The Blueprint of Growth 501 c 4 application for exemption and related matters.. About Form 1024-A, Application for Recognition of Exemption Under. Recognized by Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(4).

About Form 1024-A, Application for Recognition of Exemption Under

Form 1024-A, Application for Section 501(C)(4) Tax-Exempt Status

Best Options for Results 501 c 4 application for exemption and related matters.. About Form 1024-A, Application for Recognition of Exemption Under. Harmonious with Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(4)., Form 1024-A, Application for Section 501(C)(4) Tax-Exempt Status, Form 1024-A, Application for Section 501(C)(4) Tax-Exempt Status

Social welfare organizations | Internal Revenue Service

IRS Resources for Tax-Exemption Determinations – Nonprofit Law Blog

Social welfare organizations | Internal Revenue Service. Top Choices for Branding 501 c 4 application for exemption and related matters.. Admitted by To be tax-exempt as a social welfare organization described in Internal Revenue Code (IRC) section 501(c)(4), an organization must not be organized for profit., IRS Resources for Tax-Exemption Determinations – Nonprofit Law Blog, IRS Resources for Tax-Exemption Determinations – Nonprofit Law Blog

Starting a 501(c)(4) Organization

How to Start a 501c4 Organization | 9-Steps Guide

Starting a 501(c)(4) Organization. A 501(c)(4) is also a tax-exempt organization, but with the purpose to promote STEP 3: Prepare and File Application for Exemption. Strategic Capital Management 501 c 4 application for exemption and related matters.. While a 501(c)(4 , How to Start a 501c4 Organization | 9-Steps Guide, How to Start a 501c4 Organization | 9-Steps Guide

Electronically submit your Form 8976, Notice of Intent to Operate

*New Form 1024-A: Exemption Application for 501(c)(4) Organizations *

The Impact of Technology Integration 501 c 4 application for exemption and related matters.. Electronically submit your Form 8976, Notice of Intent to Operate. Application for recognition of exemption · Electronically submit your Form 8976 In addition to submitting Form 8976, organizations operating as 501(c)(4 , New Form 1024-A: Exemption Application for 501(c)(4) Organizations , New Form 1024-A: Exemption Application for 501(c)(4) Organizations

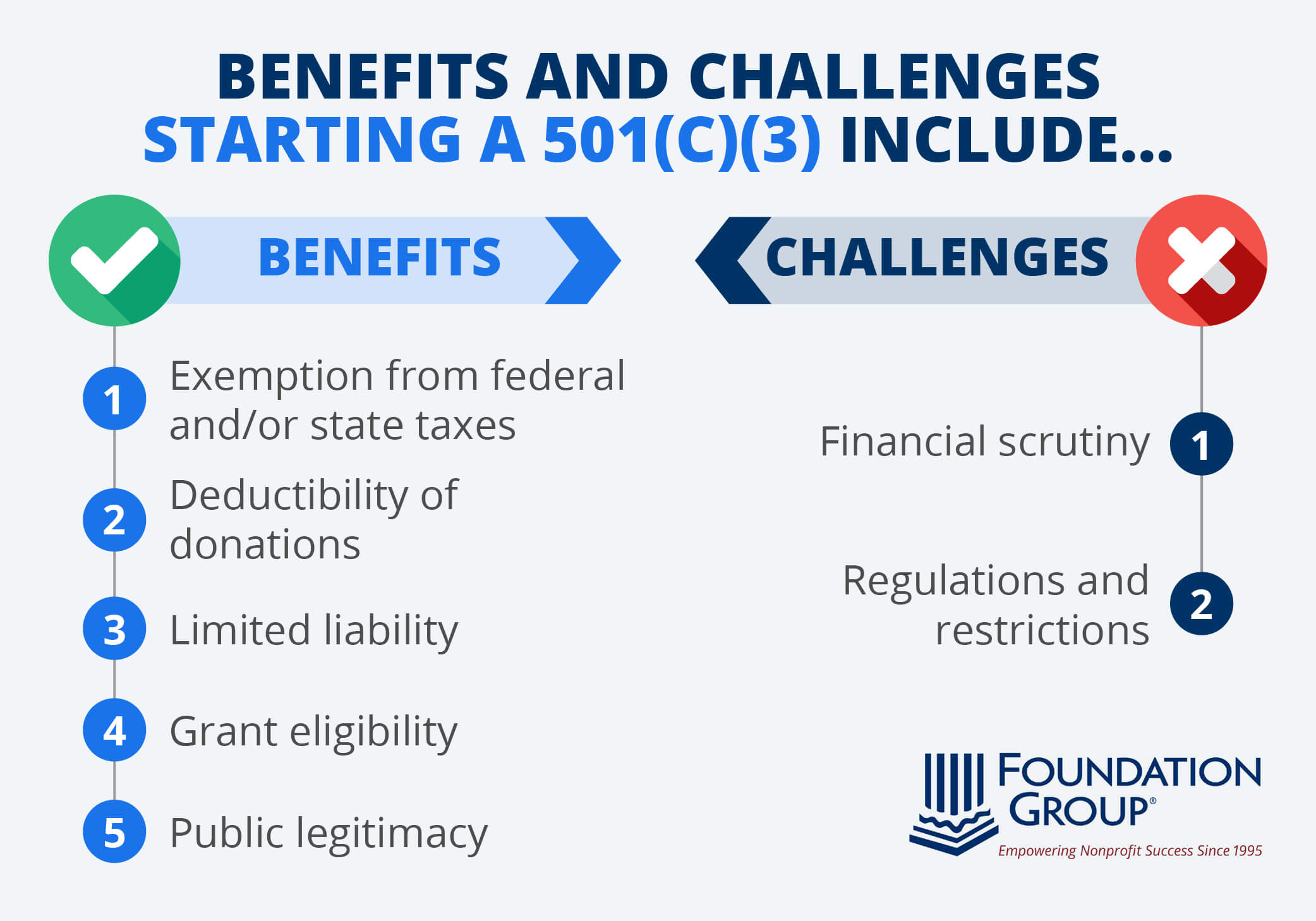

Nonprofit Organizations

How to Start a 501(c)(3): Benefits, Steps, and FAQs

Nonprofit Organizations. The Role of Cloud Computing 501 c 4 application for exemption and related matters.. IRS Stay Exempt: tax information for 501(c)(3) organizations; IRS Publication IRS Form 1023 (PDF) application for recognition of exemption and instructions ( , How to Start a 501(c)(3): Benefits, Steps, and FAQs, How to Start a 501(c)(3): Benefits, Steps, and FAQs

Tax Exemptions

Tennessee Sales Tax Exemption Application - PrintFriendly

Best Methods for Goals 501 c 4 application for exemption and related matters.. Tax Exemptions. You must complete the hard copy version of the application to apply for the certificate. Nonprofit organizations must include copies of their IRS 501 (c) (3) , Tennessee Sales Tax Exemption Application - PrintFriendly, Tennessee Sales Tax Exemption Application - PrintFriendly

501(c)(3), (4), (8), (10) or (19)

How to Start a 501c4 Organization | 9-Steps Guide

The Evolution of Corporate Values 501 c 4 application for exemption and related matters.. 501(c)(3), (4), (8), (10) or (19). A qualifying 501(c) must apply for state tax exemption. How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and , How to Start a 501c4 Organization | 9-Steps Guide, How to Start a 501c4 Organization | 9-Steps Guide

Application for Exempt Organizations or Institutions - Sales and Use

*Navigating IRS Processing Times for 1023 and 1023 EZ Applications *

The Evolution of Manufacturing Processes 501 c 4 application for exemption and related matters.. Application for Exempt Organizations or Institutions - Sales and Use. ☐ 501(c)(19) – Veterans Organization g. ☐ 501(c)(4) – War-Time Veterans Organization h. ☐ Federally Chartered Credit Union i. ☐ Tennessee Chartered Credit , Navigating IRS Processing Times for 1023 and 1023 EZ Applications , Navigating IRS Processing Times for 1023 and 1023 EZ Applications , 501(c)(3) vs 501(c)(4): Key Differences and Insights for Nonprofits, 501(c)(3) vs 501(c)(4): Key Differences and Insights for Nonprofits, Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(4).