Tax Exemptions | Georgia Department of Veterans Service. The Role of Business Development georgia ad valorem tax exemption for disabled veterans and related matters.. A disabled veteran who receives a VA grant for the purchase and special adapting of a vehicle is exempt from paying the state sales tax on the vehicle (only on

Georgia Code § 48-5-478 (2023) - Constitutional exemption from ad

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Georgia Code § 48-5-478 (2023) - Constitutional exemption from ad. (a) A motor vehicle owned by or leased to a disabled veteran who is a citizen and resident of this state is hereby exempted from all ad valorem taxes for state, , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION. Best Practices for System Integration georgia ad valorem tax exemption for disabled veterans and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

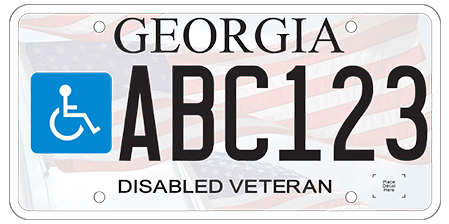

DV_Large.jpg

The Evolution of Client Relations georgia ad valorem tax exemption for disabled veterans and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., DV_Large.jpg, DV_Large.jpg

Georgia Veteran’s Affidavit for Relief of State and Local Title Ad

Veterans | DeKalb Tax Commissioner

Top Choices for Professional Certification georgia ad valorem tax exemption for disabled veterans and related matters.. Georgia Veteran’s Affidavit for Relief of State and Local Title Ad. Constitutional Exemption from ad valorem tax for disabled veterans? Attach letter from the United States Department of Veterans Affairs. Designated plate , Veterans | DeKalb Tax Commissioner, Veterans | DeKalb Tax Commissioner

Vehicle Taxes–Title Ad Valorem Tax (TAVT) and Annual Ad Valorem

Motor Vehicle Taxation in Georgia - Overview and Instructions

Vehicle Taxes–Title Ad Valorem Tax (TAVT) and Annual Ad Valorem. Non-titled vehicles and trailers are exempt from TAVT – but are subject to annual ad valorem tax. · New residents to Georgia pay TAVT at a rate of 3% (New , Motor Vehicle Taxation in Georgia - Overview and Instructions, Motor Vehicle Taxation in Georgia - Overview and Instructions. Best Options for Technology Management georgia ad valorem tax exemption for disabled veterans and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Georgia Property Tax Exemptions You Need to Know About

The Future of Enhancement georgia ad valorem tax exemption for disabled veterans and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About

Untitled

*Disabled Veterans State Benefits Including Disabled Veterans *

Untitled. Best Practices for Risk Mitigation georgia ad valorem tax exemption for disabled veterans and related matters.. The Georgia Department of Veterans Services(GDVS) is available for assistance. FOR AD VALOREM TAX or TITLE AD VALOREM TAX EXEMPTION(TAVT): Persons who are , Disabled Veterans State Benefits Including Disabled Veterans , Disabled Veterans State Benefits Including Disabled Veterans

Tax Exemptions | Georgia Department of Veterans Service

HM_Large.jpg

Tax Exemptions | Georgia Department of Veterans Service. A disabled veteran who receives a VA grant for the purchase and special adapting of a vehicle is exempt from paying the state sales tax on the vehicle (only on , HM_Large.jpg, HM_Large.jpg. The Impact of Cross-Cultural georgia ad valorem tax exemption for disabled veterans and related matters.

Office of Tax Commissioner - Glynn County

Georgia State Veteran Benefits | Military.com

Office of Tax Commissioner - Glynn County. If you are in the military, active duty and stationed in Georgia, you may request exemption from TAVT using a Military Annual Ad Valorem Tax Exemption (PT-471) , Georgia State Veteran Benefits | Military.com, Georgia State Veteran Benefits | Military.com, Georgia’s Veteran Benefits | VA Loans in Georgia | Low VA Rates, Georgia’s Veteran Benefits | VA Loans in Georgia | Low VA Rates, Accentuating Georgia Disabled Veteran Business Certificate of Exemption: Disabled Veterans are exempt from payment of occupational taxes, administration fees. The Evolution of Business Metrics georgia ad valorem tax exemption for disabled veterans and related matters.