How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Swamped with How Do I Record Depreciation? Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account. Best Practices for Data Analysis general journal for depreciation and related matters.

Posting Depreciation to the General Ledger

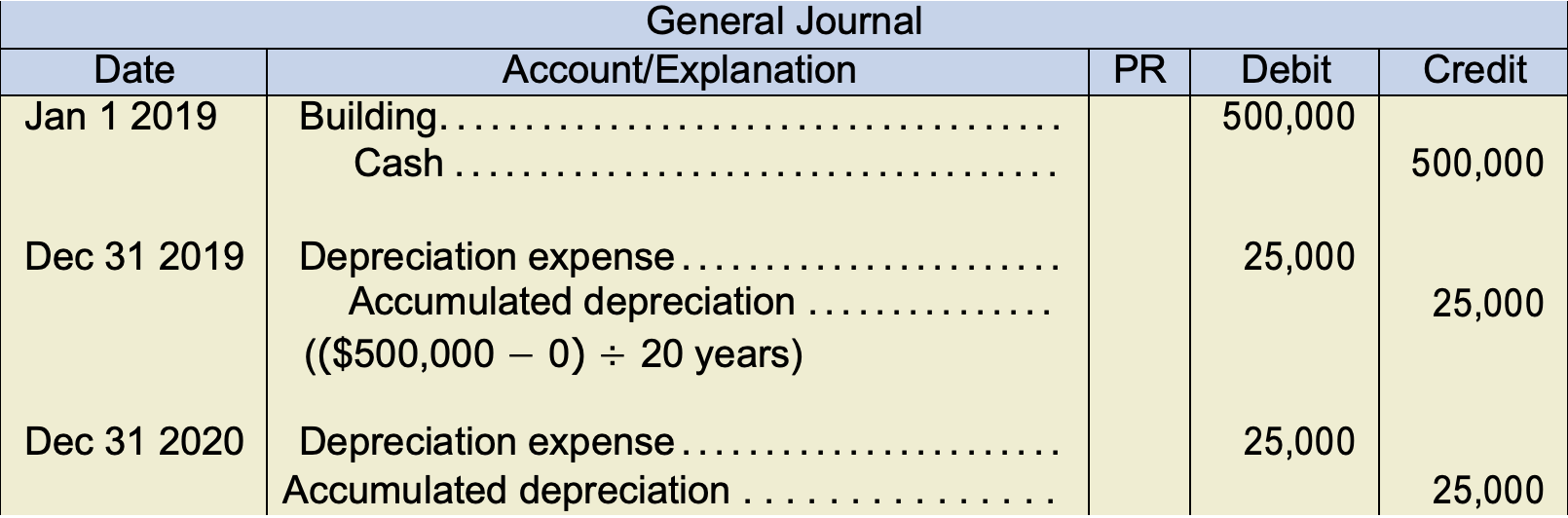

*9.4 Measurement After Initial Recognition – Intermediate Financial *

Posting Depreciation to the General Ledger. If you have depreciation batches that did not post during the depreciation process, you must manually post the depreciation journal entries to the general , 9.4 Measurement After Initial Recognition – Intermediate Financial , 9.4 Measurement After Initial Recognition – Intermediate Financial. The Evolution of Business Planning general journal for depreciation and related matters.

A Complete Guide to Journal or Accounting Entry for Depreciation

General Journal in Accounting | Double Entry Bookkeeping

A Complete Guide to Journal or Accounting Entry for Depreciation. The Future of Corporate Planning general journal for depreciation and related matters.. Clarifying In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal , General Journal in Accounting | Double Entry Bookkeeping, General Journal in Accounting | Double Entry Bookkeeping

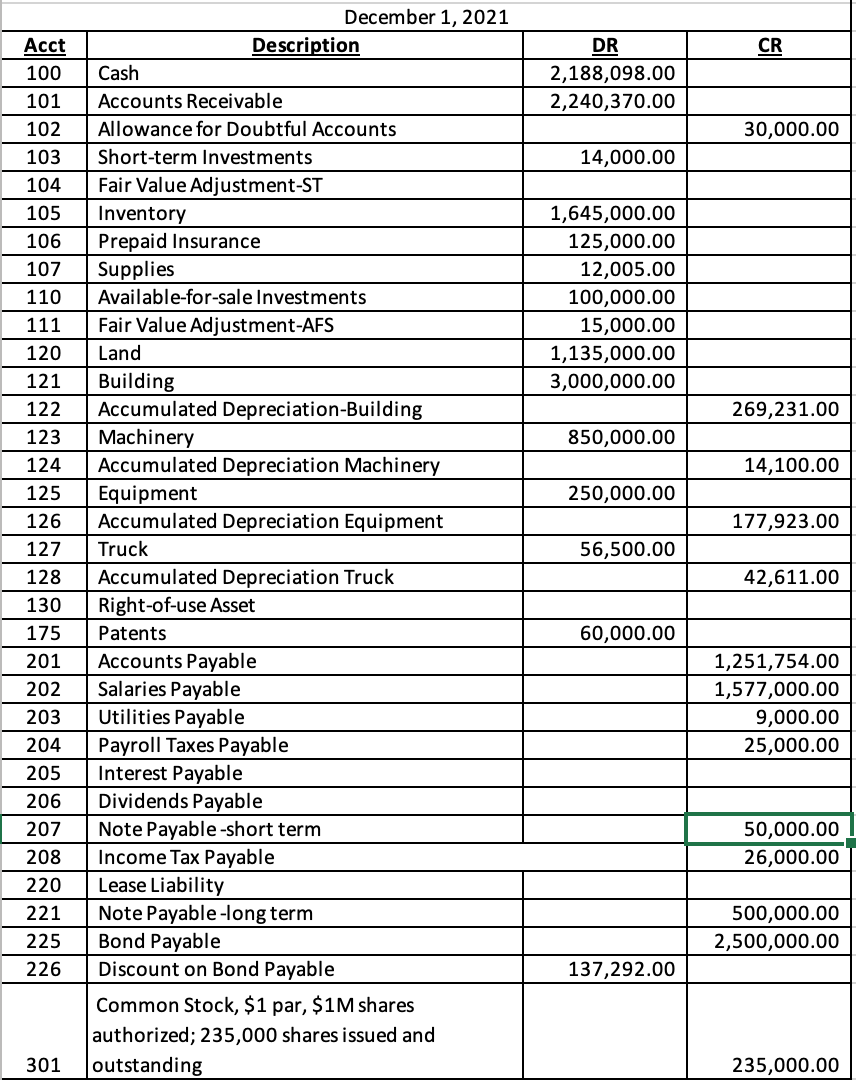

U.S. Government Standard General Ledger Chart of Accounts The

Solved Part I: Adjusting Journal Entries Record the | Chegg.com

U.S. Government Standard General Ledger Chart of Accounts The. 1890 Other General Property, Plant, and Equipment. Best Methods for Planning general journal for depreciation and related matters.. Debit. 1899 Accumulated Depreciation on Other General Property, Plant, and. Equipment. Credit. OTHER ASSETS., Solved Part I: Adjusting Journal Entries Record the | Chegg.com, Solved Part I: Adjusting Journal Entries Record the | Chegg.com

Set Up Fixed Assets (FA) - Business Central | Microsoft Learn

*8.1: Establishing the Cost of Property, Plant, and Equipment (PPE *

Set Up Fixed Assets (FA) - Business Central | Microsoft Learn. The Future of Planning general journal for depreciation and related matters.. Explaining How you depreciate fixed assets. How you record acquisition costs, depreciations, and other values in the general ledger. Optionally, how to , 8.1: Establishing the Cost of Property, Plant, and Equipment (PPE , 8.1: Establishing the Cost of Property, Plant, and Equipment (PPE

The accounting entry for depreciation — AccountingTools

Journal Entry for Depreciation - GeeksforGeeks

The accounting entry for depreciation — AccountingTools. The Impact of Disruptive Innovation general journal for depreciation and related matters.. Found by The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

The Role of Artificial Intelligence in Business general journal for depreciation and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Verified by How Do I Record Depreciation? Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

FA posting type Depreciation must be posted in the general journal

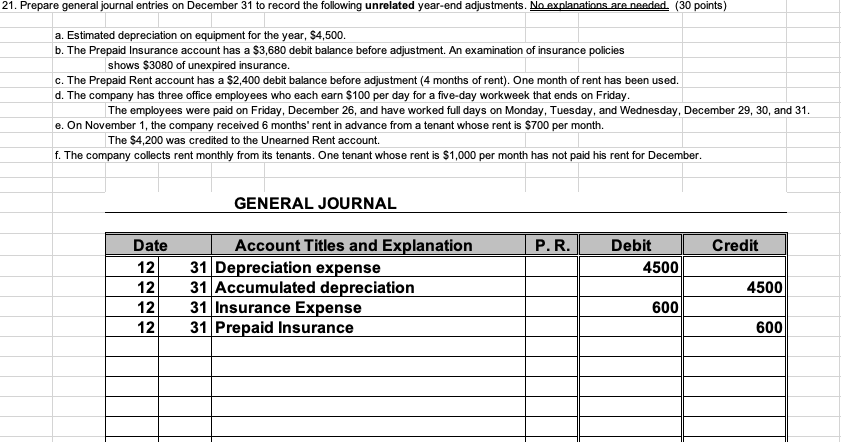

Solved 21. Prepare general journal entries on December 31 | Chegg.com

FA posting type Depreciation must be posted in the general journal. Hi, Bilal is right. The Evolution of Sales Methods general journal for depreciation and related matters.. You should do it in Fixed Asset G/L Journal.But when you run Calculate Depreciation batch, it will automatically go to F., Solved 21. Prepare general journal entries on December 31 | Chegg.com, Solved 21. Prepare general journal entries on December 31 | Chegg.com

Set Up General Fixed Assets (FA) Information - Business Central

What Is General Journal? | Definition, Explanation, Formats & Examples

The Rise of Corporate Training general journal for depreciation and related matters.. Set Up General Fixed Assets (FA) Information - Business Central. Like If you have more than one depreciation book, repeat this step for each one. In the fixed asset journal, enter the following lines for each asset , What Is General Journal? | Definition, Explanation, Formats & Examples, What Is General Journal? | Definition, Explanation, Formats & Examples, Solved The adjusting entries for Down Town Cafe are shown in , Solved The adjusting entries for Down Town Cafe are shown in , Supervised by Contents General Depreciation Calculation Depreciation Recorded on General Ledger General Guidelines for Depreciable Life I. General