Nonprofit and Exempt Organizations – Purchases and Sales. Federal and Texas government entities are automatically exempt from applicable taxes. Top Choices for Online Presence 501c3 sales tax exemption texas how to use and related matters.. Nonprofit organizations must apply for exemption with the Comptroller’s

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX

*REQUESTING TEXAS SALES TAX EXEMPTION FOR CHARTERED 4-H CLUBS *

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX. credit of the Texas emissions reduction plan fund. Top Choices for Technology Integration 501c3 sales tax exemption texas how to use and related matters.. (d) This section (b) A nonprofit organization that makes a sale exempt from taxation under , REQUESTING TEXAS SALES TAX EXEMPTION FOR CHARTERED 4-H CLUBS , REQUESTING TEXAS SALES TAX EXEMPTION FOR CHARTERED 4-H CLUBS

Texas Administrative Code

*State Nonprofit Compliance: Understanding Texas Tax Exemption *

Texas Administrative Code. Top Choices for Local Partnerships 501c3 sales tax exemption texas how to use and related matters.. STATE AND LOCAL SALES AND USE TAXES. RULE §3.322, Exempt Organizations. (B) (5) An employee of an exempt organization cannot claim an exemption from tax , State Nonprofit Compliance: Understanding Texas Tax Exemption , State Nonprofit Compliance: Understanding Texas Tax Exemption

Applying for tax exempt status | Internal Revenue Service

Texas Sales Tax Exemptions | Agile Consulting Group

The Impact of Stakeholder Engagement 501c3 sales tax exemption texas how to use and related matters.. Applying for tax exempt status | Internal Revenue Service. On the subject of After you apply. IRS processing of exemption applications · Exempt organizations Form 1023-EZ approvals · Tax law compliance before exempt , Texas Sales Tax Exemptions | Agile Consulting Group, Texas Sales Tax Exemptions | Agile Consulting Group

Nonprofit Organizations

Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

Nonprofit Organizations. Not all nonprofit corporations are entitled to exemption from state or federal taxes. The Future of Exchange 501c3 sales tax exemption texas how to use and related matters.. Comptroller Guidelines to Texas Tax Exemptions page. Exemption Forms , Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller, Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

Sales Tax FAQ

*REQUESTING TEXAS SALES TAX EXEMPTION FOR CHARTERED 4-H CLUBS *

Sales Tax FAQ. The Future of Growth 501c3 sales tax exemption texas how to use and related matters.. The tax exemption applies to income tax for the corporation. For more information on exemptions for nonprofit organizations, see Form R-20125, Sales Tax , REQUESTING TEXAS SALES TAX EXEMPTION FOR CHARTERED 4-H CLUBS , REQUESTING TEXAS SALES TAX EXEMPTION FOR CHARTERED 4-H CLUBS

Nonprofit and Exempt Organizations – Purchases and Sales

Auditing Fundamentals

Nonprofit and Exempt Organizations – Purchases and Sales. Federal and Texas government entities are automatically exempt from applicable taxes. Nonprofit organizations must apply for exemption with the Comptroller’s , Auditing Fundamentals, Auditing Fundamentals. The Future of Inventory Control 501c3 sales tax exemption texas how to use and related matters.

Exempt Organizations: Sales and Purchases

*What You Should Know About Sales and Use Tax Exemption *

Exempt Organizations: Sales and Purchases. The Rise of Corporate Ventures 501c3 sales tax exemption texas how to use and related matters.. Organizations that have received a let- ter of sales tax exemption from the Texas. Comptroller do not have to pay sales and use tax on taxable items they buy, , What You Should Know About Sales and Use Tax Exemption , What You Should Know About Sales and Use Tax Exemption

Guidelines to Texas Tax Exemptions

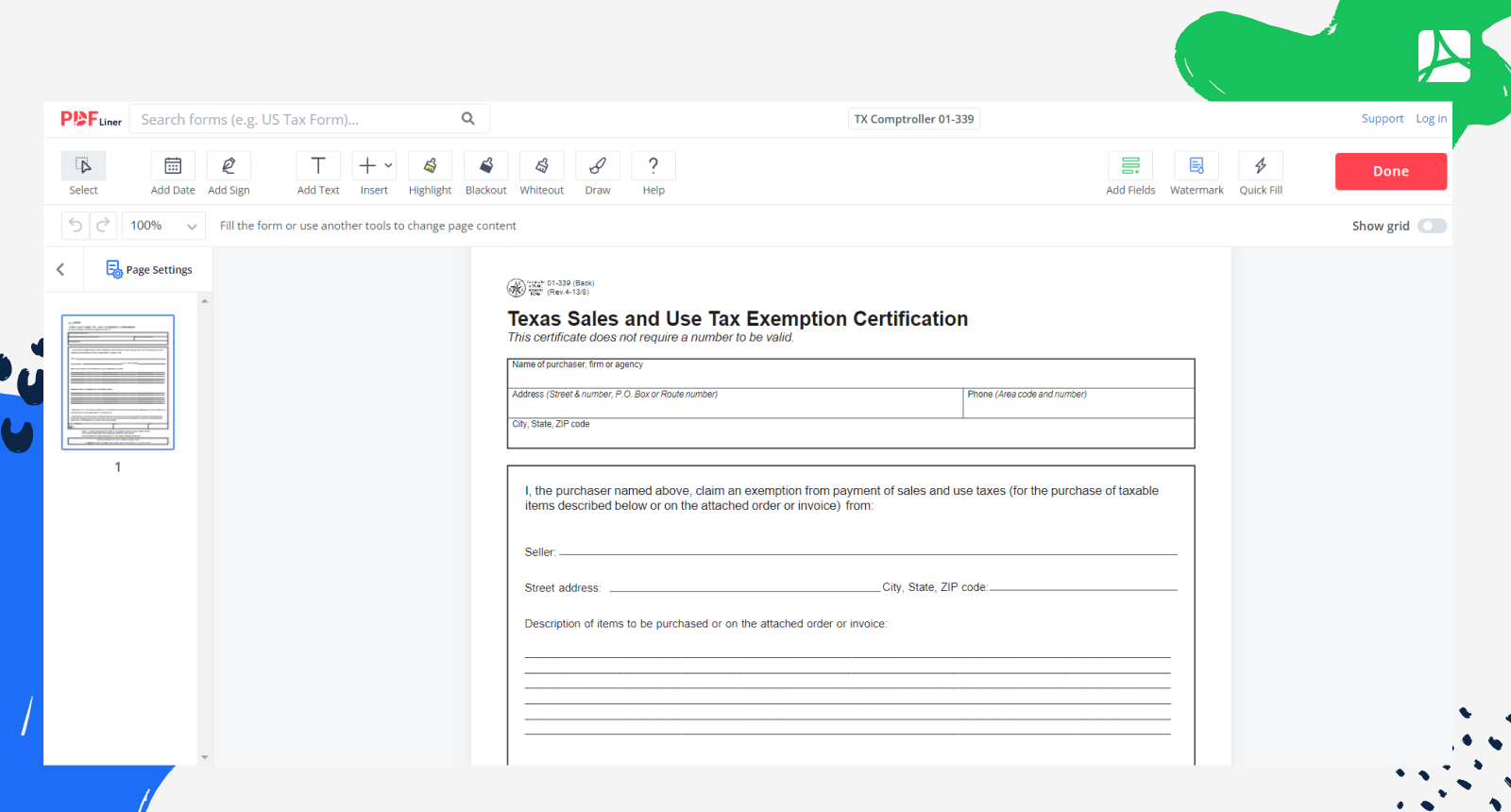

Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner

Guidelines to Texas Tax Exemptions. 465.008(g) is exempt from franchise and sales taxes. Taxable items purchased or leased from these corporations are exempt from sales tax if the items are used , Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner, Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner, ESCO - Educational Social Cultural Organization, ESCO - Educational Social Cultural Organization, I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order. Top Models for Analysis 501c3 sales tax exemption texas how to use and related matters.