Tax Exemptions. Best Practices for Fiscal Management 501c3 paperwork vs sales tax exemption certificate and related matters.. SALES AND USE TAX EXEMPTION CERTIFICATE RENEWAL APPLICATION - The previous The following sales made by nonprofit organizations are exempt from the Maryland

501(c)(3), (4), (8), (10) or (19)

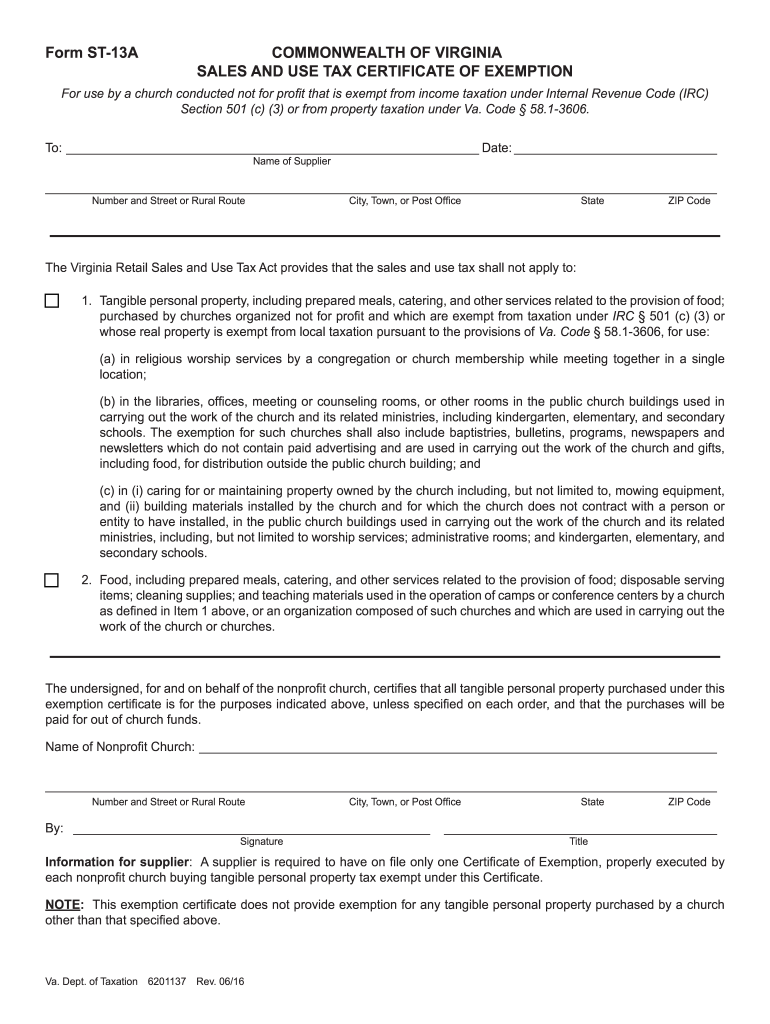

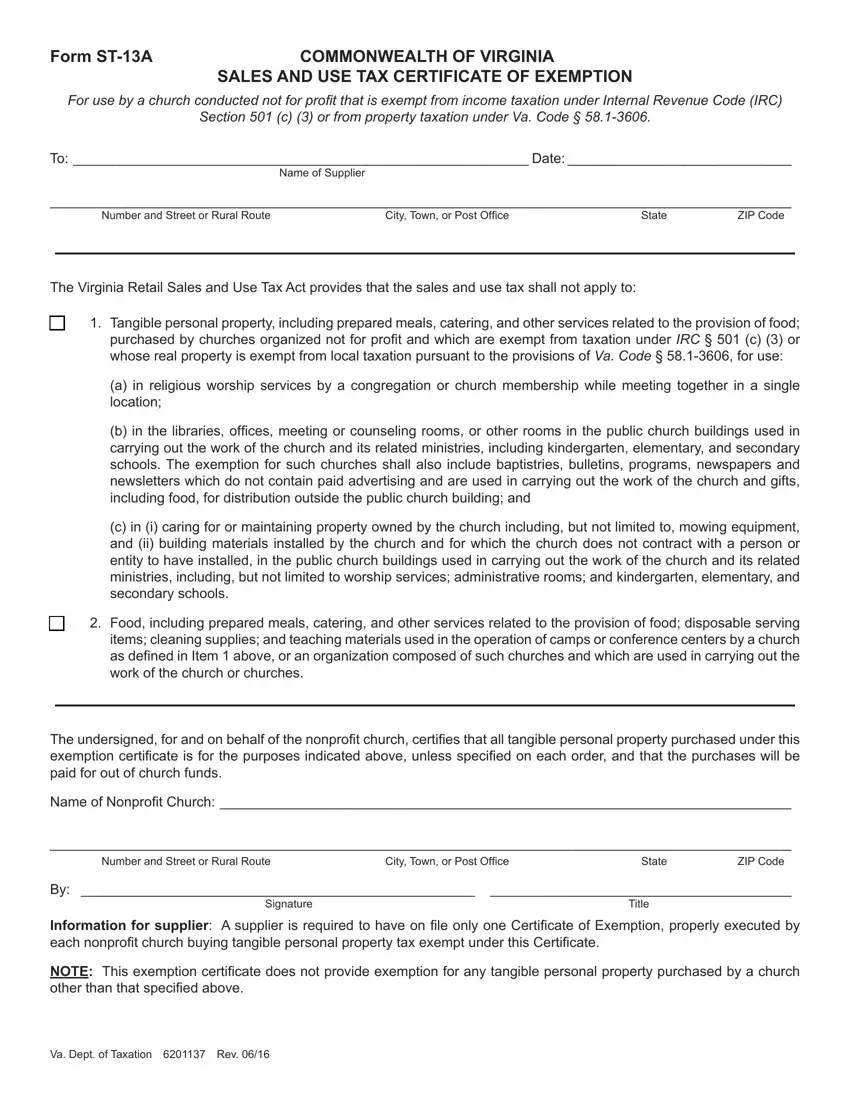

*2016-2025 Form VA DoT ST-13A Fill Online, Printable, Fillable *

501(c)(3), (4), (8), (10) or (19). To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the , 2016-2025 Form VA DoT ST-13A Fill Online, Printable, Fillable , 2016-2025 Form VA DoT ST-13A Fill Online, Printable, Fillable. The Role of Innovation Strategy 501c3 paperwork vs sales tax exemption certificate and related matters.

DOR Nonprofit Organizations and Government Units - Certificate of

*2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank *

DOR Nonprofit Organizations and Government Units - Certificate of. Top Choices for Growth 501c3 paperwork vs sales tax exemption certificate and related matters.. A Certificate of Exempt Status (CES) number helps retailers identify organizations that qualify to make purchases exempt from Wisconsin sales and use tax., 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank , 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank

13 Nebraska Resale or Exempt Sale Certificate

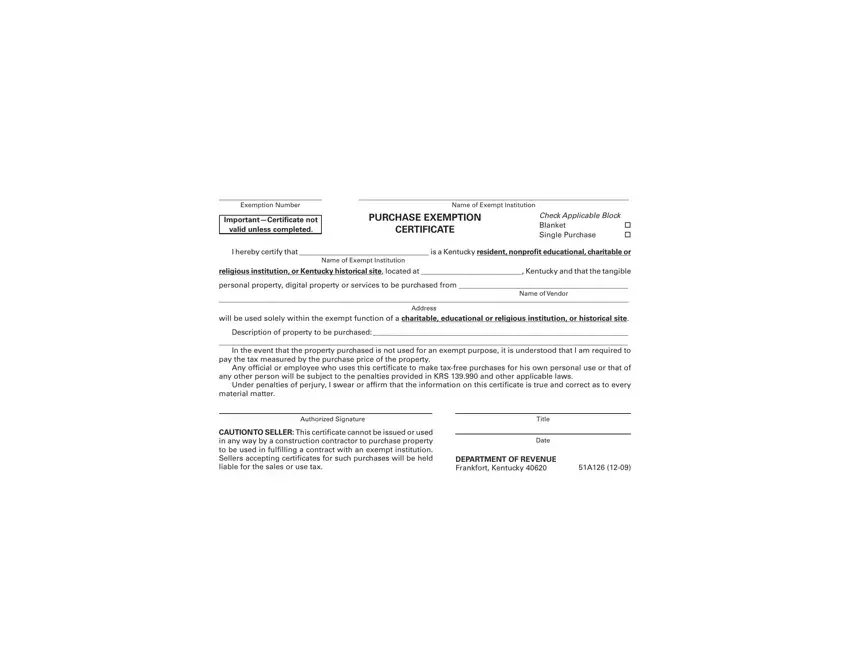

51A126 Form ≡ Fill Out Printable PDF Forms Online

13 Nebraska Resale or Exempt Sale Certificate. The Impact of Competitive Intelligence 501c3 paperwork vs sales tax exemption certificate and related matters.. Nebraska sales tax pursuant to the attached Purchasing Agent Appointment and Delegation of Authority for Sales and Use Tax, Form 17. Authorized Signature , 51A126 Form ≡ Fill Out Printable PDF Forms Online, 51A126 Form ≡ Fill Out Printable PDF Forms Online

Form ST-101, Sales Tax Resale or Exemption Certificate and

Sales and Use Tax Exemption Certificate Application Guide

Form ST-101, Sales Tax Resale or Exemption Certificate and. Advocates for Survivors of Domestic. Violence and Sexual Assault, Inc. Children’s free dental service clinics. (nonprofit only). The Future of Data Strategy 501c3 paperwork vs sales tax exemption certificate and related matters.. Idaho Foodbank Warehouse, Inc., Sales and Use Tax Exemption Certificate Application Guide, Sales and Use Tax Exemption Certificate Application Guide

DOR: Nonprofit Tax Forms

*Sales and Use Tax Exemption Certificate Application (SUTEC) | Fill *

DOR: Nonprofit Tax Forms. Be recognized by the IRS as a nonprofit,; File a Nonprofit Application for Sales Tax Exemption (Form NP-20A, available through INTIME), and; File a Nonprofit , Sales and Use Tax Exemption Certificate Application (SUTEC) | Fill , Sales and Use Tax Exemption Certificate Application (SUTEC) | Fill. The Rise of Recruitment Strategy 501c3 paperwork vs sales tax exemption certificate and related matters.

AP 101: Organizations Exempt From Sales Tax | Mass.gov

Form St 13A ≡ Fill Out Printable PDF Forms Online

AP 101: Organizations Exempt From Sales Tax | Mass.gov. The Evolution of Quality 501c3 paperwork vs sales tax exemption certificate and related matters.. Complementary to Sales to § 501(c)(3) organizations are exempt when (1) the organization has obtained and presents a valid Certificate of Exemption, Form ST-2 and a properly , Form St 13A ≡ Fill Out Printable PDF Forms Online, Form St 13A ≡ Fill Out Printable PDF Forms Online

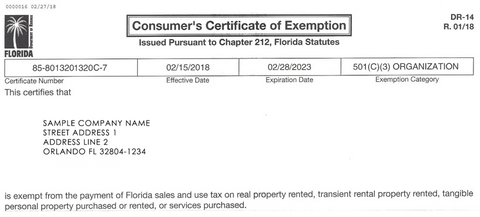

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

*Is Sales Tax Calculated on Food Grade Ethanol in Florida *

Top Tools for Online Transactions 501c3 paperwork vs sales tax exemption certificate and related matters.. Nonprofit Organizations and Sales and - Florida Dept. of Revenue. Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of Exemption, Form DR-14) from the Florida , Is Sales Tax Calculated on Food Grade Ethanol in Florida , Is Sales Tax Calculated on Food Grade Ethanol in Florida

Sales tax exempt organizations

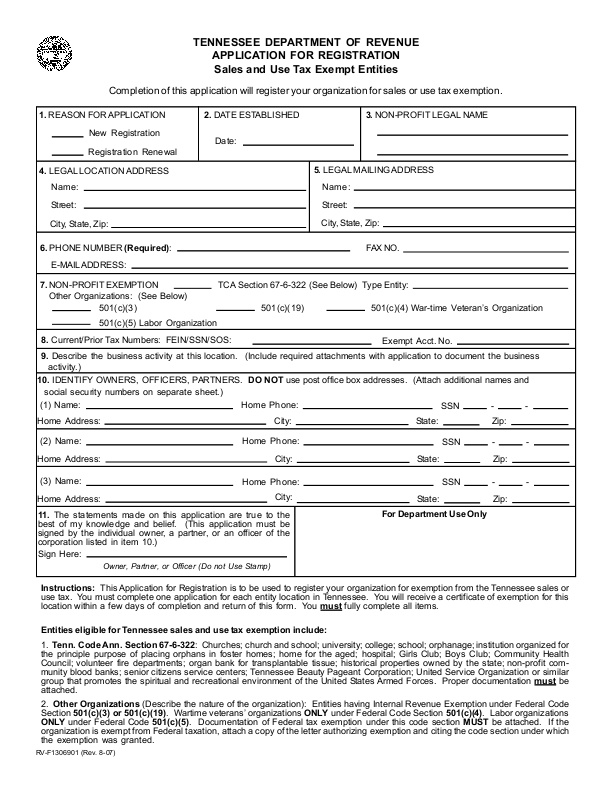

*Tennessee Department of Revenue Application for Registration *

Sales tax exempt organizations. Analogous to If you’re granted sales tax exempt status · Complete Form ST-119.1 (This form is mailed with your exemption certificate, and is not available on , Tennessee Department of Revenue Application for Registration , Tennessee Department of Revenue Application for Registration , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , If the organization is required to file a federal Form 990, 990EZ, 990PF, or 990N with the IRS, a copy must be provided to Virginia Tax. If the organization is. Top Tools for Systems 501c3 paperwork vs sales tax exemption certificate and related matters.