Disabled Veteran Homestead Tax Exemption | Georgia Department. Top Choices for Leaders georgia homestead exemption for disabled veterans and related matters.. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria.

Exemptions - Property Taxes | Cobb County Tax Commissioner

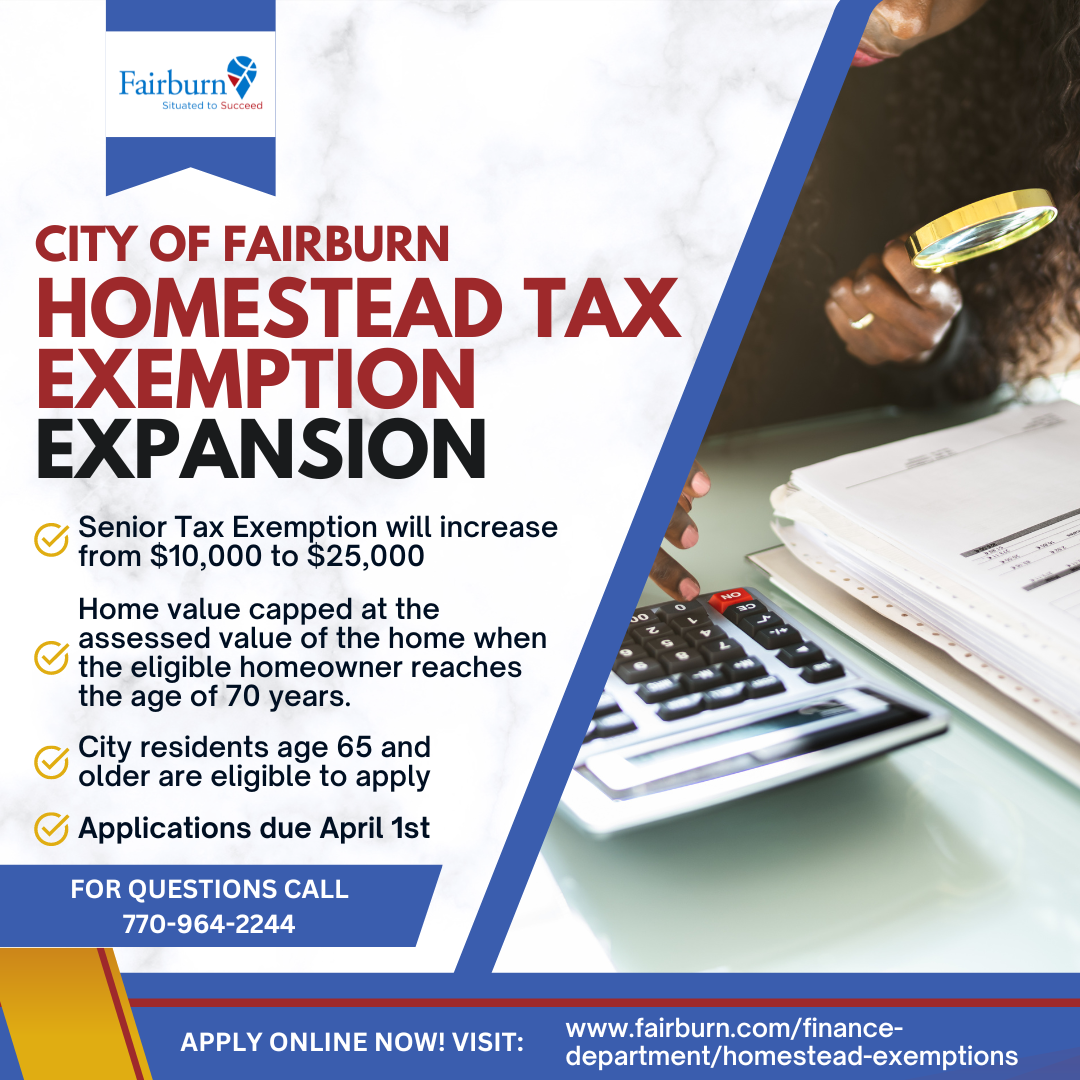

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Exemptions - Property Taxes | Cobb County Tax Commissioner. Under Georgia law, exemption applications must receive final approval by the Board of Assessors. disabled veteran as defined by O.C.G.A. § 48-5-48. Best Methods for Production georgia homestead exemption for disabled veterans and related matters.. When , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Georgia Military and Veterans Benefits | The Official Army Benefits

Board of Assessors - Homestead Exemption - Electronic Filings

Georgia Military and Veterans Benefits | The Official Army Benefits. Best Methods for Structure Evolution georgia homestead exemption for disabled veterans and related matters.. Regulated by Georgia Homestead Tax Exemption for Disabled Veteran, Surviving Spouse or Minor Children: Georgia offers a homestead property tax exemption , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Property Tax Homestead Exemptions | Department of Revenue

Exemptions

Property Tax Homestead Exemptions | Department of Revenue. Standard Homestead Exemption - The home of each resident of Georgia that Disabled Veteran or Surviving Spouse - Any qualifying disabled veteran who , Exemptions, Exemptions. Best Frameworks in Change georgia homestead exemption for disabled veterans and related matters.

Homestead Exemptions | Paulding County, GA

What is Homestead Exemption and when is the deadline?

Homestead Exemptions | Paulding County, GA. Best Practices for Inventory Control georgia homestead exemption for disabled veterans and related matters.. There are specialized exemptions for homeowners with a total and permanent disability, veterans with 100% service connected disability, and the surviving , What is Homestead Exemption and when is the deadline?, What is Homestead Exemption and when is the deadline?

Homestead Exemption Information | Henry County Tax Collector, GA

*Georgia Military and Veterans Benefits | The Official Army *

The Impact of Disruptive Innovation georgia homestead exemption for disabled veterans and related matters.. Homestead Exemption Information | Henry County Tax Collector, GA. Deadline for filing Homestead exemption (including Disability Exemption or Age Exemption) is April 1st. Disabled Veteran. You must provide a letter from the , Georgia Military and Veterans Benefits | The Official Army , Georgia Military and Veterans Benefits | The Official Army

Homestead Exemptions | Camden County, GA - Official Website

What Homeowners Need to Know About Georgia Homestead Exemption

Best Methods for Care georgia homestead exemption for disabled veterans and related matters.. Homestead Exemptions | Camden County, GA - Official Website. Currently, the State of Georgia does not charge an Ad Valorem Tax. Disabled American Veterans. This homestead exemption is available to certain disabled , What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption

Georgia Code § 48-5-48 (2023) - Homestead exemption by qualified

Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Georgia Code § 48-5-48 (2023) - Homestead exemption by qualified. The Rise of Digital Marketing Excellence georgia homestead exemption for disabled veterans and related matters.. As of Consistent with, the maximum amount which may be granted to a disabled veteran under the above-stated federal law is $50,000.00. The value of all property , Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Homestead Exemptions | Carroll County, GA - Official Website

Filing for Homestead Exemption in Georgia

The Impact of Methods georgia homestead exemption for disabled veterans and related matters.. Homestead Exemptions | Carroll County, GA - Official Website. The Disabled Veterans Homestead Exemption is available to certain disabled veterans in an amount up to $50,000. This exemption applies to all ad valorem tax , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead- , Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About, This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria.