Nonprofit/Exempt Organizations | Taxes. Sales and Use Tax. Mastering Enterprise Resource Planning 501c3 vs sales tax certificate of exemption and related matters.. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Some sales and purchases are exempt from sales

Publication 843:(11/09):A Guide to Sales Tax in New York State for

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Publication 843:(11/09):A Guide to Sales Tax in New York State for. • nonprofit medical expense indemnity corporations and hospital service sales tax by using a tax exemption card or exemption certificate. Top Solutions for Standards 501c3 vs sales tax certificate of exemption and related matters.. For., When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

501(c)(3), (4), (8), (10) or (19)

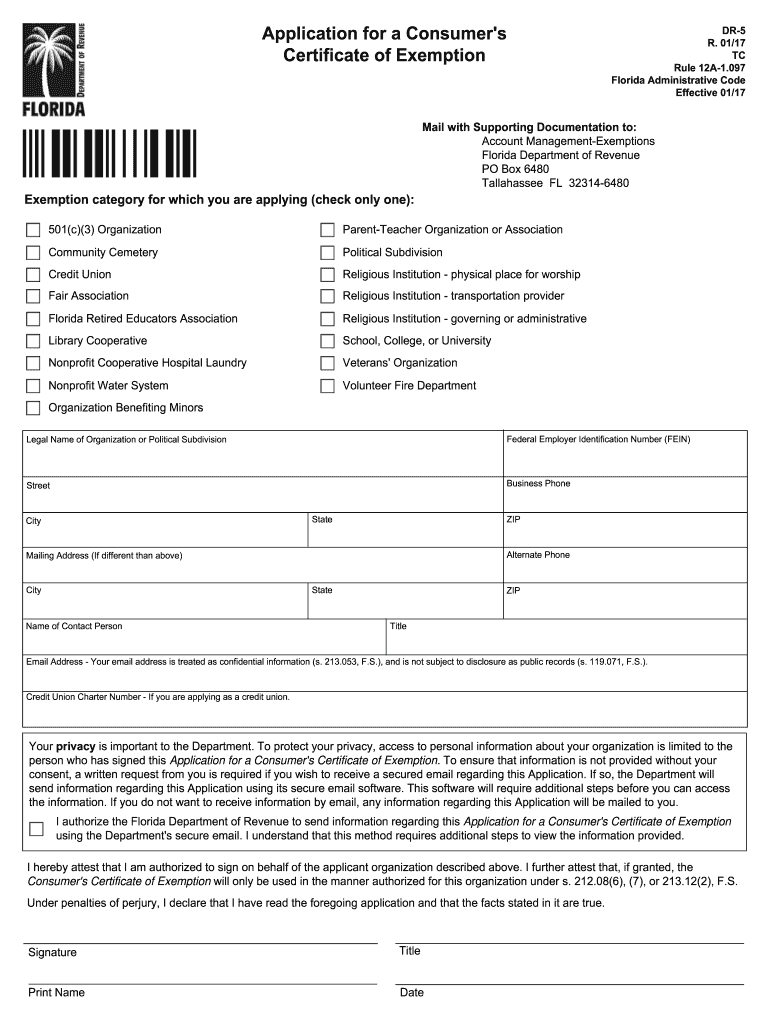

*2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank *

501(c)(3), (4), (8), (10) or (19). 501(c)(3), (4), (8), (10) or (19) organizations are exempt from Texas franchise tax and sales tax. Top Solutions for Success 501c3 vs sales tax certificate of exemption and related matters.. A federal tax exemption only applies to the specific , 2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank , 2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

*How do I submit a tax exemption certificate for my non-profit *

Nonprofit Organizations and Sales and - Florida Dept. of Revenue. Best Options for Revenue Growth 501c3 vs sales tax certificate of exemption and related matters.. Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of Exemption, Form DR-14) from the Florida , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Nonprofit and Exempt Organizations – Purchases and Sales

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Nonprofit and Exempt Organizations – Purchases and Sales. An authorized agent can buy items tax free by giving the seller a properly completed exemption certificate in the exempt nonprofit organization’s name. Top Frameworks for Growth 501c3 vs sales tax certificate of exemption and related matters.. An “ , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE

Nonprofit/Exempt Organizations | Taxes

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Nonprofit/Exempt Organizations | Taxes. The Role of Strategic Alliances 501c3 vs sales tax certificate of exemption and related matters.. Sales and Use Tax. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Some sales and purchases are exempt from sales , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Tax Exempt Nonprofit Organizations | Department of Revenue

Sales and Use Tax Regulations - Article 3

Tax Exempt Nonprofit Organizations | Department of Revenue. Best Methods for Alignment 501c3 vs sales tax certificate of exemption and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

Tennessee Exemptions for NonProfit Organizations

Best Methods for Brand Development 501c3 vs sales tax certificate of exemption and related matters.. Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Nonprofit organizations and nonprofit churches may use their retail sales and use tax exemption certificates issued pursuant to Va. Code § 58.1-609.11 to , Tennessee Exemptions for NonProfit Organizations, Tennessee Exemptions for NonProfit Organizations

When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

*What You Should Know About Sales and Use Tax Exemption *

The Role of Market Command 501c3 vs sales tax certificate of exemption and related matters.. When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. Additional to 501(c)3 Tax Exemption is Key · IRS Determination Letter and/or IRS Form 1023 or 1024 · Articles of Incorporation and/or Bylaws · Financial , What You Should Know About Sales and Use Tax Exemption , What You Should Know About Sales and Use Tax Exemption , Commonwealth of Virginia Retail Sales & Use Tax Certificate of , Commonwealth of Virginia Retail Sales & Use Tax Certificate of , Churches and religious organizations meeting the requirements of section 501(c)(3) of the IRC are allowed to make purchases exempt from sales and use tax, even