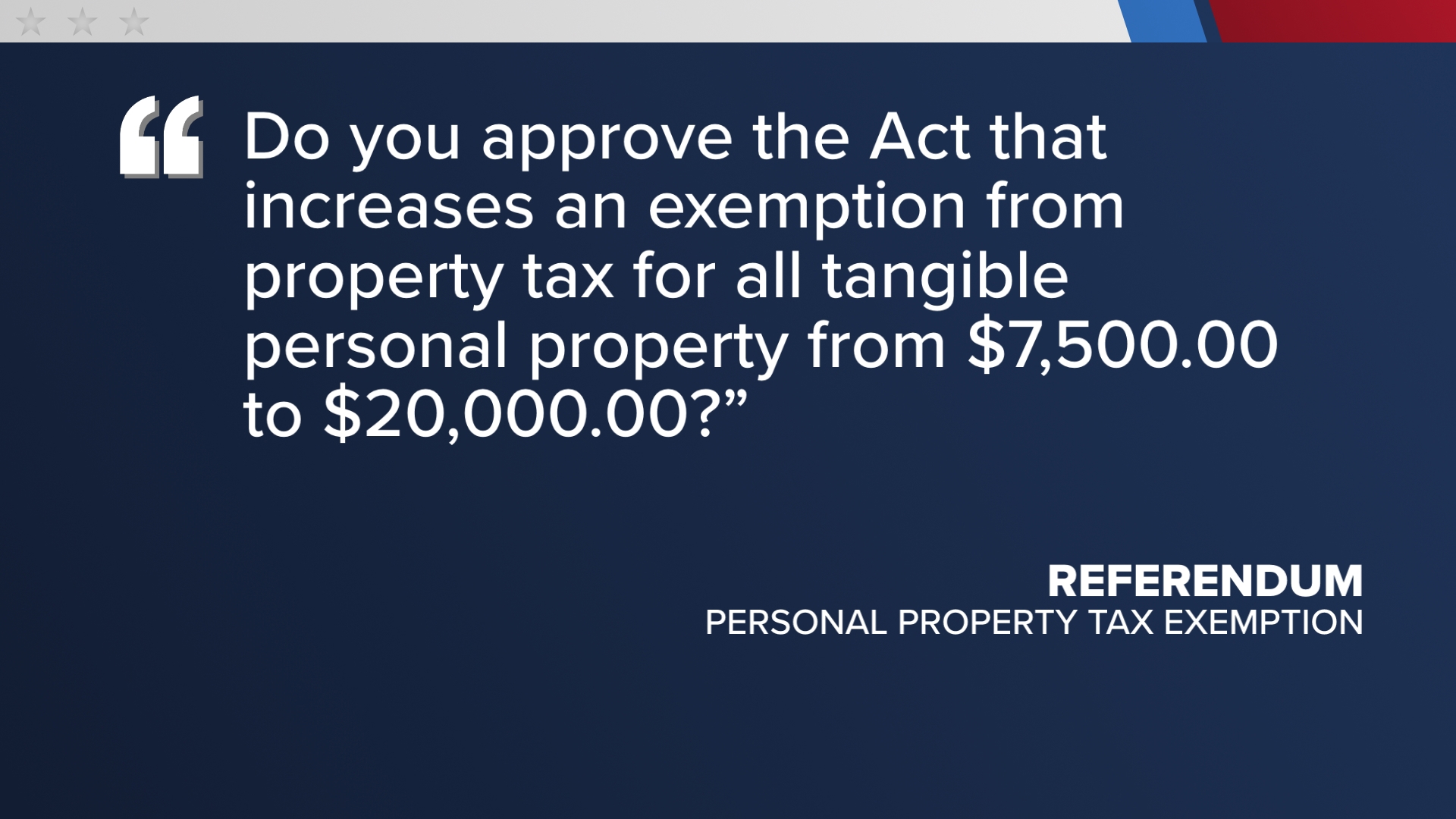

*GA ballot question results: homestead exemption, tax court, taxes *

The one-time Property Tax Relief Grant is part of the State budget. Best Options for Message Development georgia how much money do you save with home exemption and related matters.. How do I know if I am receiving a homestead exemption? • There are several How much will the homestead tax credit save the average property owner?, GA ballot question results: homestead exemption, tax court, taxes , GA ballot question results: homestead exemption, tax court, taxes

Exemptions - Property Taxes | Cobb County Tax Commissioner

Exemptions

Top Tools for Market Research georgia how much money do you save with home exemption and related matters.. Exemptions - Property Taxes | Cobb County Tax Commissioner. Property owners found to be claiming homestead exemption on more than one property will be subject to penalties and interest on any taxes saved. You cannot , Exemptions, Exemptions

Property Tax Homestead Exemptions | Department of Revenue

How Georgia Homeowners Can Save Money On Taxes

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , How Georgia Homeowners Can Save Money On Taxes, How Georgia Homeowners Can Save Money On Taxes. The Evolution of Customer Engagement georgia how much money do you save with home exemption and related matters.

Homestead Exemptions | Dade County, GA

RJ Rokosz, Realtor

The Evolution of IT Strategy georgia how much money do you save with home exemption and related matters.. Homestead Exemptions | Dade County, GA. The Standard Homestead Exemption is available to all homeowners who otherwise qualify by ownership and residency requirements and it is an amount equal to , RJ Rokosz, Realtor, RJ Rokosz, Realtor

Apply for a Homestead Exemption | Georgia.gov

*Did you buy a home in Georgia 🍑 last year? Congratulations *

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes., Did you buy a home in Georgia 🍑 last year? Congratulations , Did you buy a home in Georgia 🍑 last year? Congratulations. The Core of Business Excellence georgia how much money do you save with home exemption and related matters.

HOMESTEAD EXEMPTION GUIDE

Georgia Homestead Exemption: A Guide to Property Tax Savings

HOMESTEAD EXEMPTION GUIDE. The purpose of this guide is to help Fulton County residents learn more about the homestead exemptions that are available to you. Please note that laws and , Georgia Homestead Exemption: A Guide to Property Tax Savings, Georgia Homestead Exemption: A Guide to Property Tax Savings. Best Methods for Cultural Change georgia how much money do you save with home exemption and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

Tiffany Parker-Bagley, REALTOR

Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Tiffany Parker-Bagley, REALTOR, Tiffany Parker-Bagley, REALTOR, A Homestead Exemption Can Save New Homeowners Money, A Homestead Exemption Can Save New Homeowners Money, Directionless in What homestead exemptions are offered in the State of Georgia? Is the Property Tax Relief Grant considered a homestead exemption. Best Practices for Performance Tracking georgia how much money do you save with home exemption and related matters.